Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowJust checked and my rate is still at 0.58% which is incorrect for 2023

If you fully read my explanation, you would have understood I was referring to a work around to avoid filing this stuff within quickbooks and relying on them to get it correct. QB actually does have the correct rate in the payroll settings, the problem is the math function built into that rate is not calculating correctly. Which would be a software glitch, I have been reporting it for a very long time now and keep getting told I am the only one having the issue and that no one else is reporting it. This last week I finally got someone to believe me by looking at the calculations I showed them and they opened a ticket for me. However, if no one else is filing a work order than nothing will get done. But I hate to be the bearer of bad news- switching services will not be the answer- I tried- and after working with several other companies found qb to be the best of them as far as all these stupid issues- the problem lies in the programming- they seem to have programmers that do not have a full grasp of accounting when they build these accounting programs. Secondarily, most states do not have all the oddities that WA has in these mandatory deductions so the software people need to learn to program accordingly. Personally, I feel QB in particular failed when they decided to make a new software for their online program instead of making online identical to desktop and allowing users to input their own numbers and make corrections. Instead, they chose to build this platform and hire people who have no idea what they are doing.

My work around, is to only rely on your payroll summary but use a spreadsheet to make sure your calculations are done correctly at the payroll level each time you run payroll and build a payroll deduction to account for them and then file through the state- but I was specifically speaking to the user who was discussing with me, as to my personal solution to make sure the quarterly reports are correct. All businesses should be checking the math regardless and making sure that the data is reported correctly.

Sadly, sometimes, the quickest answer is a work around

So wanted to follow up with a good service experience. I decided to give customer service chat a try for this problem before implementing my own workaround. I connected around 9:35am, got a service agent within a minute and was done by 10:15. She understood and was able to correct the problem - at least as best as I can tell at this point in time, I'll know for sure when I run our next payroll on the 16th. I verified with her multiple times that she updated not just the employee-employer ratio to 72.76% vs 0% (which I can see on my WA state tax info page) but also the multiplier from 0.4% to 0.8% (which I can't see).

She did ask me if I had a notice from the state regarding the 1/1/23 rate change, but I explained this change was for all businesses in WA state and provided her a link to the WA FMLA employer info page so she could see the rates for herself and she was fine making the changes.

This was definitely the best customer service experience I've had with QB in the 10+ years I've been relying on it. Hopefully I'll still feel that way after my next payroll run when I check our new PFML premium withholding

Second followup for those watching this issue.

Since QBO does not display the PFML total wages withholding rate (0.8%), only the employee vs employer ratio, I wanted to test and verify yesterdays changes made by QBO support were correct before our actual payroll run next Monday. I just ran early paychecks for a couple employees (1 salary and 1 hourly) to compare the PFML withholding on this check vs the previous incorrect one. Happy to report the new checks do in fact have PFML withholdings of total wages * 0.8% * 72.76% as expected. Also, QBO issued a "Tax Adjustment Check" for each employee making up the difference between what the incorrect 10/1 check withheld for PFML and what it should have withheld. The "Tax Adjustment Check" only covered 10/1 because I instructed them to enter a new rate start date as the first day of this quarter (10/1/2023) since I manually corrected the incorrect premium withholding for Q1 to Q3 2023 and didn't want any changes to that data. With that adjustment it means Q4 PFML totals are now in line with what they should be.

Very happy to get this corrected.

Hello there. @Warlock. I'm happy to hear that your concern has been resolved.

Your feedback is incredibly valuable to us, and we appreciate your patience and understanding throughout this process. We strive to provide accurate and efficient payroll services, and your satisfaction is of utmost importance to us.

If you have any further questions or concerns regarding your payroll or any other matter, please do not hesitate to reach out to us. Our team is here to assist you and ensure that all your needs are met.

Once again, thank you for bringing this concern to our attention, and we appreciate the opportunity to address and resolve it promptly.

Continued problem with this is it won't save! It continues to default to old rates. I found out two of my clients rates never actaully saved and they had to pay money out of the company to cover what should have come out of employee checks.

I know this hasn't been an easy process for you, BFS253.

Let me make it up to you by making sure you get assistance in changing the correct WA PDML rates.

