Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

My 941 for Q3 is coming up with a balance owed of over 4K. Every single payment was made as it was calculated in Intuit. I don't understand what would cause us to have a balance owed. Any ideas?

Thanks for dropping by the Community, gtuck.

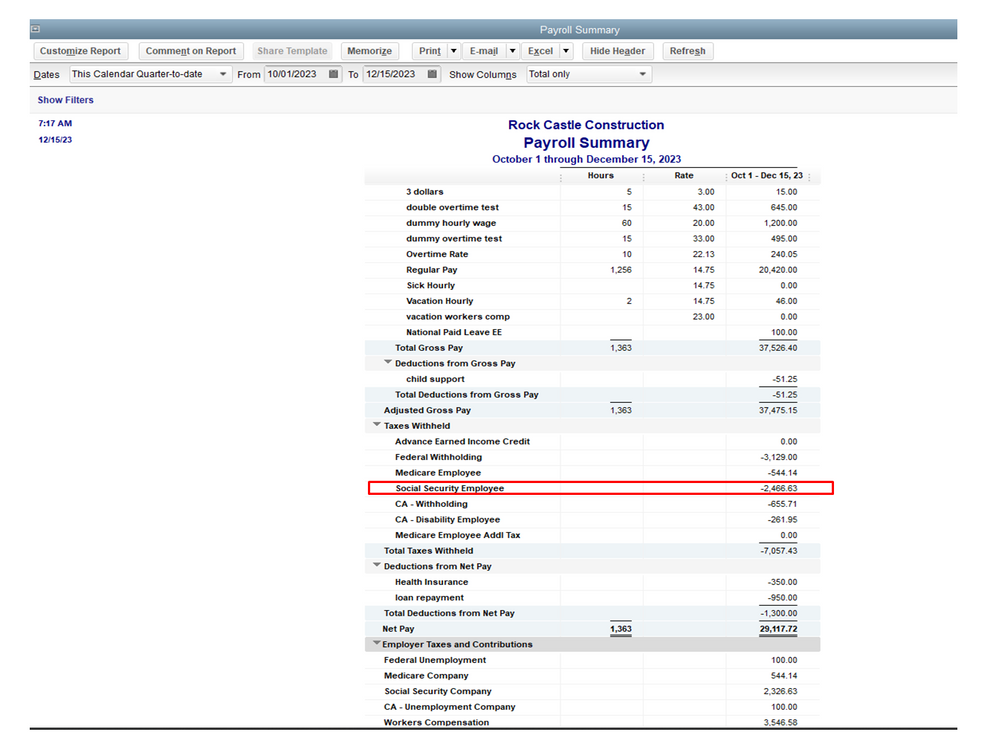

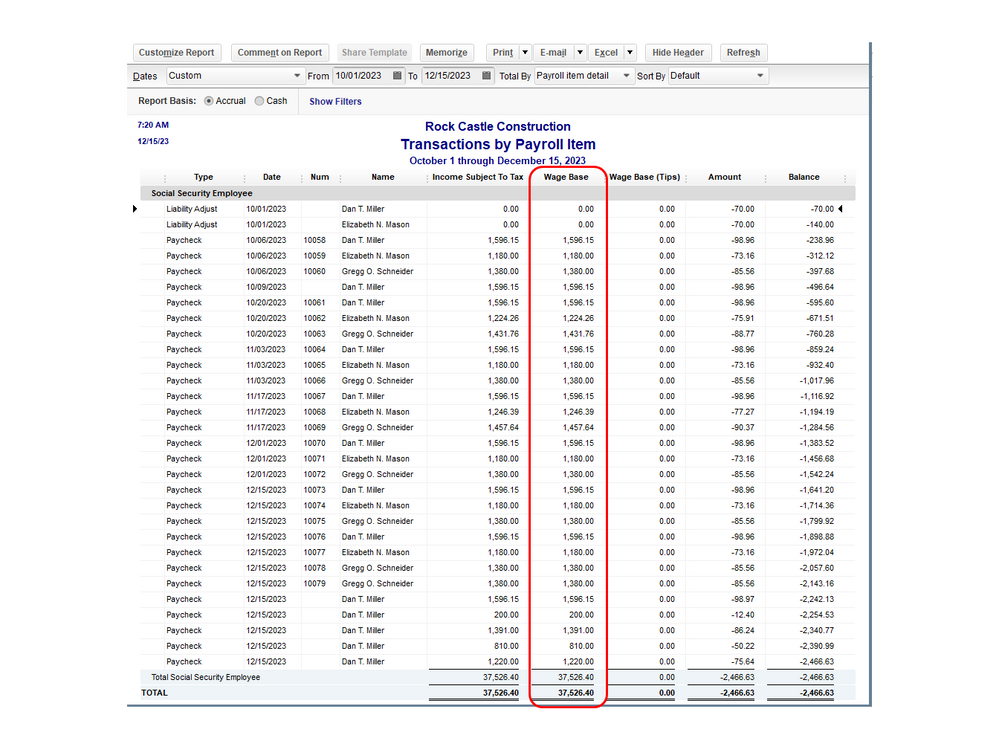

There are several reasons why there’s over $4000 balance owed in QuickBooks. It could be taxes on the previous quarter are incorrect or the system is doing an auto-correction. Let's open the Payroll Summary and Payroll Liability Balances Reports to determine which quarter the discrepancy comes from.

Before proceeding, update the tax table version. This is to ensure you have the correct calculation for federal and state taxes.

To update the tax table:

When you open the Payroll Summary Report, pick a per quarter date range to get the correct wages, taxes, payroll additions, and deductions for that period. Here's how:

Once you’re able to identify the discrepancy, take note of the amount and enter a liability adjustment to correct the amount. Check out this article for detailed instructions: Adjust payroll liabilities in QuickBooks Desktop.

For additional resources, here's a guide that contains tips on how to fix common payroll errors in QuickBooks.

Don’t hesitate to let me know if you need further assistance with any of these steps. I’ll be happy to help and make sure this is taken care of for you. Have a good one.

Greetings, gtuck.

May I know if you’re able to identify where the $4000 is stemming from? I want to ensure you’re paying the correct amount of 941 taxes.

Please don't hesitate to let me know if there's anything you need. I'm always up to talk about QuickBooks. Have a great rest of the day.

Tax tables were downloaded through out the quarter so that wasn't the problem. In doing the above reports, etc. I'm finding the amount paid to Treasury is coming up on the reports correctly but not on the 941. What the report says we have paid is exactly the same amount as what is showing up on line 12 of the 941.

Why would the 941 not be capturing the correct payment amounts?

Thanks for getting back to us about this topic, @gtuck,

