Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Connect with and learn from others in the QuickBooks Community.

Join nowI have QB desktop, I have a couple employees who had loans, but were deducted through our ADP payroll system.

They are all paid off and need to close them out. They no longer owe any money.

How do i go about closing them out?

Hi there, @laurenmcginn.

You can create a deduction item for the employees' loan then make sure that the deduction account assigned is a liability account.

Let me show you how:

To edit the payroll item, you can go to the Lists menu, then select the item under Payroll Item List.

To close out the loan, you can use journal entry. However, I recommend consulting your accountant for guidance with the posting accounts.

You may follow the steps on how to create a journal entry.

I'll add this article as your reference on how to set up loan accounts and manually track them in QuickBooks Desktop: Manually track loans in QuickBooks Desktop.

Feel free to visit our QuickBooks Live Bookkeeping to get a dedicated expert to guarantee all your records in QuickBooks are accurate and up to date.

Feel free to tag me if you have additional questions. I'm here anytime you need help. Take care!

They are not under payroll though.... They are just classified as employee loans. The loans were taken out of our separate payroll system, That is not attached to QB in any way... Please let me know how to close them out from here with that all being said?

I have this same question. Did anyone ever answer you?

Hello, @gorejs. I appreciate you participating in the discussion, and I'd be happy to assist you in closing out the loan to your employee in QuickBooks Desktop. This enables you to keep track of the loan balance and record payments.

In QuickBooks Desktop, there are two ways to close off an employee loan. Before doing any process make sure that you'll still remember the liability accounts created when setting up the loan.

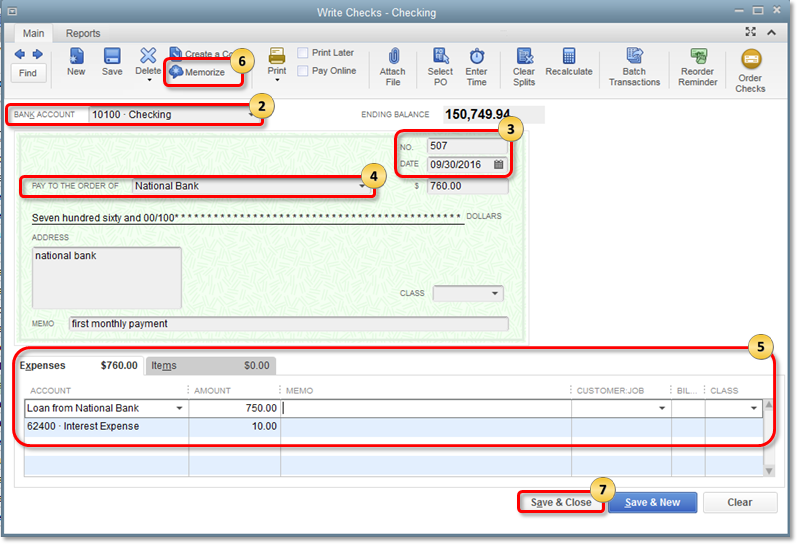

To start, you can write a check for the affected loan account and do a bank deposit for the repayment. Then, make sure to use the correct account to ensure the accuracy of your data.

Here's how:

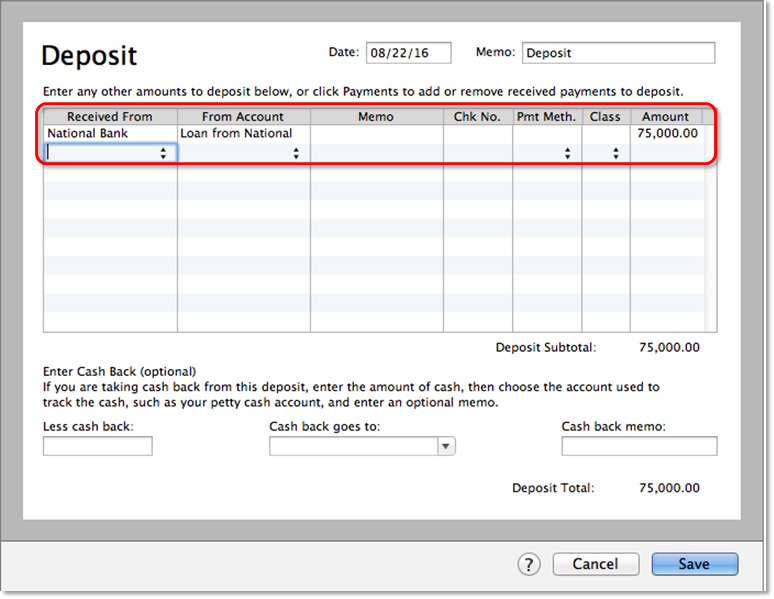

Then, create a bank deposit for the loan repayment. To do so, follow the steps below:

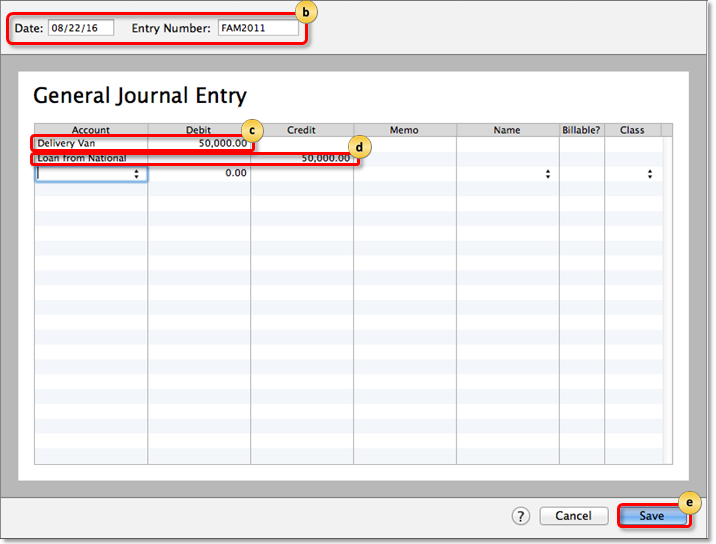

On the other hand, you can create a journal entry to record the loan amount. However, I'd suggest consulting your accountant for the accounts you'll use. They can give you advice on how to properly record this to ensure the accuracy of your books.

To enter a journal entry:

Then, do the repayment. You may follow the steps above for the first line to credit the liability account, and in the second line debit the bank account. For more details about the process, follow this article: Manually track loans in QuickBooks Desktop.

Additionally, check out these articles below to track your loan with the help of Loan Manager and other related topics:

Drop me a comment if you have more questions about employee loan payments. I'll be sure to help you some more. Take care always.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.