Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHello cindyherrmann1,

In QuickBooks Online Payroll, you have the option to assign a class for each employee. For now, I'll take note of your question as a product feature request. I'll personally send it to our engineers.

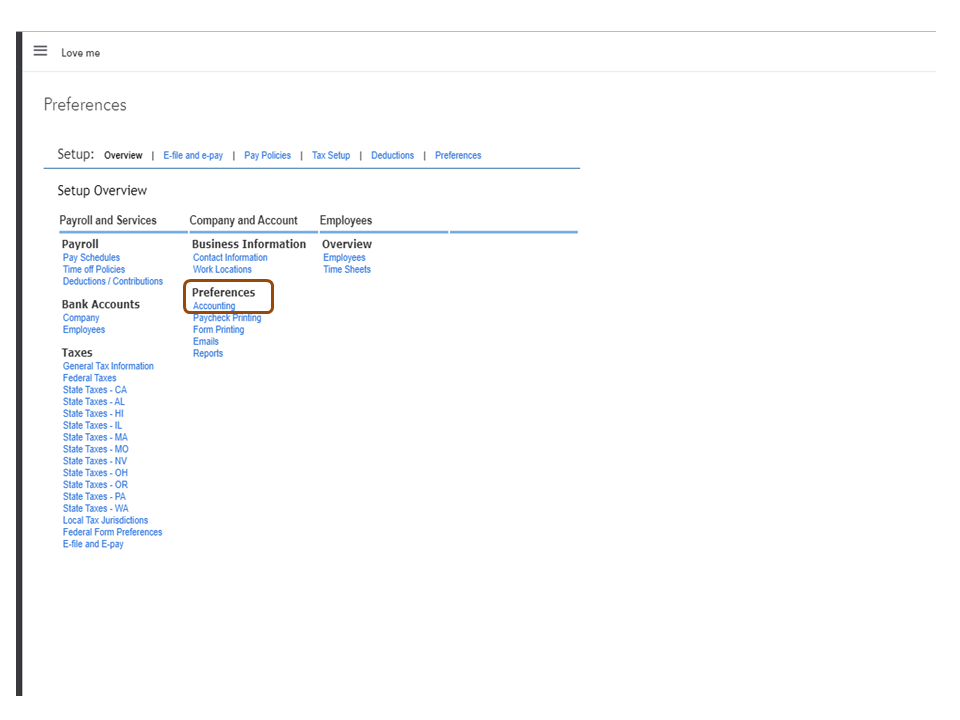

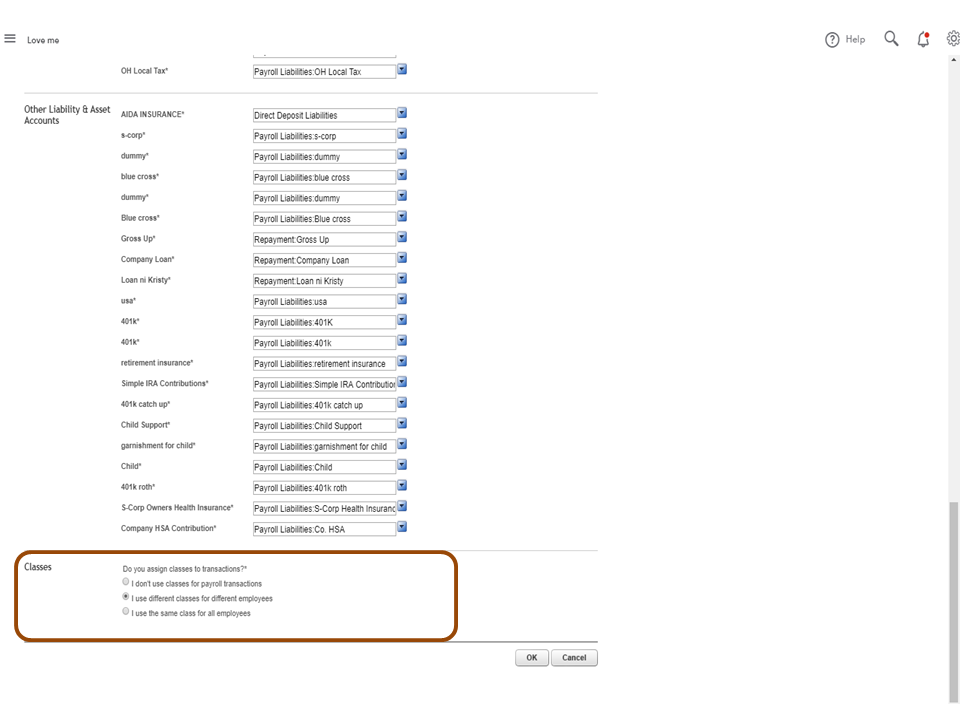

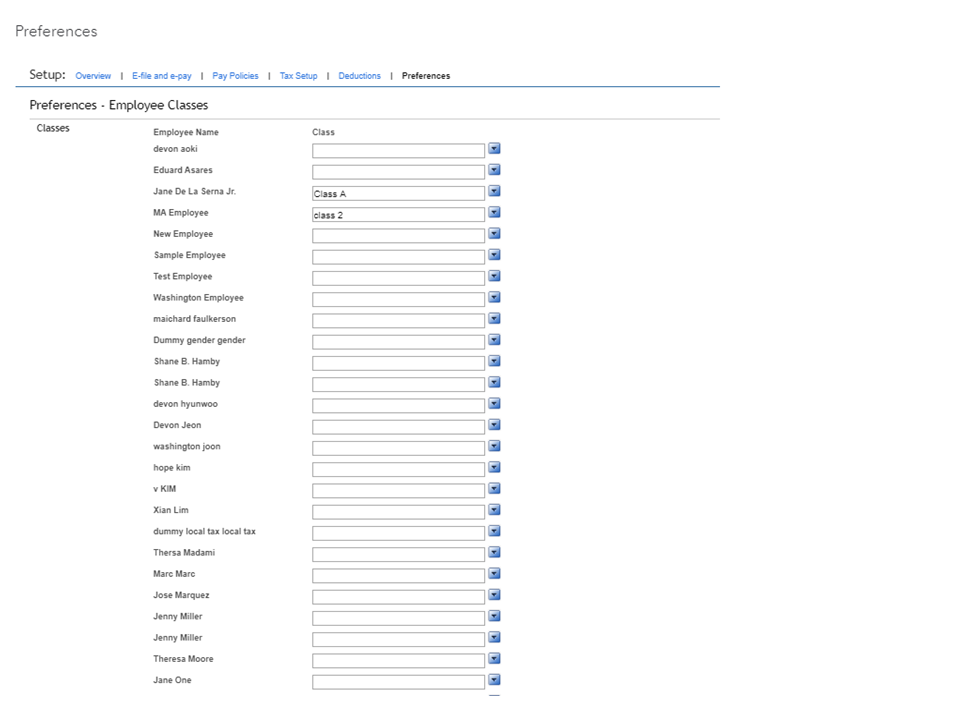

Let me share the steps how to assign a class for each employee:

If you have any questions, please let us know. We'll be right here to help.

Hello cindyherrmann1,

In QuickBooks Online Payroll, you have the option to assign a class for each employee. For now, I'll take note of your question as a product feature request. I'll personally send it to our engineers.

Let me share the steps how to assign a class for each employee:

If you have any questions, please let us know. We'll be right here to help.

Thank you. I did that and it did not work the first time. I went back in a couple of days later as I needed to run payroll and did it again and this time it worked. Thank you!

Hi there, @cindyherrmann1.

Happy to know that the steps provided by my colleague GarlynGay worked on your end and was able to assign a class to each employee successfully.

For more information about class tracking in QuickBooks Online, you may check this article: How to set up and use class and location tracking.