I can share some more insights to help you trace where this discrepancy came from. First we need to make sure those payments or liability checks are applied to the correct period.

The data recorded on the report is derived from the payroll entries or payment transactions covering the period selected on the return. To help you identify if it was applied to the right period, use a Payroll Liability Balances Report.

We will use this report to see which liability period has an existing balance and compare it to the payment you've created. That way, we can make necessary corrections and rule out the problem in no time.

Here's how to generate the report:

Let me know the result after trying out the steps. I'll be right here if you need anything else. Have a nice day!

I'm having this same issue with my Q3 941 report. We paid each bi-weekly payroll calculated liability during the quarter and QuickBooks shows us with no remaining Liability balance for Fed WH, Social Security or Medicare for Q3. The 941 report shows higher calculated Totals for Soc Sec and Medicare taxes on Page 1.

I have gone through and calculated these taxes for Q3 by each employee and there are some that match up and there are a number of the 30 or so employees that have lower amounts reported on the Q3 Payroll Summary than my calculations.

How do I fix these differences when they are coming up for various employees and it looks like QuickBooks needs liability adjustments for Medicare - EE, Medicare - Co., Soc Sec - EE and Soc Sec - Co. to correct the errors in the 941 report before it can be filed.

Hello there, RJT33,

You can create employee liability adjustments for those employees with lower amounts. First, follow the steps provided by my colleague above to find payroll discrepancies.

Once done, adjust the payroll liabilities. You'll want to consult an accountant if you're unsure. Creating an adjustment can be quite tricky.

You can follow the steps in this article: Adjust payroll liabilities in QuickBooks Desktop.

You'll want to check this article about how 941 works in QuickBooks Desktop: How QuickBooks Populates The 941.

Let me know if you have other questions.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here