Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow do I map accounts to track 1099s. some are being tracked. Others are not. Thanks

Solved! Go to Solution.

Happy Thanksgiving Eve, @newyorktutor.

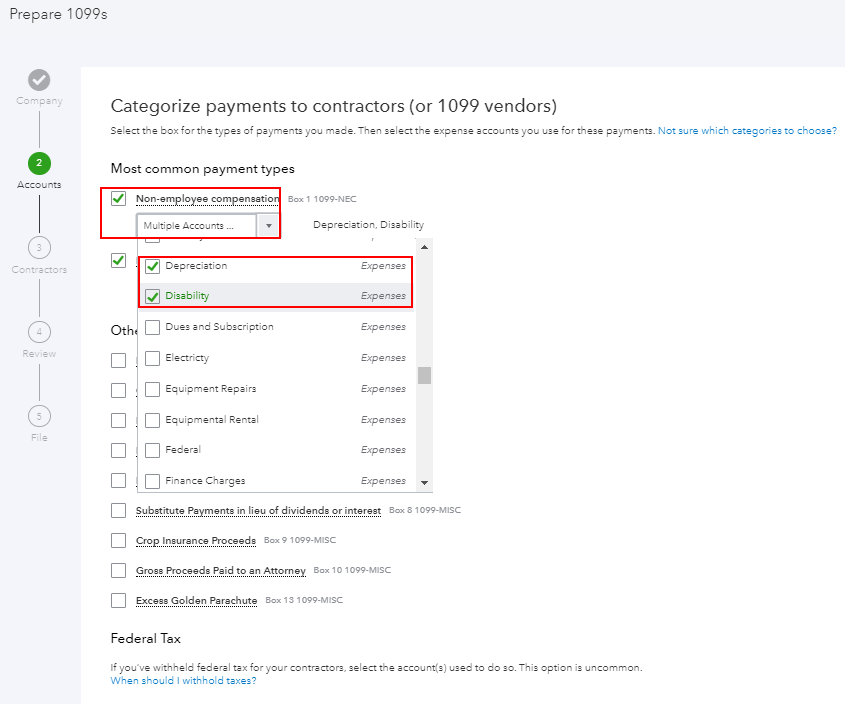

I'm here to provide some additional clarification on your question regarding 1099's. For a visual reference of what Rustler said, see below:

Begin Configuring 1099's

Check out this brief video demonstration of the steps above:

The information here is also available in our guide on preparing and filing 1099's if you're interested. Additionally, Vendors have to be configured for their transactions to be tracked for 1099's. Follow these steps to accomplish this:

Mark a vendor to track their transactions for 1099's

We also offer a guide on enabling vendor 1099-tracking for your convenience. I'm including a quick video example below:

With these resources, you'll be a master at filing 1099's in no time. Please get in touch with me here should you have any additional questions or concerns. Thanks for reaching out, cheers to a safe and relaxing holiday weekend.

Hi @newyorktutor.

Thanks for getting back to me.

The magic button can be found here.

Click on the category for your question and then click "start discussion" on the right.

you ask how to add, but the title says remove

get the vendor list up

you must have a subscription to QBO Plus to have 1099 tracking

a the top is prepare 1099, click that

Happy Thanksgiving Eve, @newyorktutor.

I'm here to provide some additional clarification on your question regarding 1099's. For a visual reference of what Rustler said, see below:

Begin Configuring 1099's

Check out this brief video demonstration of the steps above:

The information here is also available in our guide on preparing and filing 1099's if you're interested. Additionally, Vendors have to be configured for their transactions to be tracked for 1099's. Follow these steps to accomplish this:

Mark a vendor to track their transactions for 1099's

We also offer a guide on enabling vendor 1099-tracking for your convenience. I'm including a quick video example below:

With these resources, you'll be a master at filing 1099's in no time. Please get in touch with me here should you have any additional questions or concerns. Thanks for reaching out, cheers to a safe and relaxing holiday weekend.

The video was most helpful. I didn't realize I could go back and pick up the accounts that should be mapped as 1099 since someone else set this up. REALLY appreciate the assistance. Have a great holiday.

Yes. I was trying to add AND remove. got it now. Thanks for responding

Don't mention it, @newyorktutor.

Please let me know if you run into any other obstacles while preparing those 1099's, I'm always available here for all of your QuickBooks needs.

I have a question not related to 1099s. Should I ask it to you here or another way? Thanks

Hello @newyorktutor.

I'm happy to see @MichaelDL was able to help resolve your 1099 question.

For any other questions, feel free to post them here or make a new post.

Either way, I'll be happy to help with that! I'll be keeping an eye out for your response.

Hi Sterling

Thanks. I'd like to start a new post. I feel like an idiot. Where is the magic button? thanks

I see this:

To post a message:

How do I find the appropriate board? Thanks again.

Hi there

I would like to make a Profit & Loss By Class report that only shows the CLASSES not the SUBCLASSES? Is there a way? Thanks.

Not sure if I have posted this correctly.....apologies

Hi @newyorktutor.

Thanks for getting back to me.

The magic button can be found here.

Click on the category for your question and then click "start discussion" on the right.

Ooooooh. Thank you

Also, a minute ago I saw a list of my unmoderated feeds. Can you tell me how to get back to that again? Thank you

You're welcome @newyorktutor.

To see your previous posts, you can click on your name and it goes to your profile and view all of your posts.

You can even do this with other users to see other posts they have commented on.

Let me know if this is what you were trying to locate.

I have a vendor where I am tracking 1099 payments under the Edit Box for their vendor information however the transactions are still not appearing allowing me to file a 1099. Any suggestions?

Hello @infoithc.

It's nice to have you in the Community. I can help with filing a 1099 for your vendor.

Since you've referenced that the vendor is already set to be tracked for 1099 payments, this is likely related to the mapping of the expense accounts. I'm including an article which includes steps for resolving issues with this form: 1099 Troubleshooting. I suggest looking at the section 1099 vendor is not showing on the list when preparing 1099s.

I'm confident this resource will help to prepare the form and get you back to business.

I'd be glad to provide further assistance should you have any questions or need anything. Cheering you to continued success.

look in the manual

How do you remove the mapping for a GL account? I accidently selected the option to make them all box 1 for NEC and now I can't change them for MISC accounts!

Removing a GL account associated with 1099-NEC is easy peasy, @Morrison123.

You'll have to go back to the Categorize payments to 1099 vendors to remove the GL account selected from Box 1 for 1099-NEC and associate it with the 1099-MISC. Here's how:

You might want to check out these articles to learn more about preparing 1099s and their payments categories:

Should you need any assistance preparing your 1099s in QuickBooks Online, I'm available here to help any time!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here