Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Welcome to the QuickBooks Community, Dan_CPA. I understand how this is affecting your business. Please understand that our team is aware of this situation and doing their very best to find a solution. Once we received an update, you will be notified. Until then, be safe and take care.

Another nonsense, "be patient and maybe we'll fix it" reply.

Does Quickbooks just assign random employees to post the same platitudes to placate customers?

If you want your customers to "rest assured" then say "we are working on this and will fix it by X date" or "we will post a definite date for a fix by X date".

Vague words about someone maybe doing something sometime and "take care" - thats nonsense and you know it.

With NJ's one year advance notice, I can't even believe this is an issue for Quickbooks. Oh wait, yes I can because unless something has recently changed, they also can't manage to cap sick leave hours.

Hi Sasha,

Any update as to a time for the NJW3 being filed electronically?

Thanks

Dan

Thanks for following up with the Community, Dan_CPA.

Once there's an update about filing Form NJ-W-3 through QuickBooks, you'll be notified by email and in-product notifications. You can also review our blog to stay up-to-date with Intuit's latest news.

While New Jersey hasn't made electronic filing of these forms available in QuickBooks, they mention on their website that there's a workaround using Secure File Transfer Protocol (SFTP) technology through Axway Secure Transport. To obtain the data you'll need for utilizing this option, you can run your Payroll Summary report.

Here's how:

Once you've generated a copy of it, you can follow the steps in the If you're in New Jersey section of our File your state W-2s resource to complete the process.

Please feel more than welcome to send a reply if there's any additional questions. Have a great day!

"The State of New Jersey’s requirements for filing W-2 information via electronic filing (E-File)

conform to specifications defined by the Social Security Administration and published in their

booklet “Specifications for filing Form W-2 electronically” (efW2)." - quote from the link you gave the NJ requirements. It looks like they want the same file you send to the SSA. How can I get that copy to send to the state through Axway?

"The State of New Jersey’s requirements for filing W-2 information via electronic filing (E-File)

conform to specifications defined by the Social Security Administration and published in their

booklet “Specifications for filing Form W-2 electronically” (efW2)." quote from the NJ requirement link you have provided.

Unless there is a way to export the payroll summary in a text file to match the SSA file, your instructions are worthless. I suggest someone at Intuit actually reads the stuff they are advising their clients to use. I'm not a computer expert by any means, but I can read. The file they need is the same one that goes to the SSA. Tell me how I can get that file and I will be happy to upload it on Axway.

Your answer to the NJ W2 and W3 e-fling is not acceptable.

I

@ZackE wrote:Thanks for following up with the Community, Dan_CPA.

Once there's an update about filing Form NJ-W-3 through QuickBooks, you'll be notified by email and in-product notifications. You can also review our blog to stay up-to-date with Intuit's latest news.

While New Jersey hasn't made electronic filing of these forms available in QuickBooks, they mention on their website that there's a workaround using Secure File Transfer Protocol (SFTP) technology through Axway Secure Transport. To obtain the data you'll need for utilizing this option, you can run your Payroll Summary report.

Here's how:

- In the top menu bar, go to Reports.

- Move your cursor over Employees & Payroll.

- Choose Payroll Summary.

- Enter the appropriate Dates, then click Refresh.

Once you've generated a copy of it, you can follow the steps in the If you're in New Jersey section of our File your state W-2s resource to complete the process.

Please feel more than welcome to send a reply if there's any additional questions. Have a great day!

@ZackE wrote:Thanks for following up with the Community, Dan_CPA.

Once there's an update about filing Form NJ-W-3 through QuickBooks, you'll be notified by email and in-product notifications. You can also review our blog to stay up-to-date with Intuit's latest news.

While New Jersey hasn't made electronic filing of these forms available in QuickBooks, they mention on their website that there's a workaround using Secure File Transfer Protocol (SFTP) technology through Axway Secure Transport. To obtain the data you'll need for utilizing this option, you can run your Payroll Summary report.

Here's how:

- In the top menu bar, go to Reports.

- Move your cursor over Employees & Payroll.

