Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow can I create, print, and save a federal form 941 for last year, last quarter after already downloading a payroll update?

Solved! Go to Solution.

Hello there, DON1916,

The forms in QuickBooks Desktop is already updated for 2020. Creating a form for the last quarter of 2019 is already unavailable.

You can download the 2019 version of the form on the IRS website. Then, manually file the form. You can visit this Prior Year Products section on the IRS website.

Lastly, here's an article you can read to learn more about filing your 941 tax form: File Quarterly Tax Forms.

Let me know if you need further assistance.

Let me show you how to generate 941 Form for last year, DON1916.

In QuickBooks Desktop, it's very easy to pull up previous tax forms. We just need to select the correct filing period and QuickBooks Desktop will automatically provide it to you. You can follow these steps:

When the Payroll Tax Form pops-up, you'll see the Save and Close, Save as PDF, and Print. You can click any of those so you can print and save it. You can also refer to this article for more details: Process, print, and save QuickBooks Desktop Payroll tax forms.

I've added this link if you need assistance with printing issues.

Keep on posting if you need more help from me. Wishing you all the best! Take care!

Your information puts me on the right track, but I am trying to create a form 941 for the last quarter of 2019 (I overlooked doing it earlier), and I have already installed new updates. What I need to know is if there is some way I can create that 941 for last year from scratch and have it show the correct dates and information.

Thank you for your help,

Don1916

Allow me to chime in, @DON1916.

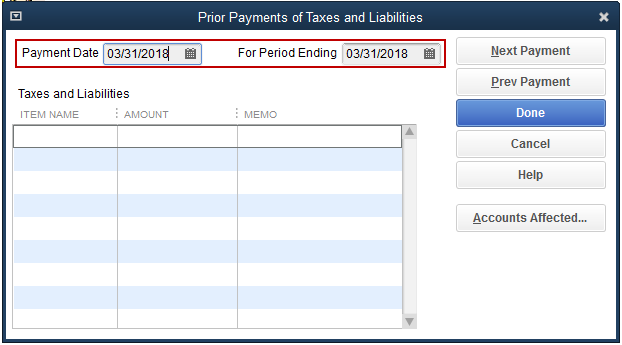

I hope you're having a wonderful week. You can enter historical tax payments for previous years by following these steps:

6. In the Taxes and Liabilities field, select the payroll tax item that you've already paid and enter the amount (note: you can add a memo to remind you what the payment is for).

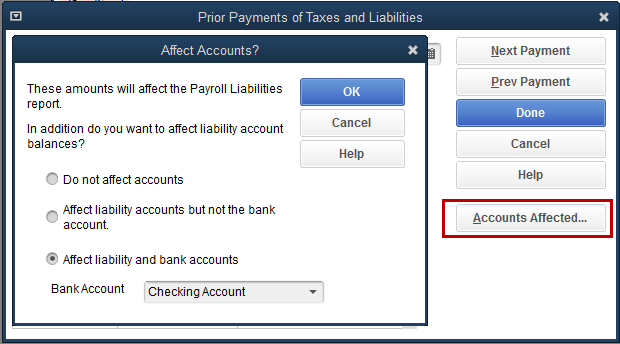

7. Push Accounts Affected to display options for how you want the payment to affect your Chart of Accounts.

8. After you have completed the steps to add your first payment, you can hit Next Payment and continue the process to add more payments. Press Done to save your work and Finish to close the window.

Now your prior payments are entered, and you can get back to business. You may find this article about entering historical tax payments helpful too.

I'm only a post away if you have any other questions. Enjoy the rest of your week!

The instructions from Anna S. appear to get me closer to where I need to be, but I don't see them showing me how I would be able to create a form 941 report for Q4/2019. I have the amounts entered into my account, and have made the payment; I just haven't filed the report. When I go to the "process payroll forms" screen under the Employees section, it will only allow me to create a 941 for 2020, while I need one for 2019. Will this process allow me to do that?

