Get 50% OFF QuickBooks for 3 months*

Buy now- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and payroll

- :

- Payroll Changes in July Update to QB Enterprise Contractor

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

We use QB Enterprise Contractor. Previous to the July update we were able to duplicate each employee so that we could pay them in multiple states and we would list their name and then put the state in (). Since the update it is no longer allowing me to duplicate employees. It says that an employee with the same SSN has already been added. Anyone else have this same issue or figured out any solutions?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

Duplicating your employees to easily pay them in multiple states is a breeze in QuickBooks Desktop (QBDT), @Accountant1233. I'm happy to share with you the steps on how to get this done right away.

Thanks for providing details of your concern. To ensure you'll be able to achieve your goal, let me first discuss details about the process.

In QBDT, you'll receive the warning message "Another employee (employee's name), already has the Social Security Number XXXXXXXXX. Do you want to save this employee with the same Social Security Number?" once the system detects a duplicated SSN. To resolve this, you simply have to select the Yes button to let the program add that name with the same info from the previously entered employee.

For reference, feel free to visit this article: Get started with QuickBooks Desktop Payroll.

Once everything is fine, you can check this link for additional guidance in paying your employee: Create and run your payroll.

I'm always around here in the Community to help with any of your payroll concerns. Also, I'd love to know updates on how the steps work for you. Please don't hesitate to add a reply below. Have a good one and take care always.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

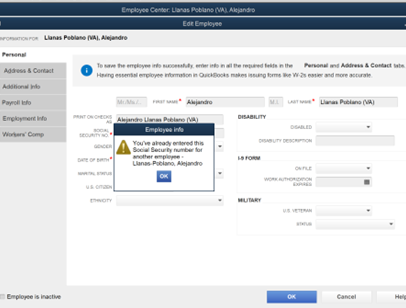

I used to get this error but now since the July 2022 update I am getting a different error and QB is requiring me to change the SSN before it will let me save the employee so it is no longer allowing this. See attached with the new error.

Any ideas?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

My attachment did not save - when i try to save a duplicate employee now the popup says "you've already entered this social security number for another employee"

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

My attachment did not save - when i try to save a duplicate employee now the popup says "you've already entered this social security number for another employee

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

Thank you for getting back and providing us with a screenshot of the error you're having, @Accountant1233.

It's possible that there are some minor data issues with your company file that's why your company's address is not showing in your invoices fully. Try running the Rebuild and Verify Utility tool to fix possible data damage on your company file.

Please follow the steps below:

- Open your company file again.

- Go to the File menu, then select Utilities and choose Rebuild Data.

- Click OK in the QuickBooks Information window.

- Wait until the repair is done. Then, click OK.

- Then, go back to the File menu and select Utilities and choose Verify Data.

- Click OK if QuickBooks doesn't find any problems. Or Rebuild Now if it finds issues with your company file.

If you still get the same issue, let's try running the QuickBooks File Doctor to fix common issues.

- Open your QuickBooks Tool Hub.

- Select Company File Issues.

- Click Quick Fix my File.

- Choose OK when it completes and launch your QuickBooks.

I'm adding this article for more troubleshooting steps: Fix data damage on your QuickBooks Desktop company file.

After processing your payroll, you can run payroll and employee reports to manage and keep track of employee expenses. Check out this article for detailed guidance on how to generate and customize your reports: Customize payroll and employee reports.

Let me know if you need further help resolving the error you're having in setting up your employee's profile. Keep safe and have a wonderful day!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

I think you may have responded to the wrong question. We aren't having issues with our address not showing up on our invoice. We are having payroll issues.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

Yes I have done this already and still getting same error.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

Hey there again, @Accountant1233.

I appreciate you returning back and letting us know those steps didn't work.

Since you're the error is persisting, I recommend contacting our Customer Support Team for further assistance. Here's how:

- Go to the Help menu.

- Select the QuickBooks Desktop Help option.

- Click the Contact Us button/hyperlink.

- Enter your question and hit let's talk.

- Scroll down and choose to Get a callback.

From there, you'll receive an estimate time of when they'll be in touch.

Keep us updated on how the call goes. It's my priority that you're able to get back to running your business. Bye for now!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

I have talked to 4 people at QB and no one had an answer. I think it works in other versions of QB desktop but doesn't appear to be working in my contractor version. Wondering if this will be a change across the board to the other versions of QBD?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

I appreciate all your efforts in resolving the contractor issue, @Accountant1233. I am determined to improve your experience with our customer service. You may rest assured that your experience has been noted and will be passed on to the management team.

