Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHey there, time. Thanks for reaching out to the Community about this.

With QuickBooks Online Payroll, paychecks can easily be reissued if they were lost. When doing this, you'll want to notify your bank of what's happened and have them process a Stop Payment order. In the event it's already cleared, you can try to recover funds from whichever financial institution cashed it.

I'll guide you through how to generate a replacement check for your employee:

1. Go to the original paycheck.

2. Review and take note of the information on it.

3. Change its number to the next one available. For example, if it was 100, update it to 101.

4. Select Save and close.

1. Use your ADD NEW (+) icon and choose Check.

2. For the Payee ▼ drop-down, pick the worker's name.

3. Specify which Bank Account is used for payroll.

4. Complete the rest of your available fields. If the date of your original check was issued over 90 days ago, enter today's date.

5. Select Print check.

6. Hit Save and close.

Now the employee's check will be reissued. Next, you'll need to void it so your register is balanced.

Here's an archive of QBO Payroll resources which you may find useful: QuickBooks Online Payroll Help Articles

Feel welcome to respond if there's any other questions. I'll be here to help. Have a wonderful Monday!

Does this work the same in QBDT? I have to reissue a payroll check from August and because of the taxes involved that are paid, am not sure how to do that.

Thanks,

Welcome to this thread, Whoadeb.

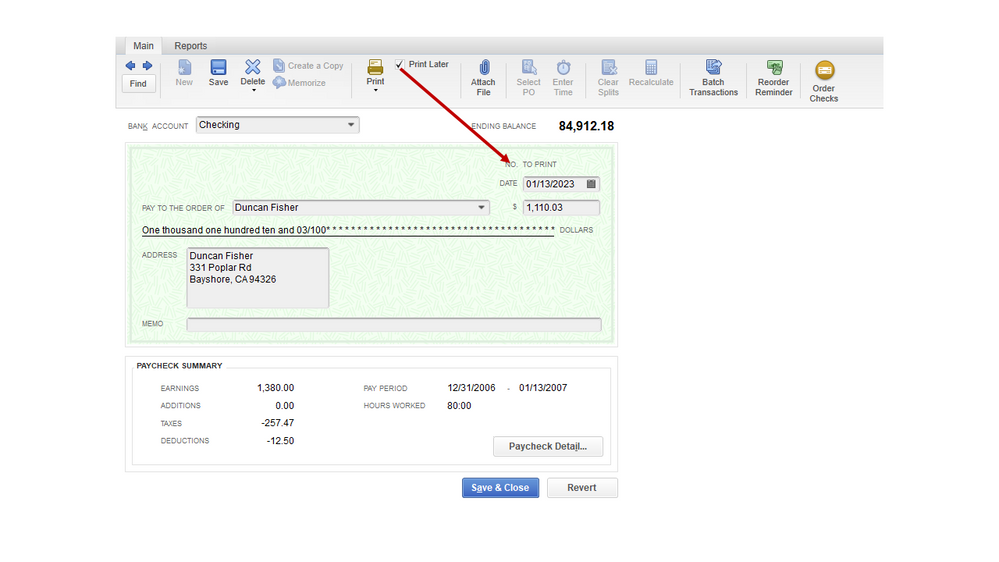

In QuickBooks Desktop, we’ll have to furnish a replacement check with a different check number and give it to the employee. Then create a dummy check to record the missing check number, and void it to balance your check register.

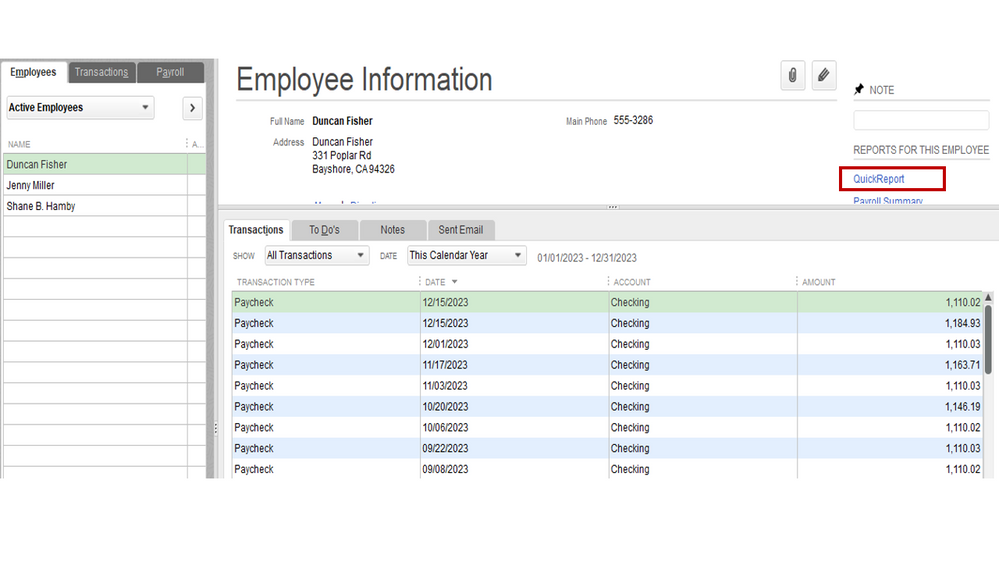

The process is scenario-based, and I’m here to help and guide you through the steps. If the lost paycheck is dated in the current quarter, let’s open it and enter a new number.

Here’s how:

Next, create a dummy check. Check this article for detailed instructions: Issue a lost paycheck.

Make sure to perform the steps in the following sections: Account for the missing check number by creating a dummy check and Void the dummy check and balance your check register. Please know that you can use the same resource when the paycheck is dated in the prior quarter or cannot be cashed due to the date.

You can also bookmark this link for future reference: Understanding Escheat regulations for unclaimed wages. It provides detailed information on how to handle unclaimed property for unclaimed wages.

We've also collated resources to help customers easily handle any payroll tasks in QuickBooks: Self-help guides. The articles are arranged are by topic, so you'll be able to access each one right away.

Don’t hesitate to post a comment below if you need assistance managing paychecks and other payroll-related activities. I’ll be glad to help and make sure this is taken care of for you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here