Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I accidentally recorded S Corp owners insurance as "Health Insurance (company paid)" on every check for the member this year. I know how to add the S Corp piece, but I do not know how to adjust the "company paid" amount off of the paystub/W-2. Can anyone help with this?

Solved! Go to Solution.

Hi there, jennrobe.

You've come to the right place. Adjusting the company paid health insurance amount is my specialty.

Ideally, the appropriate way to clear this amount is to edit each paycheck and remove the Health Insurance (company paid) payroll item. However, that will take a long time to accomplish, especially if you have a lot of paychecks.

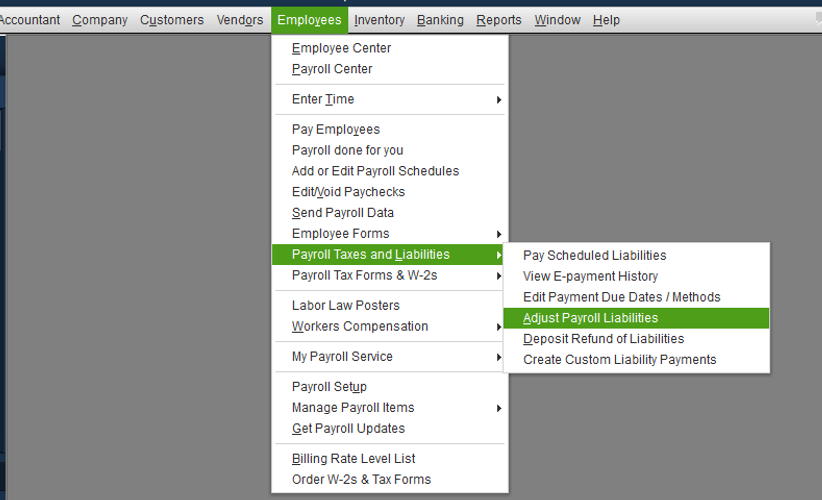

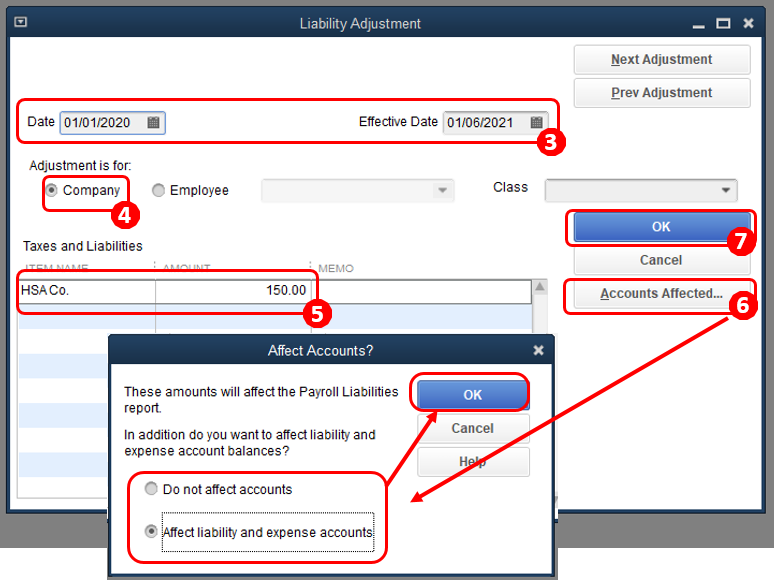

To easily fix this, you could do a payroll liability adjustment. Allow me to walk you through the steps on how to do it:

All of this information and more is available from our guide on how to adjust payroll liabilities. That should do it. With these resources, I'm confident you'll be able to clear the amount off of your forms and reports.

Keep in touch with me here if there's anything else you need. I always got your back. Thanks for reaching out, wishing you and your business the best.

Hi there, jennrobe.

You've come to the right place. Adjusting the company paid health insurance amount is my specialty.

Ideally, the appropriate way to clear this amount is to edit each paycheck and remove the Health Insurance (company paid) payroll item. However, that will take a long time to accomplish, especially if you have a lot of paychecks.

