Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowIn Quickbooks under our 'wages' on our P&L, there seem to be duplicate transactions for where the money was withdrawn from our bank and where the payroll check itself (we utilize direct deposit through QBO) was withdrawn from the bank, showing our wage cost as almost double what it should be. Is this something anyone has experience on?

Hello, cofoadrianna.

There are several factors why you're seeing duplicate payroll expenses on your Profit and Loss report. I'd be glad to list some of the common ones, then help you take care of them.

The most common reasons include the following:

Looking at the screenshot, I see that those entries have different amounts. Did you create another check within the same pay period?

If so, we can review the Paycheck history report, and review what the checks are for. Go to the Reports page, then search for Paycheck history in the search box.

If these are duplicates, we can pull them up from the Profit and Loss report, then delete them.

Open the entry by clicking on the amount. It should automatically direct you to the Paycheck list page. Simply find the duplicate checks, then check them. Click on Delete to remove them from your books.

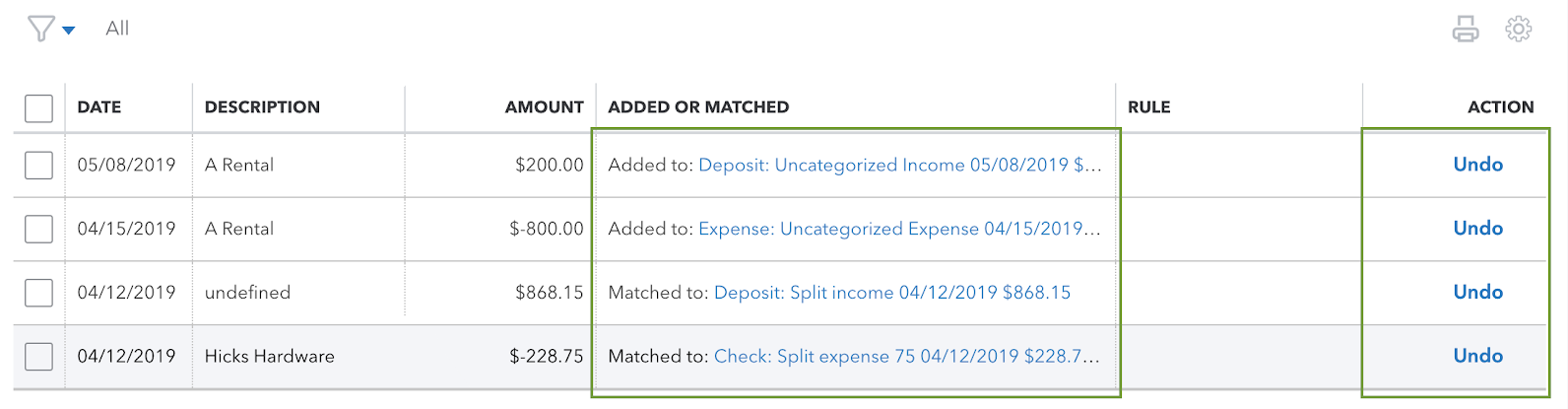

It's also possible that these were automatically added by the Online Banking feature. The system could've added those transactions instead of matching them.

So, in this case, we'll want to undo those payroll entries, then match or simply exclude them:

They should now be added under the For review tab. Simply click each entry, then select Find match. Locate the matching entry within QuickBooks, then match both transactions.

If you don't want these added, we can exclude them by checking them, then selecting Exclude.

After fixing the duplicate entries, do you also need help paying and filing your taxes within QuickBooks? Feel free to read this article as a guide: Pay and file payroll taxes and forms in Online Payroll.

Please let me know if you have more questions about managing the paychecks in QuickBooks. If you have concerns about your sales or expense entries, lay down the details below. I'm here to help.

Thank you so much for these insights, James!

It looks like the charges were not mapped correctly to our banking account. We utilize both Quickbooks Payroll and Quickbooks Online, and I have corrected the mapping for moving forward.

From our P&L, it looks like Quickbooks Payroll is showing the net pay, as to where the banking charge is showing the gross pay. Since we have a category set up for payroll tax, we will want our net pay to show on the P&L, so I am thinking we will likely want to remove the Quickbooks Payroll charges from the P&L. Is deleting the paychecks in QBP the only way to do that? If so, will this affect our books?

Thank you again for your thorough response,

Adrianna

I can help match the downloaded bank transaction to your payroll expenses so there won't be duplicate entries, cofoadrianna.

There isn't a need to delete paychecks. Duplicate entries happen when bank transactions aren't matched with what's recorded in QuickBooks Online. That being said, you can undo the money withdrawn from the bank and match it to the payroll expenses in QuickBooks.

