Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI accidentally cut an employee health insurance deductions. The employee is not on health insurance. How do i refund him the 2 week premiums? I was hoping I could just enter a negative amount in the deduction field on his check, but I am not allowed to enter a minus number.

Thanks

tag: overcut deduction refund health insurance premium payroll

Hi there, LDO.

I'm here to help you process a refund for your employee who was accidentally deducted for health insurance in QuickBooks Online (QBO) Payroll.

As an employer, it's crucial to ensure that your employees are correctly taxed. When employees are underwithheld or overwithheld, adjustments need to be made to correct it.

As you are utilizing QBO Payroll, please reach out to our Payroll Support team to rectify the employee's paycheck. Following the resolution of the paycheck issue, you will be sent an email containing instructions for the subsequent procedures.

Here's how to reach them:

To check for our Support hours, visit this article: Contact Payroll Support.

To know more about processing a refund to your employee for an incorrect paycheck deduction, refer to this article: Refund your employee for a deduction that was overwithheld.

I'm also adding this article that tackles handling overwithheld and underwithheld employee-paid taxes in QuickBooks for future reference: Handle overwithheld or underwithheld employee-paid taxes.

Please leave a comment below if you have more questions about refunding an employee or anything else, LDO. I'll be here to assist. Take care.

Where do I find Open Paycheck Detail? I am on online payroll formally Intuit.

Thanks

Thank you for getting back to the thread and for the confirmation. I see that you accidentally overcut a payroll deduction in QuickBooks Online. I'll chime in and would like to inform you of some updates.

My colleague FritzF already updated his answer. You may check it out again. He included information on the process and the support experts' assistance needed in this matter.

I'm including these articles you may use in the future as you go through tasks in QuickBooks:

If you have more questions about your employee's paycheck, leave a comment below. I would be more willing to answer all of them ASAP. Stay safe!

JamesAndrewM,

UGH!!! Please re-read my original questions. I don't think you read it very well

I can not use the reimburse option you referenced as health insurance is a pretax deduction. And then answer the ones below.

1) Where do I find "paycheck details?

2) Can you reverse a pretax deduction in online payroll.

Thanks

Hello there, @LDO. I understand your concern about the pretax deduction for health insurance. I'm here to answer your questions.

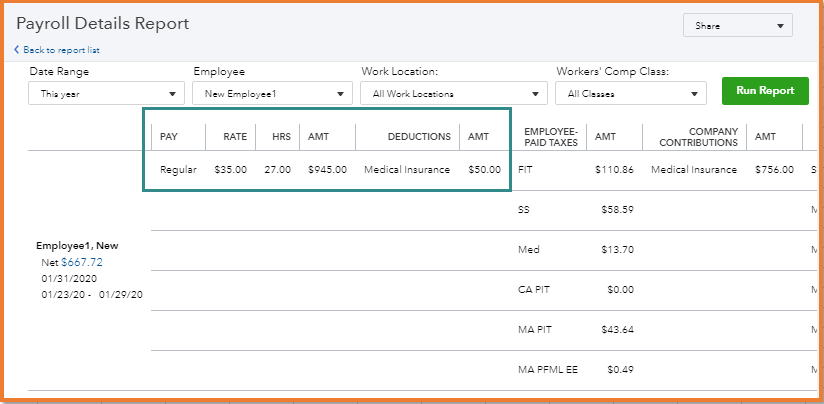

You can run the Payroll Details report to see detailed info of your employees. It includes the rate, pay type, and other payroll data.

Here's how to run the report:

Moreover, about handling pretax deductions and reimbursements within QuickBooks, I suggest contacting our Support Team for further guidance and solving your employee's paycheck issue. You can follow the steps provided by my colleague @FritzF.

To check for our Support hours, visit this article: Contact Payroll Support.

Also, I've attached an article you can use to know more about the list of payroll reports available in QBO: Run payroll reports.

Here's an article you can read to learn more about customizing reports in QBO: Customize your reports in QuickBooks Online.

I'd appreciate any updates you can add. If you have additional questions in QBO about refunding an employee, feel free to comment below. I'm always around and ready to lend a hand. Have a good day and take care.

AbegailS. I dont think you understand. I dont think you read my posts. You told me how to print reports, but I never asked how to print a report.

The biggest problem with the intuit QB moderators is that they dont read the post thorughly before they answer.

Hey there, @LDO.

Thanks for reaching back out and voicing your concern.

To clarify, my colleague from above was providing steps on how to run a Payroll Details report to help you get an answer to your first question about where to find paycheck details.

As for your second question, the best route would be to contact our Customer Support Team for more information on how to reverse a pretax deduction in QuickBooks Online. Here's how:

Keep us updated on how the call goes. I'm only a post away if you need me again. Take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here