Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI am trying to make my COGS account more accurate. We have an S-Corp so myself and husband are employees of the corporation on payroll but our payroll doesn't change like hourly employees do. Is there a way to list the payroll expenses differently?

You can set up and pay an owner's draw that would allow you to pay the corporate officers, socksoff.

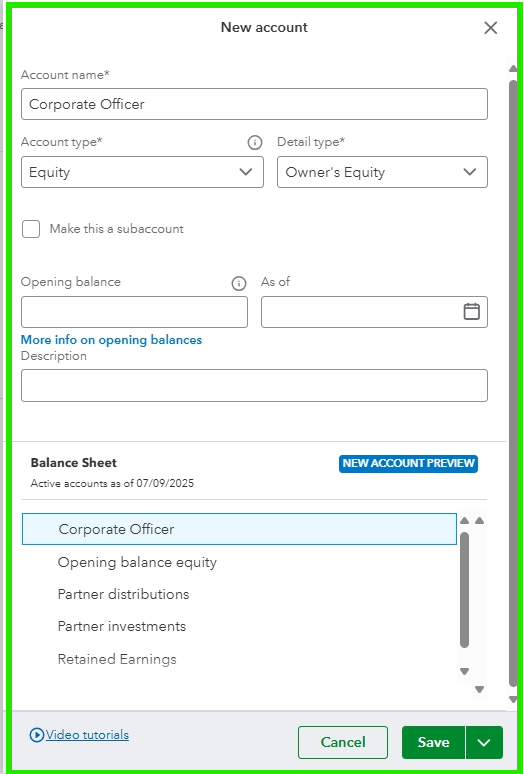

To start, create an Owners' Equity account by following the steps provided below:

Once you have successfully created an Equity account, you're ready to generate a regular check for the officer employee in QuickBooks:

Please feel free to leave a comment below with any other questions; our Community Space is here to assist you.

Owner's draw applies to sole proprietorships where a single owner is not an employee. Your customer has an S-Corp, and they are employees of the S-Corp.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here