Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have an employee who has their direct deposit split between their checking account and savings account. The portion that was supposed to go into their savings account was rejected because of a wrong savings account number. The portion that was supposed to go into their checking account cleared. I can write a paper check for the savings account portion but how do I reconcile the savings portion that was refunded to my company bank account?

Good morning, @stolidog00.

I am happy to help you get your account reconciled! This shouldn't be any different than a typical reconciliation. Let me show you how:

You will first want to review your opening balance. The opening balance needs to match the balance of your real-life bank account for whatever day you choose to start tracking the account in QuickBooks.

If you need more step-by-step instructions, check out this article for more information on reconciling your account in QuickBooks Desktop.

For additional information on an employee not receiving their direct deposit check out this article: Employee did not receive direct deposit created in QuickBooks Desktop Payroll

Please let me know if you have any additional questions on this process. Take care!

I know how to reconcile. My question is part of an employee's direct deposit was rejected, not the whole thing. For example, the employee was paid $1000. $200 was deposited into their checking but the $800 that was supposed to go into their savings was rejected because the account number was wrong. Intuit deposited the $800 back into the company checking account. I don't know how to write the employee a check for only the $800 without having a double entry; one from the original direct deposit and one from the paper check I write.

Thanks for the clarification, @stolidog00.

I also appreciate the additional details you’ve shared. Allow me to guide you on how to get around this.

In QuickBooks, there a few options on how to pay your employee when they did not receive the direct deposit. The ideal one is to create a regular check. Don’t worry though, this will not cause a double entry in your account since Intuit deposited it back to your company checking account.

Before doing so, we’ll need to delete the direct deposit check for your employees. This way, we can ensure the transactions recorded in your company are accurate. Let me guide you how in your QuickBooks Desktop (QBDT):

You can also read this article for more details: Delete or void employee paychecks.

Once done, you can now create a regular check to pay your employee. You can refer to this article for the detailed steps and additional information on how to handle a rejected direct deposit: Employee did not receive direct deposit created in QuickBooks Desktop.

You can also utilize this article that can guide you through the steps on how to print your paychecks in QBDT.

Let me know if you need further assistance with direct deposit in QuickBooks. I’m always around ready to back you up. Have a good one!

If I void the paycheck and re-issue a new one, what happens to the portion that DID get direct deposited? Will the employee get overpaid?

Thanks for keeping in touch with us, @stolidog00. I'm here to get you moving in the right direction towards fixing the rejected direct deposit.

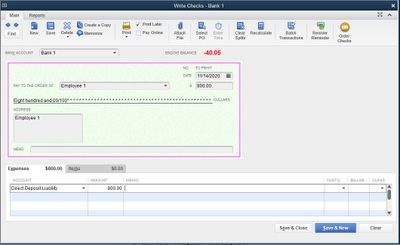

After receiving the rejected portion of the direct deposit, Intuit will create a deposit to your Direct Deposit Liability account. To offset the rejected payroll and pay your employee, all you need to do is to create a regular check for the rejected amount, which is $800. Then, debit the Direct Deposit Liability account. The instructions below will ensure your success:

For more information about managing rejected direct deposits, check this link: Employee did not receive direct deposit created in QuickBooks Desktop Payroll.

Please let me know if you need further assistance with payroll. I'm always here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here