- Choose Payroll Summary.

- Enter the appropriate Dates, then click Refresh.

Once you've generated a copy of it, you can follow the steps in the If you're in New Jersey section of our File your state W-2s resource to complete the process.

Please feel more than welcome to send a reply if there's any additional questions. Have a great day!

n order to send the file to NJ it has to be txt file in an exact format.

Your answer does NOT provide a solution to the problem that we are having.

We know how to run payroll summary.

Why don't you answer how to create the txt file so we can upload to the NJ Axway portal?

If you wan create the file for other states, why can't you create the file for NJ.

You should say that QuickBooks has not made NJ efiling available. Not that NJ has not made QuickBooks available for the NJ Efile.

It looks like QuickBooks does not care enough for its customers in order to fix this problem.

I am a small business in NJ. We all get frustrated when our softwares can't do certain things. Obviously I have no idea how much effort QB has put into NJ w-2/3 e-filing. But they have succeeded in every other state that requires an e filing, so that is good evidence of their competency. I seriously doubt they have it out for NJ businesses as some seem to bemoan. I have spoken to Axway, the NJ Div of Taxation and have emailed NJ Treasury. NJ was more than satisfied to issue the electronic mandate knowing full well that most businesses with less than 100 employees would have to manually enter all the employee W-2 info (and 1099s too) on that NJ927/WR30 filing website. So at the moment, it doesn't matter if QB can provide the proper file format--if you don't have 100 employees, you can not get an Axway account--period. Sure seems like it is our elected and appointed leaders, and not QB, that doesn't care about us. That to me is unacceptable. I recommend doing what I did. I made my annoyance known to Axway, Div of Taxation, Treasury and the Governor's office. At least I wasn't totally ignored by the first 3. Murphy's office didn't even send a BS form letter back.

Getting the Axway account takes one day and then you can upload the txt file. This is mandatory for 2020. I have several clients that have well over 200 or 300 employee's and we can't post them all on the NJ Website from scratch.

I have Enhanced Payroll and still was not able to efile NJ W3.

One work around is if you have a NJ Premier Business service account and enter it there. The problem is that you have to make all the entries manually from the paper W3 into the portal. You will also need to have a copy of the W2s in order to enter UI, DI, FLI numbers.

It's a very tedious and frustrading task and definitely do not recommend it for many employees. If you have a few (many 1-5) you can try it this way.

QB needs to fix it right away.

Super cumbersome and time consuming but yhtax876 is right on the money. Here's the link to start this awfully painful process of filing Forms NJ-W-3, W2s, and 1099s.

| https://www1.state.nj.us/TYTR_BusinessFilings/jsp/common/Login.jsp?taxcode=45 |

QB needs to make it as easy as filing Forms NJ-927 and WR-30! They had at least a year to work on it.

This reply is nonsense.

NJ published in 2019 guidelines for e-filing for payroll providers. This is highlighted on the state website and easy to find via Google, but since Quickbook's developers couldn't find it, here you go:

https://www.state.nj.us/treasury/taxation/pdf/current/nj_efw2.pdf

I contacted New Jersey and they indicated (a) there has been no recorded contact by Intuit or Quickbooks about this form and (b) as Quickbooks already e-files other forms, the question is not one of access or connectivity, but about Quickbooks software.

This isn't an issue with the state - this is Quickbooks ignoring a fix that needs to be made and then pretending they didn't. Stop trying to placate customers with illegal solutions (see above: file by paper), platitudes ("rest assured we're working on it") or handing them off to other providers like Axway.

Axway is NJ's website portal to upload a .txt file created by tax software. You can't upload a payroll report. I have clients on Desktop with over 200 employees and can't file them all by entering them individually into the NJ Portal, which is ok if you have 10 to even 50 employee's. it's the ones with over 200 or 300 employee's.

Please update as to a fix for this or at least a timeline????

Thanks

I appreciate your time getting back here, Dan_CPA.