Thanks,

Don1916

Hello there, DON1916,

The forms in QuickBooks Desktop is already updated for 2020. Creating a form for the last quarter of 2019 is already unavailable.

You can download the 2019 version of the form on the IRS website. Then, manually file the form. You can visit this Prior Year Products section on the IRS website.

Lastly, here's an article you can read to learn more about filing your 941 tax form: File Quarterly Tax Forms.

Let me know if you need further assistance.

It is EXTREMELY annoying that QB does not let you file previous year forms... disk space is so cheap now that it would be no problem for them to include a year or two of previous forms and would be very useful to many QB users.

I am trying to create Federal 941 for the 1Q of 2020. Quickbooks is telling me that I do not have a valid form. That's for the prior year, however, it is NOT for the prior year. I created a PDF anyway and it has a watermark on it that says "Do Not file. Form Not Final." I even tried to prepare one for the 2Q just to see and it says the same thing. I have performed all updates and I'm not yet due to upgrade the program. Please help.

Good afternoon, @jegowatts.

Thanks for joining this thread.

I recommend getting in touch with our QuickBooks Desktop Support to help investigate this further. To get in touch with a live agent, you can refer to these steps:

Below are several articles for more information about filing 941 Forms in QuickBooks Desktop:

Feel free to comment below and let me know how it goes. Have a safe and productive week ahead!

Did anyone ever find a answer to this problem? I missed filing 2 quarters of 941 reports last year. Payments were made but forgot to file the quarterly reports. Now Just like the other user it will only allow me to file 2021 forms. Did Quickbook's fix this problem for unorganized people like me?

I had to create and file a 941 tax for for 1st qtr 2021. I wasn't able to do it through quick books and the form would not download through IRS site. I did it through www.1099.com.

It cost me 4.99 to e file it and it worked like a charm. I just entered the data I got through QB.

Best way to file 941 for previous years.

I did the exact same thing for 2021. Best way to file previous 941 forms for previous years is through www.tax1099.com. All you have to do is create the form in QB and then enter the data at tax1099 and they will efile it for you. its simple and fast. Cost was $4.99

This has happened to me as well. How do I get the information to submit it to tax1099?

This has happened to me as well. How do I generate the info in quickbooks?

Hello there, @ACC0945. I can help you with generating information in QuickBooks Desktop (QBDT).

If you are unable to file Form 941 for the previous quarter within QuickBooks, you have the option to file it externally. To have the necessary data, you can generate a Payroll Summary report. Let me guide you through the process:

You can also export the report to Excel or PDF format for easier reference or printing.

Please note that although the Payroll Summary report offers most of the information required for Form 941, you might still need to manually calculate specific figures or seek guidance from a tax professional to ensure accuracy and adherence to IRS regulations.

Moreover, you can also check out this link where you can browse for articles that can help you with managing your taxes in QuickBooks: Help Articles for Taxes in QuickBooks Desktop.

Whether it's tax-related or any other QuickBooks matter, I'm here to assist you. Feel free to ask me anything. I'm always available and ready to provide guidance.

I NEED A COPY OF FORM 941. WAS NOT ABLE TO SAVE OR PRINT A COPY BEFORE FILING.

How can I retrieve a copy? I need it for audit purposes.

How can I retrieve a copy of form 941 for 1st & 2nd quarter? I need it for audit purposes.

Hello there, CVM3.

To retrieve a copy of Form 941 for the 1st and 2nd quarters, you can follow these steps:

However, if you encounter difficulties retrieving the forms, you may need to contact our QuickBooks Desktop support for assistance. They should be able to guide you through accessing and obtaining the necessary forms for your audit.

Let me know if you have other concerns.

Thanks for your input.

Appreciate it!

Just made it on time for my deadline.

Hello there, @CVM3.

It's nice to hear that my colleague's answer has resolved the issue you're having. Don't hesitate to post in this forum if you have other concerns.

Please know that we're always here to offer assistance anytime. The Community space is always here for you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here