Get 50% OFF QuickBooks for 3 months*

Buy now- US QuickBooks Community

- :

- QuickBooks Q & A

- :

- Employees and payroll

- :

- Payroll checkup reversing payroll liability adjustment

- Mark Topic as New

- Mark Topic as Read

- Float this Topic for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll checkup reversing payroll liability adjustment

I mistakenly setup an employee for the wrong state for unemployment insurance. I realized this when filing my quarterly reports. I performed a payroll liability adjustment decreasing the wage base, income subject to tax, and amount for the wrong state and increasing the wage base, income subject to tax, and amount for the correct state. After my adjustments the Payroll Detail Review report shows the correct amounts as do the tax forms. However, when I run a payroll checkup, it shows an error for this employee and creates additional payroll liability adjustments putting the amounts back to the incorrect state. What am I doing wrong?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll checkup reversing payroll liability adjustment

Hello there, @ab201.

I'd like to share some ways on how to fix the incorrect Payroll checkup.

The Payroll checkup shows an error because of the liability adjustment created in the payroll checkup. We'll need to delete it first. Here's how:

- Go to the Employees menu.

- Select Payroll Center.

- In the Transactions tab, select Liability Adjustments.

- Click to open the adjustment. Then, Delete.

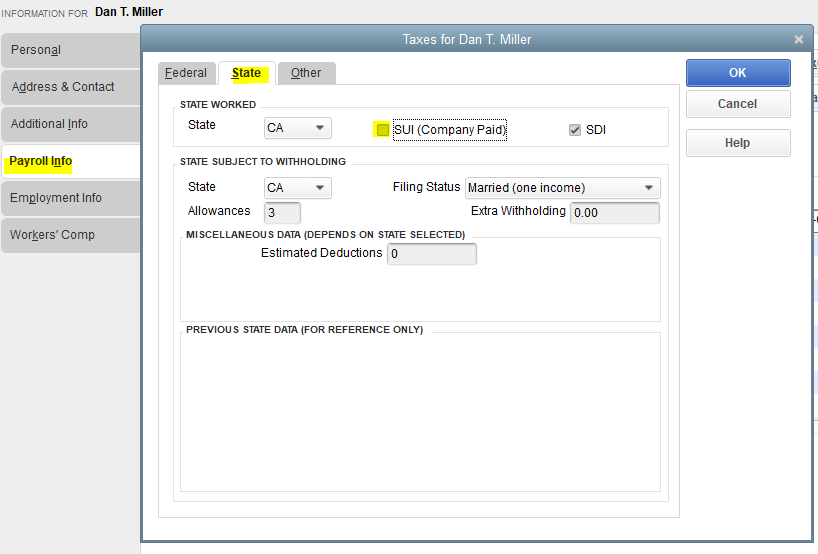

Once done, make sure the SUI is unchecked in the Payroll Info. You can follow the steps below to complete the task.

- Follow the first and second steps above.

- In the Employees tab, find the name of the employee.

- Click Payroll Info. Then, Taxes.

- Under the State section, uncheck the SUI.

- Once done, click OK to reflect the changes.

Afterward, run a payroll checkup to verify and review your employee's records.

I've collected some articles about handling payroll and employee reports. If you'd like to get more info about them, check the links below.

Please let me know how it goes. In case you need further assistance, I'm just here to help. Take care, ab201.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll checkup reversing payroll liability adjustment

Then once I’m finished do I go back into the employee profile and check the SUI box since we do pay SUI for this employee?

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll checkup reversing payroll liability adjustment

Thanks for getting back to us, @ab201. Yes, you'll need to go back and check the SUI as long as the correct SUI rate is selected.

For more insights about correcting employees' YTD or QTD, read through this article: Adjust payroll liabilities in QuickBooks Desktop.

I'll be here to guide you more with your additional concerns. Take care!

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll checkup reversing payroll liability adjustment

Unfortunately, this did not work. The system just booked different adjustments during the payroll checkup and then the errors in the payroll checkup showed there was SUI paid, the correct amounts but that there shouldn't have been.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll checkup reversing payroll liability adjustment

Let's make sure to fix the error message when running an adjustment, ab201.

Normally, correcting employees' payroll information can be fixed when adjusting payroll liabilities. I recommend reaching out to our support team so they'll be able to check and investigate this further. They have the tools to pull up your account in a secure environment. You can follow the steps below:

- Go to Help, then select QuickBooks Desktop Help.

- Select the Contact Us button.

- Enter a brief description of your concern in the What can we help you with? field and click Continue.

- Choose a way to connect (Chat or Callback).

For more information, you can check out theses articles for more payroll reference: QuickBooks Help Articles. You can click the + More topics button to view other payroll articles.

Reach out to us if you have any concerns with payroll adjustment. We're here to make sure that everything is taken care of. Always stay safe.

- Mark as New

- Bookmark

- Subscribe

- Permalink

- Report Inappropriate Content

Payroll checkup reversing payroll liability adjustment

I had this issue as well. Make sure to double check your state amounts printed on your w2.