Hey there, cmkelly. Let's get this working for you.

To get this sorted out, reverting paychecks is a good start when it comes to fixing payroll-related issues in QuickBooks Desktop.

Here's how:

- Click the Employees tab at the top menu bar.

- Select Payroll Center.

- Click Resume Scheduled Payroll.

- Right-click the name of the employee and select Revert Paycheck.

- Click Open Paycheck Detail.

- Enter the necessary information.

- Check if it calculates the Paid Family and Medical Leave premiums.

- Click Save & Close.

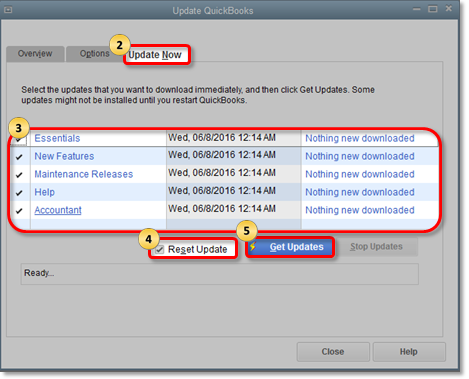

If you're still getting the same result, let's update your QuickBooks Desktop to its latest release. Let me show you how:

- Click Help at the top menu bar and select Update QuickBooks Desktop.

- Go to the Update Now tab. Tip: You can select the Reset Update checkbox to clear all previous update downloads.

- Select Get Updates to start the download.

- When the download finishes, restart QuickBooks.

- Accept the option to install the new release.

Once done, you can visit this write-up to update your payroll tax table: Get the latest payroll tax table update.

To know more about paying liabilities in QuickBooks Desktop, here's an article for your reference: Pay your non-tax liabilities in QuickBooks Desktop Payroll.

Let me know how it goes by leaving a reply below. I want to make sure you're all set. Have a good one.