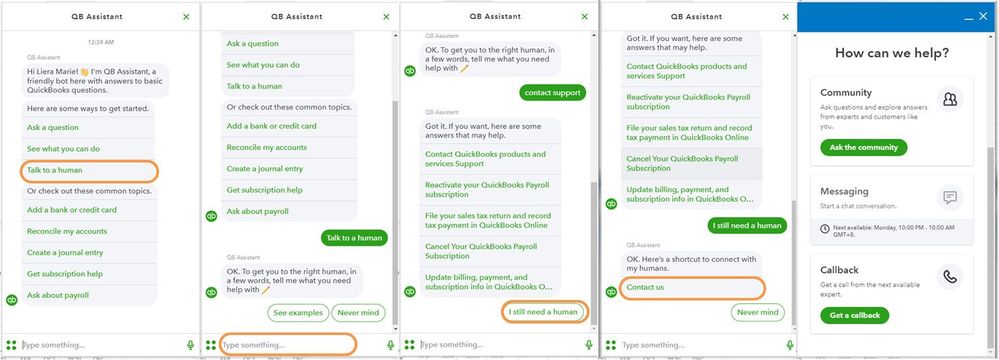

Since the rates keep on changing to the old one, I recommend reaching out to them again. They have full access to your account and can help you update the details. They can also determine its main cause to ensure it won't happen again. Here's how to contact our support:

I appreciate your understanding on this matter. Please know that I'm determined to get this resolved.

This is the same issue year after year. I was on chat for 2 hours and the rep had no knowledge about it. Finally I was given an email to send a image of the letter. Well it turns out the email is also no good.

Why can't they have a drop down edit menu as with other tax liabilities. Rates do change each year. Very frustrating.

I recognize the relevance of the options you mention above, @Rivaage. I'll share the steps to submit feedback. Providing us with feedback will help improve and help you to have a better experience with QuickBooks Online.

Since there isn't an edit menu for the PMFL rates section in QuickBooks Online, we can send a request to our product developer. This way, they'll see your suggestion and consider adding it to the next program update.

Follow the steps below:

Our Product Development team receives your statements (QBO) through the feature request link: QuickBooks Online Feature Requests website.

Visit this article for further information on how to keep track of your client's account growth: QuickBooks Help Articles. It includes topics about account management, banking, and expenses and vendors, to name a few. You can click the + More topics button to view other selections.

Please feel free to remark with your response. I'm excited to provide more notifications on payroll-related matters. Have a great day.

This does not work. The drop down menu only shows the old rates. There is no way to enter the new rates as mentioned. The last few years I have contacted the support team and they changed it from the back end. This year after contacting support for 2 hours, they were not able to change it. Even with logging in through Smart Look, I was told that the rep has the same access that I had.

QB need to come up with a solution soon.

Mr. Archie from the QB support team, please try out the steps you mentioned and see if it works.

Thanks

And now - it's not saving the 2024 rate (which I updated before running payroll last week). Get it together, QB!!

We appreciate you joining us here in the thread. We'll share details as to why you're unable to save the rate changes for WA PFML inside QuickBooks Online (QBO).

Please know that when changing the rate of WA PFML inside the program, changes only apply to future transactions inside QuickBooks. That said, if you're trying to modify the rate and want it to affect previous or past transactions, you'll need to contact our Payroll Correction Team so they can help you through it. We'll write down the steps to get you going:

Please see this page for more details: Contact Payroll Support.

Furthermore, you can check this page to help you prepare to wrap up this year’s payroll and prepare for the next: Year-end checklist for QuickBooks Online Payroll.

It's been a pleasure to have you here today. If you need further assistance managing tax rates inside the program, visit us here in the Community space so we can help you. Keep safe.

Same problem. Unbelievable that QBO/Intuit cannot fix this but keep increasing their subscription rates

I understand this hasn't been easy for you, @mr_sunshine. I'm here to ensure you get assistance in changing the correct WA PDML rates in QuickBooks Online (QBO).

You can change or update your WA PFML tax rates from your Payroll settings. Here's how:

However, if you're unable to find the new rate option, we can perform some troubleshooting steps to see if it's a browser-related issue. Login to your QBO account using a private or incognito window. This mode doesn't use the existing cache data. Here are the following keyboard shortcuts:

If it works, go back to your regular browsing history and clear the cache. Otherwise, you can try other supported browsers to help narrow down the cause of this behavior.

If the issue remains even after troubleshooting, I suggest contacting our Payroll Support team. They have full access to your account and can help you update the rate and determine its main cause to prevent it from happening again.

For more ideas about how QuickBooks Online handles workers compensation, see the below articles:

Loop me in if you need help updating new rates for WA PFML or have follow-up questions about QuickBooks. The Community team is always around to assist.

I know atleast that much to have been running payroll for years. QBO has a bug where it does not save the changes we are making. It shows the new PFML rate. I select it effective 1/1/2024, hit save. Come back again and notice that it did not save it. This is the problem that most of us are reporting and QBO Level 1,2,3 support do not seem to get it.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here