Please know that I'm always here to help you if you have any other payroll concerns, just add a post/comment below. Have a great day ahead!

Our company manufactures products. We use QB Enterprise and assemblies.

When the production workers are making the products we do not know the class in which they will be used; medical, household, commercial, government, etc. We only know the class upon sale. I'd like the production labor to show up properly in the P/L by Class Report, but I cannot figure out how to make that happen. I put labor in the BOM for the assembly items and then assign a class on the invoice, but the underlying labor remains unclassified.

I use a service item called "Production" on the timesheet (and assembly BOM), and report expenses under "Production Wages" in the CofA. But they remain unclassified.

Joining this thread to help with your question about unclassified transactions, RenoDavid.

It's possible that the assembly item (that includes the underlying labor) wasn't assigned to a class in the Class column when the invoice was created.

Let's open each invoices and make sure to assign a class beside the assembly item (see attached screenshot). Once done, run your Profit and Loss by Class again and check if the amounts are moved from Unclassified to the appropriate class.

Add another reply below if you want to ask follow-up questions.

My Invoice did not have class as a column, so I went to Customize Data Layout/Columns and checked Class for view and print. It automatically put "2 Med 2" in the class for the item.

I saved the form and refreshed the P/L but the labor still all shows up as unclassified on the P/L by Class.

See the attached word doc for various screenshots. Thank you for your help.

Hi there, RenoDavid.

Thanks for giving the above steps a try. I appreciate you for letting us know the result of the recommended solution.

Making sure that you assign the correct class on your assembly should resolve the issue. However, if it doesn't work, I'd recommend contacting our Customer Care Team so they can conduct a deeper investigation.

Here's how you can reach us:

Also, for future reference you can check this article to learn more about tracking payroll expenses by class, department, or location.

You can also have this article handy to know more about customizing reports in QBDT: Understand reports.

Let me know if you have any other QuickBooks or payroll questions, I'll always be here to help you.

When I "Click Help at the top menu and select QuickBooks Desktop Help", nothing happens. No window.

Welcome back to the Intuit Community, @RenoDavid.

Thanks for sharing the results of following the steps from @Charies_M.

Before contacting our Technical Support Team, I have another troubleshooting step you can try for the unclassified transactions to show as classified.

To begin, run the Rebuild Data tool to repair the problem in your QuickBooks company file. Next, perform the Verify Data Utility tool to check for damaged file items.

For detailed instructions, follow the steps below.

Next, run the Verify Data tool to check for the remaining data damage. From the link I attached, go directly to Step 2 for detailed instructions.

If you continue to get the same result, I recommend contacting our Technical Support Team for further assistance. Since you're unable to see the pop-up window to view the contact information, press F1 on your keyboard to display the Help window.

To get the detailed information on how to reach them, check out these steps.

Stay in touch if you have any questions or concerns working in QuickBooks. Please know I'm always here to help.

Hi Gary, Perhaps you can help me with QB payroll on line with classes. Each payperiod, the classes change for each employee as they work different hours at different market places which we coded as classes. Thanks in advance Francine

Thanks for following on this thread, @ 20fec.

Based on the information provided, manually change the classes each time you run payroll. This way, QuickBooks Online will be able to properly classify your employees.

I have a few easy steps to accomplish this task. Here’s how:

To learn more about the Class feature, check out the Get started with class tracking in QuickBooks Online article. It provides an overview of how to set up a class list as well as instructions to create a budget by category.

Let me know if you have any other concerns or questions about the product. I’m more than happy to assist further. Enjoy the rest of the day.

I really appreciate all of the posts on this subject!

I'm wondering if I can assign a class to the different pay types? I have several employees who do different jobs for us, so they have different classes on one paycheck.

Thank you!

Hello there, @ValkyrieAnne.

At this time, we can only assign classes to each of your employees. You can follow the detailed steps shared by my peer Rasa-LilaM above.

