Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI am amazed at the number of us having the same problem and in several posts it appears to be our new employees on the 2020 W4. This has been going on for two years yet QB support is still clueless? I was on the phone with them yesterday for 1.5 hrs and got nowhere; and I find this today? This is not new QB!!! WTF And I can't believe the response up above about reading more garbage as to how QB determines tax withheld! Yes, let's waste more of our time. I have several employees pissed off!!!

Please see AH5879's post on 7-12-21. There are a lot of people complaining that this is an Intuit issue but has anyone verified it?

If you think too little federal income tax is being withheld, you can verify it by looking at 2022 IRS Pub. 15-T. In there, you will find the proper withholding amounts based on filing status (single, MFJ, HoH, etc) as well as weekly, bi-weekly, semi-monthly, and monthly payrolls. Complete the withholding worksheet on page 11 and then check the tables and see for yourself. You will be shocked at how little withholding there is when using 2020 and later Form W-4.

Pub. 15-T also allows you to compare the difference in withholding based on Form W-4 2020 and 2019 and earlier. Spoiler: 2020 and later Form W-4s generally have significantly less withholding than pre-2020 forms. If you need to have additional withholding, check the box in Step 2 or request additional withholding in Step 4(c).

A single taxpayer that makes $50K/year and claims the standard deduction of $12,550 in 2021 has a taxable income of $37,450. That taxable income owes $4,295 in federal income tax. That's only 8.6% of their gross wages going to federal income tax.

I did the math for the employee's 2021 withholding, based on their total 2021 earnings.

QBO withheld less than half of what the IRS tables calculate.

Not sure what you mean by "verify". We can't see HOW QBO does the withholding match, only the end result.

And the end result leaves employees owing a lot of money that should have been withheld.

Discovered a way to increase withholding for commissions.

There is an option in the Commission setup to withhold a flat amount per commission. 25% I think.

Although this is not mentioned elsewhere, it is an allowed withholding that doesn't affect the regular payroll calculations.

Since QBO doesn't seem capable to combining YTD earnings amounts when determining the withholding tax brackets, this is an option that will protect our employees from owing thousands next year.

There is no math to do to determine if QB is withholding taxes properly. You verify it by looking at the withholding amount on your employee's pay stub and compare it to the withholding tables in IRS Pub. 15-T. This is on a per paycheck basis, not at year-end.

Everyone keeps saying that QB is not withholding enough. That's a fair point. But, not withholding enough compared to what? Until someone looks at the IRS withholding tables and confirms the withholding is too low, it's all conjecture. If you want QB to fix this "problem", show them that their payroll software is withholding too little in taxes as compared to the IRS withholding tables. Because an employee owes taxes at the end of the year does not indicate there's an issue with QB's withholding.

I verified my employee withholdings to the 2020 IRS tables, https://www.irs.gov/pub/irs-pdf/p15t.pdf, and found the withholding amounts to be correct and significantly less than the 2019 tables. I believe they are less, because the standard deductions have almost doubled due to the 2017 Tax Cuts and Jobs Act.

The new 2020 W4 form puts the onus on the employee to determine the amount of taxes to be taken out and allows for the input of an additional amount per paycheck. As such, I think QB is calculating the correct tax withholding amount(s).

I thought we were discussing QB Online Payroll. NOT QB Desktop Payroll.

HERE IS MY ACTUAL EXAMPLE

Employee total gross pay - $63940

Married filing jointly

Only 2 jobs.

No dependents, no exemptions, no extra withholding.

2020 W4

In 2021 QB-ONLINE Payroll withheld $2961 in FIT

The IRS Publication 15-T, Page 5 worksheet calculates the tax to be withheld as $7054.

For those that are math challenged, that is $4,093 UNDER WITHHELD!!!

Now, tell me a story about how this is not a problem, and is not a QBO program error.

Amen to you!! I am at my wits end. I also was on with them for over a hour. They got into my system and ended up saying they have no clue how to fix it. I am new to QB so super disgusted. I have 2 employees out of 7 that the Federal taxes haven't come out. So I was told to try them again.

