Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowEmployees at my company have different numbers of PTO days based on their time of service with the company. How do I factor in the different accrual rates they get? We accrue on a bi-weekly paycheck. The newest employees get 10 days or 80 hours, and veteran employees get 15 days or 120 hours per year, with varying numbers in between. I see in the company preferences that I can set a base accrual rate per paycheck, but that doesn't factor in the difference in rates.

Hi there, @tstaab73.

You can go to each of your employees' profiles to set up their accrual hours per paycheck based on the maximum hours to accrue per year. Here's how:

For more info, check out these articles:

If you have further concerns about tracking paid time off, please provide additional details. I want to make sure everything is taken care of.

Hello,

If we are not using Payroll in Quickbooks and we have our time-off set up in Quickbooks Time, can we apply a different setting to particular employees? We also have different rates depending on the time of service, but could not follow your instructions. do we just have to adjust manually?

Hi there, @Sfcrisp.

Let me help you set your time-off rates for your employees who have different times of service in QuickBooks (QB) Time.

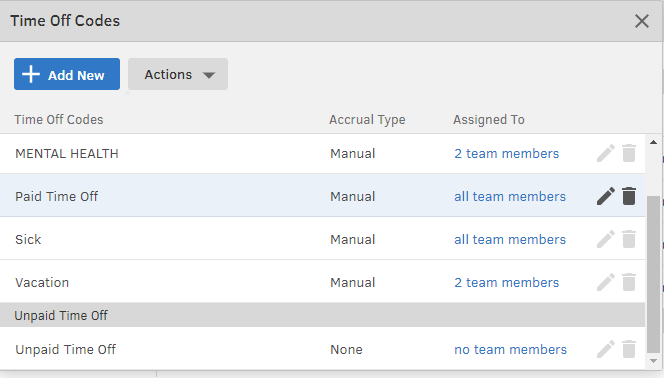

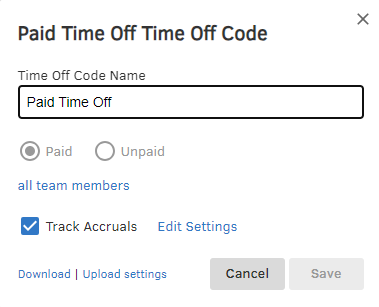

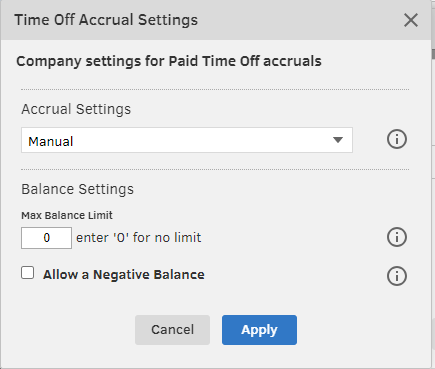

First, we need to edit the time off you set up and change the Accrual Type to Manual. Here's how:

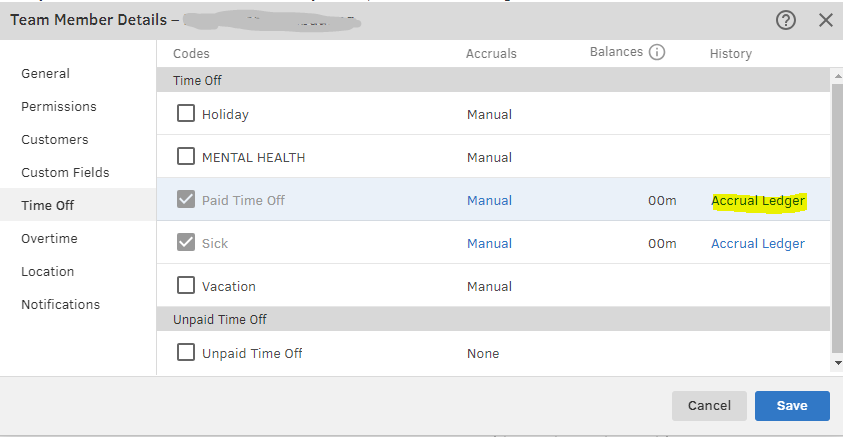

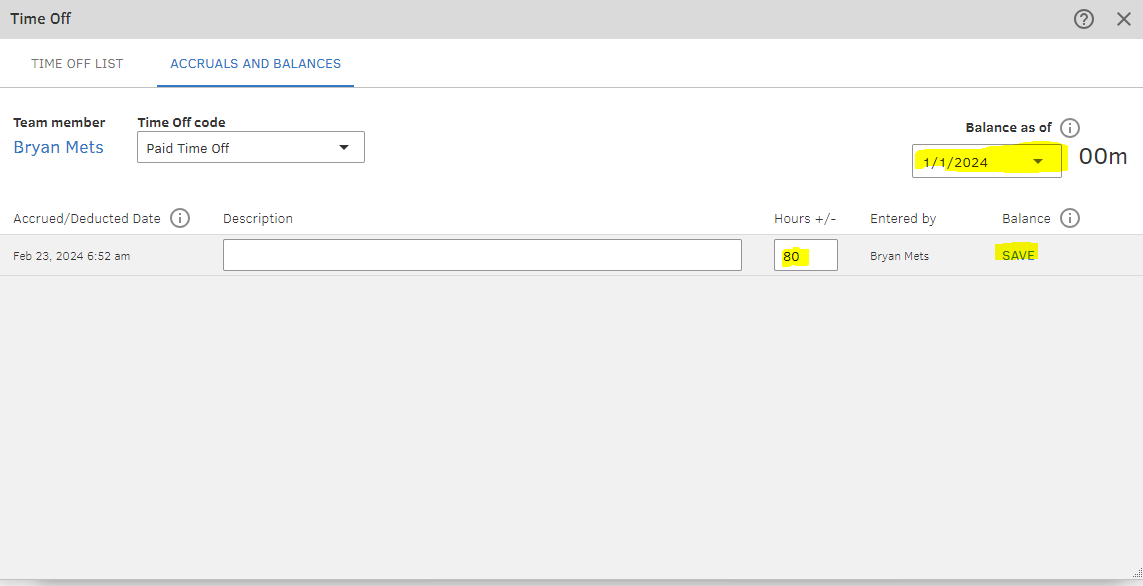

After that, let's go and set the time off for each of your employees depending on the time of service. You can follow the steps below:

Learn how to track, edit, and submit your time as a team member in the QuickBooks Time web dashboard: Track and submit your time in QuickBooks Time web.

Leave a comment below if you have additional questions about time off. I'll be willing to lend a hand. Keep safe and have a good one.

Hi Bryan,

Thanks for your reply.

With this setup, even though we select "manual" in the main settings, will the system be accruing periodically the number of days assigned to each employee?

Also, Since we are already almost in March, can I do retroactively to start Jan 1st? Would I need to adjust any activity that might have happened since?

Susie

I'm here to provide more clarification about the setup, @Sfcrisp.

When you switch your time-off settings to Manual, the system will no longer automatically accrue time off hours for you. This means that any time off hours you wish to accumulate will need to be manually entered by either a user or administrator.

Moreover, if you want to start in January, you can do so. You would need to adjust the accrued time off balances for each employee accordingly to ensure that any adjustments that have occurred since January 1st are accurately reflected in the system. For more accurate adjustment during these periods, I suggest contacting our support team since they can do so. They have the necessary tools and expertise needed to successfully do this.

Additionally, you can check this article if you want to set up time off for your employee: Set up and Manage Time Off in QuickBooks Time.

Don't hesitate to get back to us by commenting on this post. We'll always be glad to assist you anytime.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.