To easily fix this, you could do a payroll liability adjustment. Allow me to walk you through the steps on how to do it:

All of this information and more is available from our guide on how to adjust payroll liabilities. That should do it. With these resources, I'm confident you'll be able to clear the amount off of your forms and reports.

Keep in touch with me here if there's anything else you need. I always got your back. Thanks for reaching out, wishing you and your business the best.

Thank you AldrinS!

Hello AldrinS

I have a dilemma as well. I hope you can help me. Here is what happened.

We pay on the first of the month, for that month. We have additional liablility deductions that I took out for January, but they should not have been taken out until February's check because of the way the Insurance company bills. They bill for the insurance AFTER the month.

So my January's liability check is for too much. If I mail the check they will not give me a credit for the amount overpaid. They want a check for the exact amount.

so I don't know what to do. do I cut them a check, applying correct amount to 'insurance expense' just to get it right with them? but what do I do with the liability check? write it out to company, crediting insurance expense? to offset? and then there will be a balance left over there? hope you can help me. I'm not familiar with this at all.

I've got you covered, Patti1010.

It would be my pleasure to help you take care of this dilemma and get you on the right track

Thank you for the details that you provided. It's exactly what I need to provide you the best solution. We'll just take things one step at a time to avoid any confusion.

Based on what you've mentioned, we could do a couple of adjustments to transfer the additional deduction from January to February. With this, you won't need to cut them a check, and it'll let you pay January's liability for the exact amount.

That said, let me walk you through the steps on how to make the adjustments:

To remove the extra deduction from January

To add the liability to February

I know I've shared this on my first post, but let me include our detailed guide on how to adjust payroll liabilities again, just in case.

Once you're done, let's talk about how to pay the liability. Going back, you mentioned a liability check. To clarify, is this for the month of January? If it is, I recommend we void and recreate it.

I just want to make sure it has the right amount. The steps below will guide you on how to recreate the check:

For more information about this, you can check out this article: Set up and pay scheduled or custom (unscheduled) liabilities

That should do it! You'll be all set with your liabilities after you follow these steps.

You're always in good hands here in the Community. Don't hesitate to reach out to me again should you need more help with this. Thanks for dropping in, cheers to continued success.

All you need to do is Not Pay the Liability in Full.

"If I mail the check they will not give me a credit for the amount overpaid. They want a check for the exact amount."

On the Liability check, reduce it to the amount you intend to pay, now. The rest will wait in Liabilities, to be paid later.

This isn't quite right:"so I don't know what to do. do I cut them a check, applying correct amount to 'insurance expense' just to get it right with them?"

It isn't Expense, if you already have it accrued in Liability, and you never Use Write Check. You already ran it into Payroll, and you have to Pay it using Pay Liabilities. It isn't your additional expense. It's Cash Flow, not Expense.

Is there anyway to do this in Quickbooks Online? I spent a good hour on chat today, and they weren't able to adjust it. Seems odd it works in Desktop, but not online?

Any work arounds to reduce a Health Insurance liability without affecting the expense account?

Thank you in advance!

Hello @Kelster,

The company health insurance liability amount depends on how much you've set on the employee's profile.

In addition, here at QuickBooks Online, we don't recommend adjusting any entries or tracked amounts. Instead, I encouraged contacting your accountant and/or tax agency for more assistance.

If you have any other concern, don’t hesitate to comment below.

Thank you for your response. Not helpful, but thanks.

Thanks for the reply, but it doesn't answer my question..... Is there no way to adjust this? I hopefully have it set up correctly for this year.

Hi there, @Kelster.

I'm here to help you with adjusting health insurance liability in QuickBooks Online.

Currently, the Liability Adjustment tool is only available with the Desktop version. The payroll calculations in QBO are according to the setup process of your employees.

You have two options in reducing the health insurance liability without affecting the expense account:

I also recommend seeking an accountant for an expert's advice to ensure there will be no problem with the books in the future.

Let me know the results, Kelster. I'm still here to help you more if you have additional payroll questions. Wishing you all the best!

How does this adjust the erroneous amount off of the Employee's W2? This credits it out of the liability account, but how does it credit it from the employee's record?

Thanks for joining this thread, CA337.

Allow me to share some information about how a journal entry and creating a liability adjustment affects the employee’s W-2.