Thank you for responding in this thread, hinn22.

In QuickBooks Desktop, percentage method is used to calculate income taxes.

These are factors that can affect the calculation of your employee's income tax:

Also, make sure to run the latest payroll update to keep your taxes updated.

Furthermore, if an employee's gross wage is too low, QuickBooks Desktop will show $0.00 on a federal income tax. You can check out page10 IRS Publication 15-T, for more details.

The same goes if you have QuickBooks Online Payroll. Once you've set up payroll and entered the employee's information, federal income tax is calculated and automatically updated. I'm adding this article to learn more: Understand payroll tax wage bases and limits.

If you require additional assistance or have questions about payroll tax calculations in QuickBooks, please reach us back. I'll gladly assist you. Have a successful week!

Wow.

Way to not answer the question while answering a different question.

Must be in politics.

Wow.

Way to not answer the question while answering a different question.

Politics much?

Could I just create a new employee and select the 2019 W4? I'm not sure why we can't change the W4 once 2020 form is selected?

Thanks for joining this thread, @rangerover319.

I want to ensure you're able to get the correct W-4 fr your employees. Yes, you can use that workaround, but I highly recommend that you contact our support team for other options.

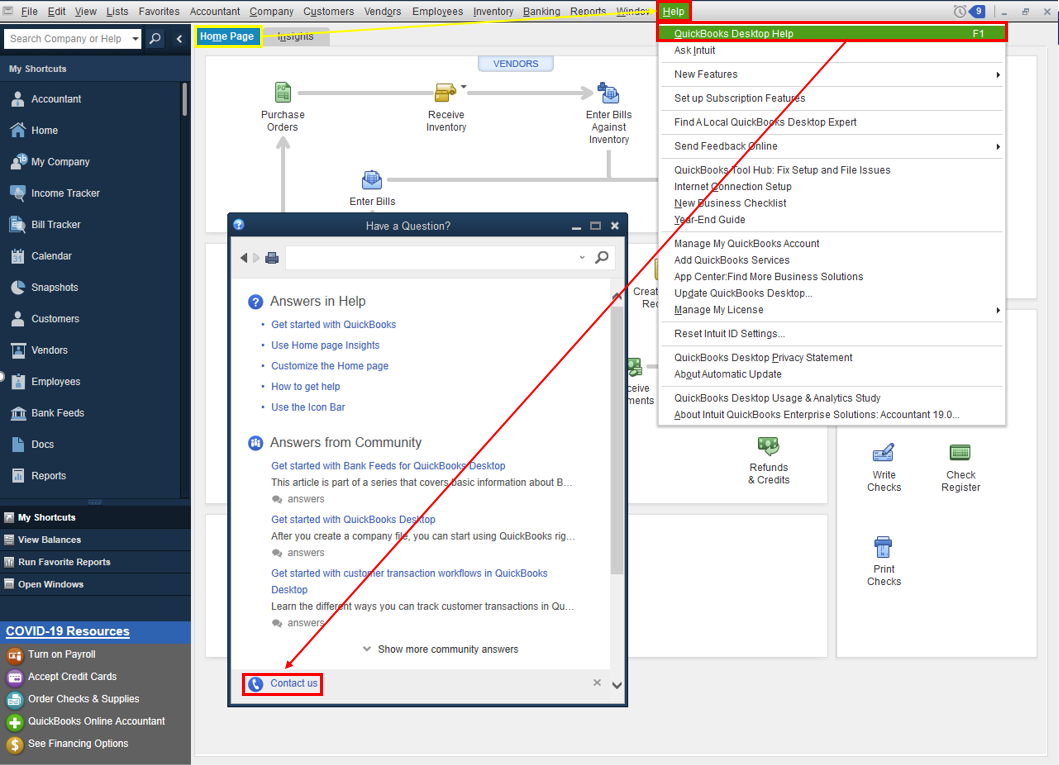

Our agents can walk you through the steps to get the form and help you further if in case you have issues with the withholding calculations. To in touch with our Technical Support, follow the steps below:

Refer to this article to learn more about our contact options and support availability: Contact QuickBooks Desktop support

I want to ensure everything is resolved for you. Post here again with the result of your call as I want to know that this has been taken care of. I'm also here to provide further assistance if you have other QuickBooks concerns.

