Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello, every time I process a termination check I follow the Intuit instructions (Employees > Pay Employees > Termination Check, enter dates including release date, review check info, etc...Create Paycheck).

They have been printed checks and we don’t want the employees receiving Intuit notification from Workforce before notifying them of the termination and handing over the check. So for example, I cut and dated a check 3/18/21, management notified the employee and handed over the check that evening, and now today 3/19 I need to send to intuit for tax processing. But QuickBooks wants to charge me a $100 late fee and says “If you terminated an employee and need to create a final paycheck dated 3/18/21, delete this check and use Create termination check.” But that’s what I did!

What am I doing wrong here?

I appreciate the complete details you've shared, @Gauchofife.

The late fee depends on the type of your payroll subscription and method. You can create a paper check so you'll not be charged for a late payments. Let me share some information on how this works.

First, it's possible that you're subscribed to Assisted payroll subscription. You can refer to this article for more insights: Assisted payroll ancillary fee schedule.

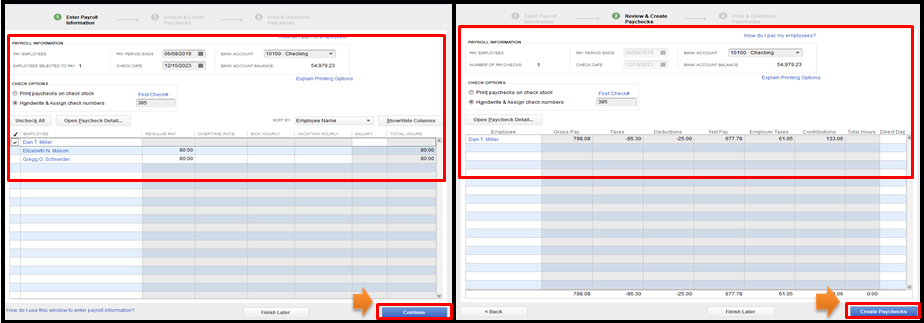

As a work-around, you can run a paper check so that you can run a paper check for it and give to your employee. First, you'd want to set the Termination status of your employee.

Once completed, you can now generate a paper check as the employee's last payroll. Here's how:

Now, you can run payroll-related reports to ensure the accuracy of your records. To do this, go to the Reports menu, and then select the desired report from the Employees & Payroll section.

You're always welcome to get back here in the Community if you have more questions about managing your payroll in QuickBooks Desktop. I'll be here to help.

I mean I basically did this - I created a paper check - but I used Create Termination check instead of Unscheduled Payroll. So If I use Unscheduled Payroll, I won’t have the fee?

My workaround has been that I just change the check date to a later date where it doesn’t charge me. But I don’t really like doing this every time and would rather just process it properly.

Let me share additional information, @Gauchofife.

Here are the factors to consider so you'll not be prompted or charged for a late payroll processing fee of $100:

Also, you'd be prompted for the late payroll processing fee if you backdate payroll. You'll be responsible for any payroll penalties and/or interest accrued for late tax payments as well.

In the meantime, I'd recommend contact our Payroll Support Team. A specialist can securely look up your account and further assist you in processing your employee's termination check. You can chat with us M-F 6 AM to 6 PM PT.

Drop a comment below if you have other questions or concerns. The Community and I are always here to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here