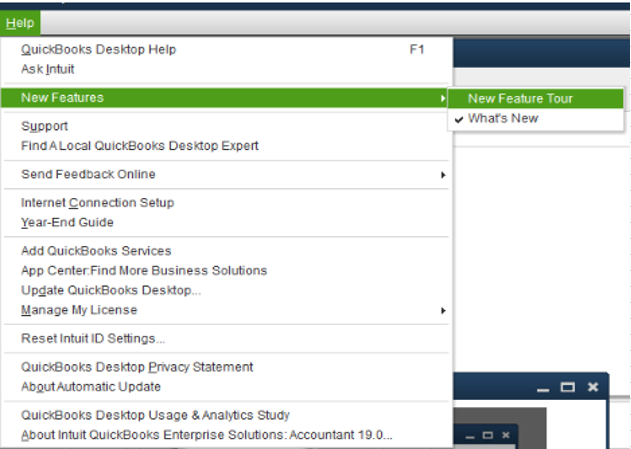

We currently don't have a specific time frame when this option will be available. You'll want to visit QuickBooks updates website here to stay updated with Intuit's latest news. Otherwise, go to Help > New Features > What's New in your QuickBooks Desktop.

You can always get back here and post a reply if you have any additional questions. My colleagues and I are here to help you out.

On January 28 I received the following email from QB:

| ||||

We are currently working on adding the ability to electronically file your 2020 NJ-W2 and NJ-W3 tax filings via your QuickBooks Desktop Payroll account. We understand that with the agency e-file mandate, this issue has been a cause of concern for our New Jersey customers. Prior to the February 15, 2021 due date, we will provide an email update when the ability to electronically file these returns has been enabled. We apologize for the delay in adding this feature for your business. Sincerely, |

If it helps, I managed to get an Axway account--I have 147 W-2's. Then when I have Qbooks create a State W-2 file Axway rejects it for reasons I cannot understand since I didn't go to school for computer science. This is ridiculous!!!! The Axway is useless and when you ask for help they send you to the SSA which give you a link to a 100+ page booklet written in computer code. Thanks NJ and Quickbooks!!!!!

Quickbooks will allow you to create a text file after you create the State W-2 file in excel. It uses macros. I selected the Federal option since our state is not listed. The problem--my file keeps getting rejected by Axway for not being the proper number of bytes on some lines. I have no idea what this means and Axway is no help. I came on here to see if any colleagues had any suggestions, but you have all confirmed what I already knew--Quickbooks support is the worst! They can't even answer a direct question. And the State of NJ is right up there with Quickbooks. If you go to the Payroll Forms & W-2's option, it allows you to "create a State W-2 File" This is where I found it.

ANY UPDATES???? C'MON QUICKBOOKS, WE HAVE 5 DAYS TO GO.

ANY UPDATES,QUICKBOOKS???? WE HAVE 5 DAYS TO E-FILE THESE FORMS. YOUR CANNED RESPONSES ARE UNACCEPTABLE.

I was afraid of this! So I should give up and go enter all 80 of my W-2s?

I was afraid of this. I looked at the Axway requirements before I asked for an account from the State of NJ and it looks like you have to be a software engineer to use it.

There has got to be a better way. I am going to have to give in and manually enter all of them on the website. So frustrating, to say the least.

I understand how important this is for you all, ptheo and jmartincpa.

We can't provide a specific time frame as to when the update for NJ-W-3 form. While we continue making improvements with the product, I want you to be updated with the new features added to the software.

Aside from receiving a notification once this is available, you can also visit our New Features to be updated.

Here's how:

Another way to be updated to the latest future release in QuickBooks Desktop is by visiting this website: QuickBooks Updates: New QuickBooks Accounting Software Updates.

I also recommend checking out New Jersey Payroll Tax Compliance for additional information on the available services.

Stay tuned for now. Let me know if you have more questions about filing W2's or anything about QuickBooks. I'd be glad to address them for you. Have a good one.

Hi

Today, I received an e-mail from Quick books saying that we can submit NJ W3 & W2 online. But when I tried, still e-file is grayed out.

Today, I received an email from Quick books taht we can efile NJW2 & W3 . But, when I tried, still e-file is grayed out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here