I can see how beneficial it is for you and your business to assign classes to the different pay types. But I want to let you know that your voice matters and I'm submitting feedback directly to our product engineers for consideration.

For now, you can visit our blog site so you'll be able to get the latest news about QuickBooks and what our Product Care Team is working on.

Please keep in touch if there's anything else I can do to help you succeed with QuickBooks. I've got your back. Have a great day!

QB online is not letting me change an employee's class without it updating the employee's entire payroll to the new class. I have selected a starting date but QB is ignoring my date. I did the ability to change an employee's class each payroll.

Hello, @Michele30.

You may have set your account's preference to assign the same class for all employees. Let me guide you in reviewing your payroll preferences.

Once completed, make sure to log out and log in to your account. Now, you can match your employees with the class that best fits your tracking requirements for each one. You can read through this article for more insights about managing your payroll: Set up Payroll account preferences.

Also, you can run the Profit and Loss by Class, or a Payroll Expense report by Pay Type to see which option gets you closest to your reporting goals.

Don't hesitate to click the Reply button if you have other questions. I'm always here to help.

I do have it set up to class employees individually. What I need to figure out is how to take 1 employee who has class X for this payroll and then needs to have class Y for my next payroll, then will need to have class X for the next one. When I try to change the class, QB updates all the payrolls to reflect that new class which makes the reporting inaccurate.

Hello, @Michele30.

At this time, we can only assign a single class per employee. Assigning multiple classes to a single employee isn't available. Though you can change the class through the payroll settings as provided by IamjuViel above, the changes may affect to all of the payrolls for that specific employee.

For additional reference about classes, check out these articles:

Let me know if you have any other questions. I'm a few clicks away to help. Have a good day!

That is mildly frustrating news as when we used the desktop version we could class an employee's wages and it did not make any changes to the other payrolls. We also could use multiple classes in one payroll for an employee. When will the online version be updated to allow this same feature?

Hello, @Michele30.

I can see the importance that the payroll type class tracking can do to your business. As of this time, we aren't able to tell when this will be available. Sending your feedback online is a big help for our engineers to determine the features that need to be added to our product. Also, I'll share this request with our Developers so this will be included in future considerations for product updates.

Also, you can visit our QuickBooks Online Blog to be updated about our latest happenings. Through this, you're able to get the newest news, features, and updates about QuickBooks Online and what our Product Care Team is working on.

Let me know if you have other questions.

I create a journal entry each pay-period after I run payroll to assign reassign payroll expenses to multiple classes for a single employee. Very inelegant but with only one employee it is doable.

I too am in the same situation. My crews work at multiple job sites throughout the week. When I run payroll through QB I would like the option to allocate each individual employees time to a job class. From what I'm reading, this is not available on QB Online, correct?

Hey there, @Domi916.

Thanks for following the thread.

You're correct. The option to allocate each employee's time to a job class is currently unavailable. As mentioned by my colleague above, we have submitted feedback to our product engineers, so this could be considered in a future update. To follow along with current updates, check out our Blog Site.

Please let us know if you have further questions or concerns. You can always reach out to the Community anytime you need assistance. Take care!

There is no ACCOUNTING option in Payroll Settings? I am using quickbooks online.

Thanks for joining us here, ohal3000.

A possible browser issue might have caused the Accounting option to not show up. Let me share some steps that can resolve unexpected results when working in QuickBooks Online.

Switch to an incognito or private browsing session. These keyboard shortcuts can start a session depending on the browser that you're accountant is using:

Once done, log back in and go back to the Payroll Settings. Then, check if you can already see Accounting.

I'd also recommend reaching out to our Payroll Support Team just in case you can't still see it. They'll take a closer look at this to check what's causing the issue. Here's how to reach out to them:

Also, please take note that due to COVID-19, we have limited staffing at the moment and have reduced our support hours. Please open this article to see the operating hours of our chat and phone support teams: Support hours and types.

Let me know if you need anything else.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here