Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI had an issue where my employees stopped receiving their paystubs in Workforce. Everybody at the company stopped getting paystubs as of February 23rd.

I contacted support and they informed me that some Paychecks were corrupt, thus not uploading to Workforce.

The solution was to delete the paycheck, and then recreate it, while ensuring I am not selecting "Direct Deposit."

I did so for 14 paychecks.

By doing so, my Bank account in QuickBooks got all out of whack and I realized what happened.

When I run Payroll for my 5 employees, the Bank account shows a single line item that totals the total payroll amount and then every employee is listed below that but with a $0.00. So when I run payroll, the deduction in QB is the single lump sum of the payroll.

When QB Support had me delete and recreate the paychecks, each employee now shows the amount of their paycheck, while the lump sum is still there from the original payroll run.

Example, if I run payroll for Bob, Jim, Rachel, Joe and Debbie and that total payroll is $10,000, QB shows a $10,000 line item in my bank register and then lists all five employees below that but with a $0.00.

By following the suggestions of QB support, my bank register still shows the $10,000 line item but also $2,000 for Bob, $2,000 for Jim, etc.....

Any suggestions on how to remedy this?

Is there a way to remedy that?

Hi there, Jkhalaf.

Thanks for taking all the necessary steps to fix your paychecks in your QuickBooks Desktop Payroll. Let me share some insights on how to handle your direct deposit paychecks.

It's possible that after you delete the paycheck and recreate it, the line item shows zero dollars ($0.00). So for this not to happen again let's create a direct deposit payroll item since it's needed when you recreate missing or voided direct deposit paychecks that are sent to employees' accounts.

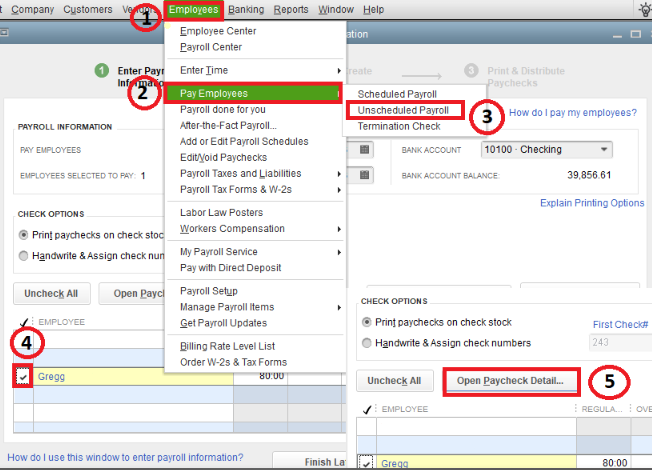

To do this here's how:

If the issue persists, I recommend contacting our customer support team again. They can closely examine the problem and conduct further troubleshooting to fix it.

Furthermore, you can also use these articles to help you manage your QuickBooks Desktop Payroll reports:

Please feel free to ask for further assistance from the QuickBooks Community if you need help with processing your payroll paychecks or generating reports in QuickBooks Online. We're always ready to support you 24/7. Have a great day.

Thank you Eman_E.

Now that I created this Payroll Item, how do I offset all the paychecks that are duplicated?

Thanks for coming back to this thread, jkhalaf. Let me help you further.

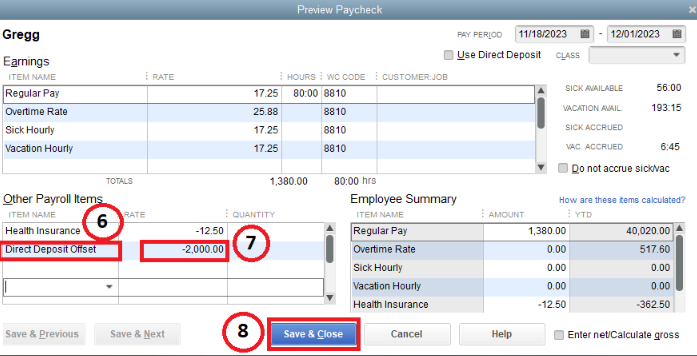

After creating a Payroll item, you can reopen the paycheck and add the created Direct Deposit Offset item. This way, it'll help to balance your check register.

Here's how:

You can also refer to the screenshot below for more visualization:

After following the steps above, you can follow step 3 in this article to correct your payroll liability balances and send your payroll data to Intuit: Recreate a missing or voided direct deposit paycheck in QuickBooks Desktop Payroll.

Furthermore, you can also run, print, and customize payroll reports in QuickBooks Desktop Payroll to check some information that is related to your employee: Run payroll reports.

Take all the time you need to follow the steps mentioned in this post. I'll be right here if you need any help along the way.

Thank you IrizA,

I followed all the steps, and it was fine, except that the Offset does not show up in the Bank register. Meaning the amount that was offset is not credited back or zeroed out to get me back to the actual balance in my bank register.

It's glad to know that the steps provided by my colleague work fine, jkhalaf.

Allow me to jump into this thread and share some insights on why the offset doesn't show up in the bank register.

In the direct deposit, the total amount should be reflected in the direct deposit liability check. Thus, the Direct Deposit offset will not appear in the bank register. It is used to zero out the net pay of the recreated paychecks to balance your check register and make sure your employees aren't paid twice.

Furthermore, you can also run, print, and customize payroll reports in QuickBooks Desktop Payroll to check some information that is related to your employee: Run payroll reports.

I'll keep an eye out for your reply. If you have further questions about turning off ads or any QuickBooks-related concerns, feel free to include them in the comments. We're here to assist you 24/7.

IrishNinoJ,

Thank you for the reply. My ultimate goal is to ensure that my bank register is reflecting the correct balance as my actual bank account.

Please take a look at the attached screenshot for the actual problem.

The line item "QuickBooks Payroll Service" reflects the total amount debited for all 5 employees combined (Assad, Brian, Dan, Janet and Joseph).

You will then notice that each employee is listed separately, but they show $0.00, except for Joseph. He is actually showing a $1,629.58 amount. It should be $0.00. The reason he is showing that amount is because I recreated his paycheck, but I never really deducted these funds form the bank, because I unchecked "Direct Deposit." So while the actual total payroll for that period is $12,206.00, QuickBooks is deducting $13,835.58 from the bank register ($12,206.00+$1,629.58).

I am looking for a way to credit back the $1,629.58 or zero it out.

Thanks for coming back with some detailed information, jkhalaf. I'm here to share some tips on how you can resolve this.

Since you mentioned that you recreated Joseph's paycheck, you're on the right track and correct about unchecking the Direct Deposit. To proceed, you'll need to enter a negative amount for the Direct Deposit Offset item. Ensure that it has an equal amount to the net amount of the paycheck. After making some changes within the paycheck, you can now Save & Close.

Additionally, you can continue in step 3 after you're done putting a negative amount to your employee: Recreate a missing or voided direct deposit paycheck in QuickBooks Desktop Payroll.

Moreover, you can run a report to check some information related to your employee.

Feel free to come back and ask us again whenever you need some help. We'll be glad to assist you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.