I understand that being able to duplicate employees and pay them in multiple states will benefit your business. However, adding employees who work in various locations is a product limitation in QuickBooks Desktop (QBDT). We do not support any workaround for this limitation because it will result in inaccurate calculations, filings, payments, and annual reporting.

Additionally, to know more about the new features available in the updated QBDT Enterprise Contractor version, see this link: New and improved in the Contractor Edition.

Lastly, you may download this Contractor Software Buyer’s Guide for future reference.

Let me know if you have other questions about your contractor. I'll be on standby, ready to answer any questions you may have. Be safe always.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

If it is actually blocking you and not letting you save an employee with the same SSN, then that's very bad because there are more than a couple of reasons where an employer needs to do this in QuickBooks, at least one is legal, when an employee changes legal status so that they are nos subject to SS and MediCare when they no longer were.

Is QuickBooks actually stopping you, or can yo proceed through the message. If you cannot, then some uninformed person at Intuit thought this was a good change - but it's not.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

It won't let me proceed without changing the SSN to a different number.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

Providing excellent service and convenience is our priority, Accountant1233.

I know that duplicating employees so you can pay them in multiple states and be able to list their name is one of the most convenient ways for you to do. As @MichelleBh mentioned on the thread, this is a product limitation and is unavailable in QuickBooks. You'll want to let our product team know how this will help your business by sending feedback. Follow the steps below for your guide:

- Go to the Help menu.

- Select Send Feedback Online.

- Choose Product Suggestion.

- Click Send Feedback.

Furthermore, you can run a Payroll Summary Report to view your payroll totals including employee taxes and contributions. I've added this article for your guide: Create Payroll Summary Report.

Please let me know if you have any questions about the report. I'll always be there if your need help.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

RE: As @MichelleBh mentioned on the thread, this is a product limitation and is unavailable in QuickBooks.

Well, it has been available for many, many years. At least until recently. And for good reason. If someone changed that in QuickBooks desktop, it's going to result in a lot of issues for the many users using QuickBooks payroll services that have and need to continue to have multiple employees with the same SSN.

Pushing people to enter a suggestion for something that has always been possible until recently isn't really a good move. This is bug, a change that was made that should be unmade ASAP.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

I am getting the same error, that only started today 04-21-2023 any help

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

I am getting this error, but it only started today 04-21-2023 and it wants me to change the Social Security #, but the SS# is correct. Any ideas

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

I figured out a solution - In order to make changes or add a state to an employee profile, you need to make sure that the other profiles that have the same SSN attached are made INACTIVE. Once you make the profile(s) that all contain the same SSN inactive, you can make changes or additions. Once your changes are done, just re-activate all the employee profiles. You will get a warning message indicating that the SSN is already in use, do you want to continue, and you just click YES (like it was before the update).

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

Thank you! Thank you! Thank you!

This solved the problem and removed those annoying exclamation marks from my payroll center.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

I have 2 instances of each employee (because they work in 2 states). Following your workaround, things go as you describe until the last step when I attempt to reactivate the last employee instance and save... at this point, I get the same error and I cannot save the result.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

I appreciate you joining the thread, Ken. Let me address your payroll concern today.

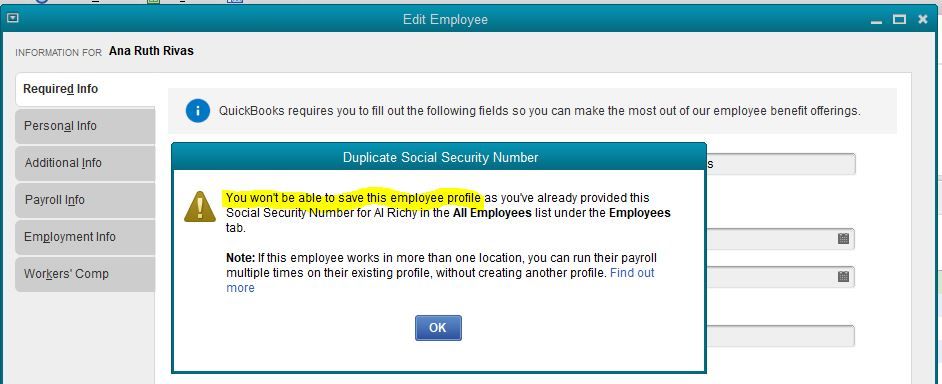

If you're trying to save your employees' records with the same SSN as discussed in the thread, the system allows you to perform the process by simply clicking on the Yes menu. I'm adding this screenshot as your visual reference.

