Print your 1099 and 1096 forms

by Intuit•565• Updated 1 month ago

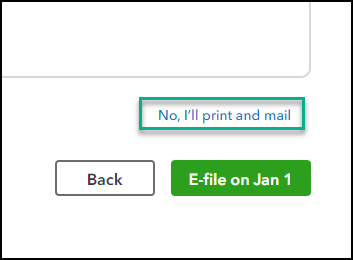

The steps to print 1099 forms depend on whether you have e-filed. If you already e-filed, you can print a PDF copy from the 1099 filings section in QuickBooks Online. If you didn't e-file, you can prepare the forms in your QuickBooks product and select the option to print and mail them.

| Note: Not sure which payroll service you have? Here's how to find your payroll service. |

Print your 1099s

Print 1099s after you e-file

Learn how to print copies of 1099s you have already e-filed.

Print 1099s if you didn’t e-file

Create and print 1099s if you haven't e-filed them.

1099s aren't automatically created in QuickBooks. There are a couple of options for creating, filing, and printing the 1099-MISC and 1099-NEC.

- You can e-file 1099s directly with the IRS using the Information Returns Intake System (IRIS). To learn more see E-file Forms 1099 with IRIS.

- Or, for a small fee, you can e-file your 1099 with your QuickBooks and Intuit products.

| If you have 10 or more combined 1099s, W-2s, or other federal forms to file, you must file them electronically. To learn more, see IRS and Treasury issue final regulations on e-file for businesses. |

Choose your product below to see the steps to print your 1099s.

Print your 1096

If you are filing electronically, Form 1096 isn't required by the IRS. For more info Form 1096 and About Form 1096, Annual Summary and Transmittal of U.S. Information Returns.

- QuickBooks Online & QuickBooks Contractor Payments don't provide Form 1096. To get the same info, you can select View Summary from the 1099s filings tab.

- QuickBooks Desktop:

- If you e-filed with Tax 1099: You can print a copy from Tax1099.

- If you haven’t created your 1099s: To print your 106s, you first have to create them in QuickBooks.

Related links:

Select your product to learn how to e-file your 1099 with us.

For more info about IRS and state requirements, consult your accountant, and see:

More like this

- Correct or change 1099sby QuickBooks

- Create and file 1099s with QuickBooks Onlineby QuickBooks

- Release notes for QuickBooks Desktop for Mac 2021by QuickBooks

- Create and file 1099s with QuickBooks Contractor Payments if you use QuickBooks Desktopby QuickBooks