Thank you for dropping by the Community today, conradfarms.

I can see the urgency of adding the EIN (Employer Identification Number) smoothly. This allows you to complete your 1099 in no time.

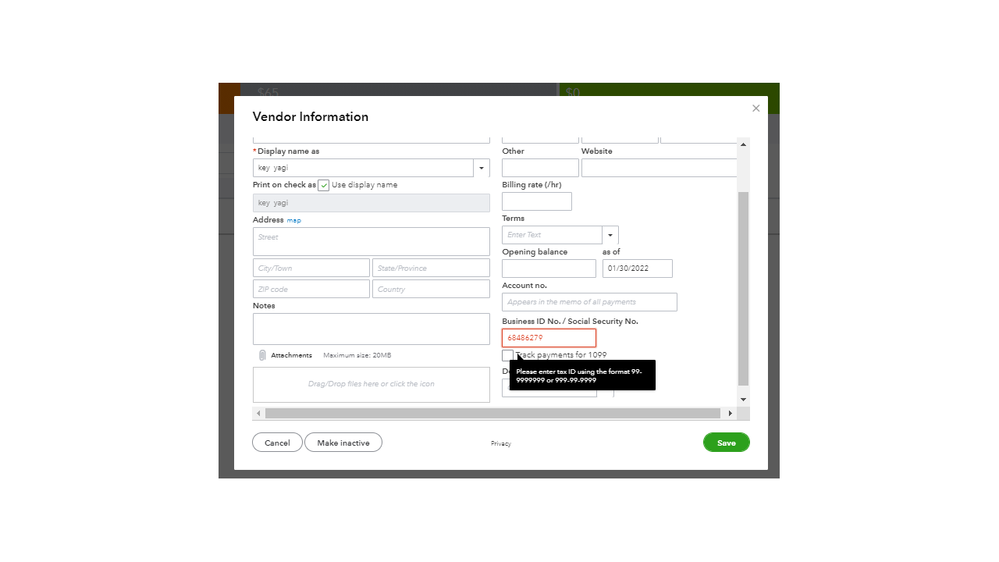

When your EIN is entered incorrectly, QuickBooks Online (QBO) will not save it. Make sure that it’s added in the following format: XX-XXXXXXX OR XXX-XX-XXXX.

Next, open the W-9 and key in the EIN for your vendor. Once completed, you can start processing the 1099 forms.

I’m adding some links below for future reference. These resources provide detailed information on how to process the tax forms, print them, and answer common questions about your 1099s.

If there’s anything else I can help you with processing the 1099s and entering EINs into the vendors' profiles, feel free to drop a comment below. I’ll get back to help.