So, apparently this is still a problem, and a problem I don't understand. I have hired multiple employees over the past year. It seems that only employees from a different county than most aren't paying FIT. I have one employee grossing $1000+ per week that hasn't had a single cent taken out in FIT. He and I are both concerned about tax time. Has anyone found a resolution other than "additional deductions"? Thank you in advance!

Employees can make over $1,000/wk (or more) and pay $0 in FIT. It all depends on their situation. How did your employee complete their W-4:

What is their filing status from Step 1 of their W-2? MFJ? HoH?

Did they check the box in Step 2?

What is the total from Step 3 (Dependents)?

Any adjustments from Step 4?

It is not unusual for taxpayers, especially those that file MFJ (or HoH) and have dependents, to make well over $1,000/wk and pay $0 in FIT.

Can I add a little insight here? When the IRS changed the form they want your employees to decide if they want more money in their paycheck or a bigger refund at the end of the year. So if they opt for more money in the check then YES they will owe more. Discuss with your employees this fact and if they want to they can have an extra amount with held. Everyone is so quick to blame QuickBooks and customer service and they don't take the time to really find out what is going on. It is not the customer service reps job to do this, YOU ARE IN CHARGE OF YOUR PAYROLL AND SHOULD BE UP TO DATE ON THIS INFORMATION! You all should be ashamed of the way you treat QuickBooks Reps.

I entered a new employee and went to pay them and the Federal and state tax was double what it should be and I called " payroll customer service and was on the phone for 2/12 hours first she said that was the new rates, then she said that the new rates would come out next week 1/10/2023 then she said I should just go to irs.gov find out the rate and put it in and next week maybe it would correct it self, I asked for a supervisor or manager and she put me on hold for 20 minutes and came back and said there was nothing wrong with my QB I am so frustrated i paid all my other employees but 1 I am at a loss

Hi there, @Rhonda68.

I can see how infuriating it is to deal with this double tax issue, and I understand how important to handle and resolve this right away.

There might be an issue with your payroll setup in QuickBooks. There's a number of reasons why taxes are doubled, including incorrect tax rates. To resolve this, you'll need to go through your payroll setup. Make sure that the Federal and State tax rates being used are correct. I recommend checking the current tax rates on the IRS and state tax agency websites.

You may also check out this article about handling overpaid taxes: Resolve a Payroll Tax Overpayment.

You’re always welcome here if you have other queries in mind. I’ll be around ready to assist you. Keep safe.

We are using QBD nonprofit 2020. We only have one employee hired after 2020 and hers is the only one for whom federal withholding is not happening. We just discovered this when I ran and reviewed the W-2s. Since every other employee literally uses the pre 2020 W-4, they are fine, or are under the threshhold for withholding. If there in an actual fix, I'd like to hear it, but if not, it sounds like I need to use the IRS tax table to calculate "additional withholding" for her. It's ridiculous that this issue has been identified for two years and still not fixed.

Good evening, @crlawton.

I appreciate you hopping in on this thread.

Contacting our Customer Support Team would be the best route. They'll be able to review your account and see why is this happening. Here's how:

It's that easy!

Keep us updated on how the call goes. I'm only a comment away if you need me again. Take care!

Hello,

It is January 16, 2023. All my employees got their W2s and are complaining that the taxes being taken out are not enough. I noticed that very little was being taken out for my employees but they were part-time and weren't making a lot so I thought that is why. Now, for someone making $40,000, only $1000 is being taken out, he claims 6 and is head of the household. Can someone help me with this? I don't enter the employee's W4 information. I send them the link and they do it themselves. I don't know what else to tell him because there have been at least 10 employees complaining about this issue.

I am going through the same thing. I noticed federal withholding is not being taken out, but it is only affecting employees who are claiming dependents. Somebody, please help! I spent 3 hours on the phone with quickbooks today and they do not know how to resolve the issue.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here