I'm glad to show you the steps.

The original downloaded transaction will go back to the For Review tab. Follow the steps in this article to find the match: Categorize and match online bank transactions in QuickBooks Online.

You may open this article to view various banking errors and how to fix them:

You can mention me in the comment section if you need more payroll tips. I'll be here to back you up always and want to make sure you're able to prevent duplicate entries while managing payroll transactions. Take care and have a wonderful weekdays ahead!

Hi Mary,

Thank you so much for your thorough response. Unfortunately, I tried to undo the categorized transactions and match them, but because the net pay is coming out of payroll and the gross pay is coming out of the bank, the amounts do not match.

Let me show you an example.

This employee's net pay is $101.59:

Which is what shows as withdrawn from the banking tab in QBO, but it does not find a match:

On the P&L the transaction out of QB Payroll shows the gross pay withdrawn of $110.00:

I believe this is why they are not matching to the QB Payroll transaction. Most of our employees are not contractors, and we have no issue with matching the contractors pay because those match exact amount withdrawn from the payroll account.

Can you please advise how to proceed?

Thanks again,

Adrianna

Thanks for getting back with the Community, cofoadrianna.

Since a match isn't being found, I'd recommend checking your register where the $110.00 transaction falls under to confirm it's present in that account. If it's not there, and only present on your payroll side of things, it'd make sense why QuickBooks isn't locating a match for the bank transaction.

When your books can't find an existing matching record, you'll need to create a new transaction using details from the financial institution.

Here's how:

Now QuickBooks will use the info you entered to create and add a new transaction to your accounts.

You'll also be able to find many detailed resources about using QuickBooks in our help article archives.

Please don't hesitate to send a reply if there's any additional questions. Have a lovely day!

Hi Zack,

Ultimately, we are trying to exclude the 'gross' pay. It is not accurate to our banking, but since it was processed in QB before we re-routed the bank to match the transactions, it still exists on our P&L. Making another transaction would also just duplicate these charges again, even if it matched, because our net pay & payroll taxes are broken out separately in our banking app.

Another example below, just to make sure I am explaining this correctly. The first highlighted item under 'credit' shows what was withdrawn from our bank for this employee's pay check.

The second highlighted item under "debit" was not the true transaction taken from the bank, but what is showing on our P&L under 'payroll check':

How can we exclude the 'payroll check' & all other associated charges (we also show direct labor taxes, but we have our own 'payroll taxes' category already) from the P&L?

Thanks again,

Adrianna

Thanks for getting back and outlining the details of your concern, cofoadrianna.

To look further into your account safely, I recommend getting in touch with our QuickBooks Payroll Support team. They can guide you on the best process to exclude those payroll checks as well as the other associated charges and fix your Profit and Loss report seamlessly.

Here's how:

For more tips while running payroll reports in QBO, refer to this article: Run payroll reports in QuickBooks Online Payroll. The same resource will detail how to mark a favorite report and customize reports.

You can tag me in your Reply if you have other QBO-related concerns, specifically on payroll forms. I'm very eager to help. Take care always.

@cofoadrianna - I am having the exact same issue. Were you able to resolve it and how did you? Much appreciated any help.

I’m having the exact same issue also and have been tossed between payroll experts and technical support, and no one can figure it out, very frustrated. My only guess is to leave the payroll QBO invoice and exclude the bank transactions and pray the reconcile. Because I tried to show as a transfer and it’s how’s now not on P+L but in my Bal sheet as a an asset to transfer the payroll to employee. So awful. Ugh. So frusterating. I used to delete the payroll invoices. But QBO won’t let you anymore.

Thank you for sharing your concern with us, Ajax.

I understand that encountering issues with payroll can be a challenging experience. Accurate reflection of payroll transactions in your financial statements is crucial, and we want to help you resolve this matter as soon as possible.

Although you've already contacted our support team, I suggest contacting our Customer Care Team again. They can securely review your account, follow up on your case, and further investigate the root cause of the issue you're experiencing.

Please follow these simple steps to connect with our Customer Care Team:

1. Click on Help.

2. Select Contact Us.

3. Enter your concern and click Let's talk.

4. Choose a way to connect with us:

Alternatively, you can find a specific number on our website to contact us directly.

For future use, here's an article explaining how to generate payroll reports that can provide helpful information about your employees and your business: Run payroll reports.

Please don't hesitate to reach out if you have any additional questions or issues related to payroll in QuickBooks. I'm always just one post away.

Hi

If you haven't fixed it I had the same problem with over 50 clients and called QBO Payroll and they were useless. I figured out the mapping under Payroll Setting the Wages were set to the Wage expense account and I switched that to Direct Deposit Payable and boom it was all fixed.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here