Once you record a journal entry, the adjusting amount will not show/reflect on the corrected W-2. For it to show on the tax form, you’ll have to process a payroll correction for the previous year’s data.

Adjusting payroll information requires account verification. The Community is a public forum, and gathering personal details can’t be done here for security reasons.

I suggest contacting our Payroll Support Team as they have tools to review your paychecks and correct the information. As mentioned by @HoneyLynn_G, create a journal entry to record the corrected amount on your chart of accounts.

As always, I recommend contacting your accountant first to help determine the correct debit and credit accounts.

The most up to date contact information can be found here:

The information I provided should correct the employee’s W-2.

If you have additional questions about payroll, leave me a comment. Please know I’m here to assist further.

I have employee health care deductions in payroll liabilities, paid back to the the company (checking). I cannot reconcile these transactions without an actual deposit, which seems really weird. :0 In any case, I cannot reconcile.

We are paying for the healthcare directly to the provider, then deducting a small portion of the additional employee optional coverages out of their payroll checks.

I have been unable to get our CPA to respond to my question, she instead refers us to a Certified QuickBooks expert, who does not respond.

Can you help me?

Kind Regards,

Erica M.

Hello there, Erica M.

Thanks for sharing your concern with us. Let's get this sorted out.

Since there is no actual deposit yet, what you can do for now is to except the transaction from reconciling until the actual deposit shows up on your bank statement.

Here's a great resource that you can check on for more information about reconciliation: Reconcile in QuickBooks Desktop.

For any QuickBooks Desktop concerns, you can reach us through the contact details found in this link: Contact the QuickBooks Desktop Customer Support Team.

Please don't hesitate to let me know if you have further questions while working with reconciliation. I'd be glad to help you out.

I have a similar issue though I didn't see it mentioned exactly. My company pays the health insurance premium but I forgot to select this for the paycheck I was producing in February. Therefore, not enough federal tax was withheld. The paycheck has been cashed. If I try to take two health insurance (company paid) deductions for March, the federal tax increases exponentially. I'm sure there's a way to adjust payroll liabilities but I'm not confident in my abilities to do so without assistance. Is there some guidance you can offer, please?

Hey there, @CCampbell.

I've got your back with payroll liability adjustments in QuickBooks Desktop. Since this process can a bit tricky you might want to consider contacting your accountant first. I've listed the steps below to help guide you with Employee adjustments:

That's all there is to it. Now you know how to adjust your employee's liabilities for the health insurance premium. Your accountant can also help you determine what information to put in each field.

Please don't hesitate to touch base with me here if you need any additional assistance. I look forward to hearing from you again.

That was easy enough to do. This should also affect the amount of federal tax I owe so can I assume that I need to add that in manually as well based on what I normally pay each month? Thank you so much for your assistance!

It's great to see you were able to get the assistance you needed with the help of the Community, CCampbell. Yes, you can manually enter the amount for federal tax each month. I would talk about this with your accountant as well to verify.

You're welcome to comment or post any time you need a hand.

Can you answer this question for the online quickbooks users?

I accidentally recorded S Corp owners insurance as "Health Insurance (company paid)" on every check for the member this year. I know how to add the S Corp piece, but I do not know how to adjust the "company paid" amount off of the paystub/W-2. Can anyone help with this?

I'm here to help keep the process of adjusting company-paid insurance easy and simple, morty3115.

You can follow the steps below to create an adjustment for the said company-paid insurance. Let me walk you through the process.

I'd suggest consulting an accountant to ensure your books are accurate and not messing up other data. Your accountant can provide more expert advice regarding an accounting perspective.

For more details about this process, check out this article: Adjust payroll liabilities in QuickBooks Desktop. On the same link, you'll find a write-up about how to correct your year-to-date additions and deductions in QuickBooks.

Additionally, if you need help with removing overdue liabilities, you can refer to this article for the detailed steps and instructions: Enter historical tax payments in QuickBooks Desktop Payroll.

Please let me know how it goes by leaving a comment below. If you have more questions about payroll liabilities or need anything else, don’t hesitate to ask. I’ll be here to help. Have a most pleasant day!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here