Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

The 401K company match calculation should be based on medicare wages (which would be after pre-tax health insurance items). How is this done in Quickbooks?

Glad to see you here, @Bbenoit,

Setting up a 401(k) Match in QuickBooks Desktop is simple. This item is considered a company contribution on a business perspective and doesn't affect employee's Net Pay.

Here's how to set it up:

See this article to learn more about creating the payroll item and how it works: Set up Roth 401(k) and Roth 403(b), and Roth 457(b) plans.

If you have any questions about this, let me know in the comment section below. I'm always here to provide further help and insights. Have a wonderful day!

I'm trying to make a journal entry for payroll item from an outside payroll service.

Employer pays half the health ins premium of employees.

What is the journal entry to make for that transaction, as the full amount of ins would be a liability, correct?

Payroll service has the ins included with gross wages before all taxes and other deductions are withheld before net wages.

What am I missing ? I seem to be needing a debit entry for the employer pd portion of health ins

example:

Health Ins payable $2000.00

What acct?? $2000.00

Thank you.

Michael

Hello @MichaelDi930,

You'll want to credit the bank account used for tracking your payroll liabilities and debit the account used to track company contribution.

In your example, debit $ 2,000.00 to your payroll expense account (or your company contribution account). Then, credit the other to your checking or bank account. Please see this article for more information about recording payroll transactions manually.

Feel free to also visit our page about the commonly used articles to get started with Payroll for future reference.

Thanks for swinging by the Community today and don't hesitate to post if you have other questions. Take care and success to your business.

Thanks for getting back to me.

I think I'm confusing the issue,.

The company has yet to pay the ins premium , so I'm crediting ins liability acct for the $2000.00, then just need offsetting debit entry to balance everything.

DEBIT CREDIT

Co pd health ins payable $2000.00

???? $2000.00

Hope I'm clear enough.

Did you see my follow up post on subject you replied to?

Not sure if this is an issue with payroll service or oversight by me.

When Health Ins is paid by employer , liabilities account would be debited by the full premium but I only have employee's half deducted from wages and entered as payroll liability.

Not seeing where employer's half of Health Ins liability goes.

Appreciate your help.

When an employee has a set dollar amount they contribute to each week and the company default is 3%, QuickBooks is not recognizing when the employee contribution is under that 3%. So the employer "match" is calculating at 3% which is often OVER the employee contribution. Thoughts?

Hi there, ShelleChristmasCPA.

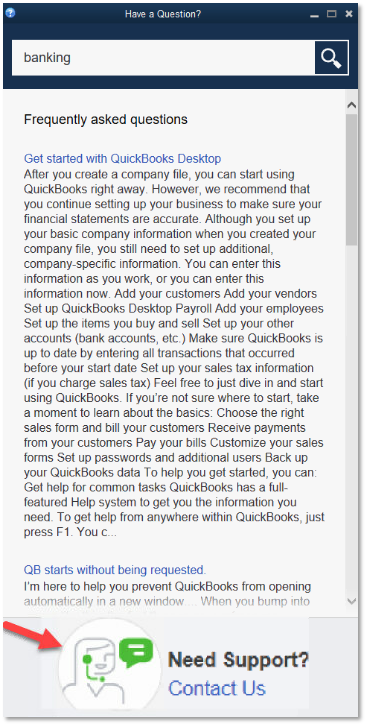

Thanks for stopping by the Community for assistance. Your best bet at this point would be to reach out to our Support team for further assistance, this is because it sounds like there may be an error in the employee profile setup and our support team can dive into the account with you and see exactly where that error is occurring. To reach them, follow these steps.

Check our support hours and contact us. If you have any other questions or concerns, feel free to post them below. Thank you for your time and have a nice evening.

Quick question, why would you ever want to calculate employer match based on number of hours?!

Also, when giving instructions on how to set up 401(k) Company Match, it would be helpful to indicate that when the employee elects a set dollar deduction and the company matches up to 3% or the employee amount, which ever is lower, QuickBooks does NOT recognize if the 3% match is greater than the employee contribution. (yes, I know...run on sentence) :)

I am setting up a safe harbor match for our 401k starting in January 2021. In the past we have had a company match which is a percentage of the amount that the employee defers. I need to set up a employer match that is a percentage of the employee gross pay not of the 401k defer amount, and the percentage will be different for employees depending on how much they defer. How do I set this up so that the match is calculated against the gross pay and not the deferral?

Hi @lplumr64,

You can create a custom company contribution item. I'll walk you through how to go about and create this payroll item for your employees.

Here's how:

You can then type in the amount you wish to use for the company contribution. Hit Finish if you're done.

More details on this process are in this article: Set up a payroll item for retirement benefits. At the bottom of the page, it includes links for related articles you'll find handy for this topic.

I'll be around in case you need more help on this matter. Post a comment below, and I'll be sure to get back to you.

I'm trying to set up employer match. Employer only wants to contribute 3% to regular hours, not overtime. Is there a way to do this? Thanks so much! Anna Kovac

Good afternoon, @AnnaKovac061255.

Thanks for chiming in on this thread. I can point you in the right direction to get this fixed.

To be sure everything comes out successfully, I suggest contacting our Customer Support Team so they can walk you through the steps with a screen share tool. Here's how:

It's that simple!

Keep us updated on how it goes. I want to ensure that you're about to get this resolved. Have a wonderful day!

Hi,

Have you figured out a way to do this yet? I'm running into the same problem. Our match is 4%, but I need QBO to only do as much as the employee deduction if that is less than 4%.

Thanks,

Kathleen.

Thanks for joining in this conversation, @Kathleenraycpa.

I want to help ensure that everything is fixed for you quickly, I suggest contacting our Customer Support Team. They can guide you through a screen share session.

Get back to us at any time if you have additional concerns. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here