If an error occurs, I recommend trying the solutions provided by my colleague MJoy_D to fix the issue. Alternatively, you can contact support to look into this more closely and process payroll for your employees accordingly.

To start:

- Open your QuickBooks Desktop (QBDT) file.

- Go to the Help menu, then QuickBooks Desktop Help/Contact Us.

- Tap on Contact Us.

- Enter a short description of your concern.

- Choose a way to connect with support.

You can conveniently contact them during their business hours.

For additional hints while setting up your employees in our system, run through the details from this article: Add your new employee to QuickBooks Payroll.

After that, get ready to create your paychecks and send your payroll.

If you have other concerns while working with your employees or payroll, let me know by leaving a comment below. I'm just a few clicks away to help. Have a good one!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

@Angelyn_T RE: If you're trying to save your employees' records with the same SSN as discussed in the thread, the system allows you to perform the process by simply clicking on the Yes menu. I'm adding this screenshot as your visual reference.

Well, yes, that's how QuickBooks should work, but it doesn't anymore due to the recent idiotic changes Intuit has made to the Employee records. I guess you didn't get the memo. Given all of the complaining here - and probably all the phone calls you're getting - I'm surprised you're still unaware of these changes.

Oh, and also you could have actually read the thread and understood the customer's question before answering with obsolete screenshots and incorrect product claims. That would have been another way for you to get up to speed on the huge issues this thread exposes - including the inability to correctly file W-2's and other tax forms for employees who have Applied For an SSN but not yet received it.

Here's what the customers on this thread are complaining about, from QuickBooks 2022 R11:

Note the new "Required Info" tab, and the completely lame reason for it, "so you can make the most out of our employee benefit offerings" (which have nothing to do with creating a payroll) and the message, which clearly states that you can't save the employee if there is another employee record with the same SSN, something which had for 30 years been just fine to do.

How is it that someone at Intuit with the power to make changes lacks so much understanding that they think forcing customers to enter all of this newly-required information - not required for payroll - and and adding new rules around SSN's that are actually harmful for customers trying to do their payroll correctly - just for the benefits add-ons that a customer might use - is a good thing? It's mind blowing that Intuit could be so inept.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

I now have 9 paychecks for 3 employees that I need to void/recreate under just one of their two employee accounts in an attempt to merge all their payroll information for this year. I'm assuming that I can still keep their prior years payrolls by just making that account INACTIVE.

Do you have any suggestions for doing the void/recreate? I just tried to open the cleared check, and change the EMPLOYEE so no liability information would be compromised, but I received the error "You cannot modify the employee on a paycheck."

I will probably have to void or delete the original check under the now INACTIVE employee account so I can recreate using the same number with all the same taxes. The problem will then arise that liabilities (which have already been paid) will be affected and reconciliations will also be affected (or will they since I'm using the same check number and date?) This is ridiculous!! Any suggestions are appreciated.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

What's going to happen when you need to run W2's & W3 at the end of the year? Will it run with BOTH SS#'s being active, which is needed to get the correct W3? This is so frustrating!!!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll Changes in July Update to QB Enterprise Contractor

I can see the urgency to have your payroll checks fixed as soon as possible to get you back in working order, HomerFair. I've got you covered.

The option to merge the payroll information is not possible. This is why you're getting an error " You cannot modify the employee on a paycheck." Not unless you delete all of them. However, it is important to note that deleting the paychecks in your records, particularly the liability account.

I suggest contacting our Customer Care Team. This is to ensure the accuracy of your records and to avoid creating discrepancies in reconciliation and taxes.

Here's how to reach them:

- Open QuickBooks Desktop.

- Go to the Help menu, then select QuickBooks Desktop Help.

- Click Contact Us at the bottom.

- Enter a brief description of your issue, then select Let's Talk.

- Choose a way to connect

I've added this article to learn more about payroll reports and tracking your employees' wages in QBDT, we can visit these articles:

Keep your post coming if you have other QuickBooks concerns aside from managing paychecks. I'm here to help you anytime. Have a great day!