Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowGreetings,

I am using Quickbooks Online. I am trying to pay my employee's SIMPLE IRA contribution to their financial institution. How do I do this? I've already set up employee accounts to deduct from payroll. I just need to pay the liability now. How to I create a bill that reduces the liability?

Thank you!

Thanks for choosing QuickBooks Online for your business, @JThouron. Glad to know you've already set up the employee accounts to deduct from payroll.

You can pay your employee's SIMPLE IRA contribution directly to their financial institution. Then, record the payment you've made in QuickBooks by creating a journal entry. Here's how:

Please know that journal entries require an understanding of debits and credits. I'd recommend reaching out to your accountant if you have specific questions about your Chart of Accounts. You can also find a ProAdvisor if you don't have one yet.

For more insights, read through this article to learn about retirement plan deductions/contributions in QuickBooks.

Visit again if you have additional concerns. I'd be here to be your guide.

Hi JThouron,

Hope you’re doing great. I wanted to see how everything is going about the concern you had yesterday about recording the SIMPLE IRA contributions in QuickBooks. Was it resolved?

Do you need any additional help or clarification? If you do, just let me know. I’d be happy to help you at any time.

Looking forward to your reply. Have a pleasant day ahead!

Greetings again,

Thank you for your response!

If I needed to print a check, how do I start the process from there? Do I just select the SIMPLE IRA liability acct?

Thank you :)

It's great to hear again from you, JThouron.

I'd like to share additional information on how to print check with liability account.

Here's how:

For more insights, read through this article to learn about retirement plan deductions/contributions in QuickBooks.

Let me know how it works on your end. I'm always here to help you.

I don't see "workers" under account type when i try to set up the account to pay the liability out of.

Good morning, @katiekeisler.

Thanks for chiming in on this thread. I appreciate you coming here with your question about setting up the account to pay the liability out of.

To clarify, where are you looking for the "workers" option in your QuickBooks Online? A screenshot of the area would be a great way for me to get to the bottom of the issue.

Please let me know this information so that I can give you the best solution for your business. Click the Reply button below to respond back to me. I'll be waiting for your post!

Hello:

Is there a way that this payment can be set up through online bill pay? If so, how is that done?

Thank you

Hello, Kristy28.

Thank you for reaching out to the Community. Bill Pay integrates with QuickBooks Online Essentials, Plus, and Advanced, so you can pay, track, and manage bills right inside the software. To learn more about Pay bill in QuickBooks, please check out this article: Bill Pay for QuickBooks Online.

For additional resources, check out the Retirement plan deductions/contributions article. It provides an overview of how to assign the payroll item to employees and steps to apply the deduction/contribution.

Don't hesitate to post a comment below if you need further assistance, as I'd be around to help. Have a good one.

Thank you. We do have the online bill pay set up, but when I called QB help desk, she told me that she didn't know that I could write a check for an IRA using that. I have the deduction amounts from the first check, and I can get the financial institution set up as a vendor, but how do I enter the payment information so I can use the bill pay system? Would I enter it as a new bill? Will that deduct it from my liability account properly? Thank you!

Hello there, @Kristy28.

I appreciate you for getting back to us here in the Community. I can show you how to enter the payment information in QuickBooks Online.

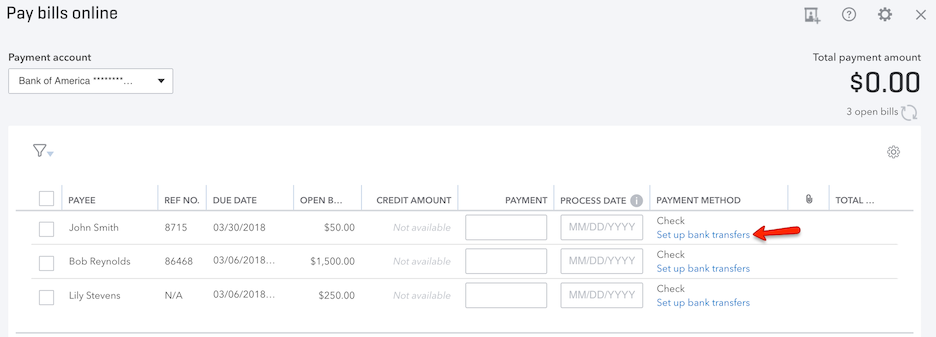

You can go directly to the Pay Bills Online section to set up the information you need. You should have an option to enter the bank account details.

Here's how:

Also, yes, you can create a new bill to pay using online bill pay. After entering the transaction, you can follow these steps to make payment:

Note: The Memo field will only appear on Paper Checks.

However, using this process will not deduct the amount directly from your liability account. I recommend contacting Bill.com Support to verify if they support IRS payments and to further assist you with the process.

If they don't and you decide to pay taxes outside QuickBooks, you can record them manually in the system. I suggest following the detailed instructions in the Recording prior tax payments article.

I've attached an article you can use to learn about the option available in QuickBooks for paying taxes online, as well as how to file forms: Pay and file payroll taxes online.

Please let me know if you need anything else regarding managing payroll taxes. The Community and I will be here to help you.

How would I manually pay a Simple IRA using Quickbooks Desktop? Can I set this up using Bill Pay or would I have to write a check?

Thanks in advance!

Hello!

How would I manually pay a Simple IRA using the Quickbooks Desktop version? Can I set this up using automatic Bill Pay or would I have to write a check?

Thanks in advance!

Hey there, @mathieug872.

We're here to help you pay your Simple IRA plan in QuickBooks Desktop.

We have to manually create a check to pay the contribution for the Simple IRA plan and then send it to their financial institution. First, let's create a payroll schedule for Simple IRA to help you keep track of when they’re due.

Here's how:

Then, follow these steps to pay a scheduled liability:

If you need to create a custom payment, refer to this article for the detailed steps: Pay Your Non-Tax Liabilities.

I'm also adding these resources to determine which plan you want to set up for your employees and review its contribution limits:

Visit us again if you have other concerns about tax payments. We're here to help and are committed to providing you with the support you need. Have a great day!

Thank you LieraMarie_A!

Do I have to setup a payroll schedule for our Employees' IRA deduction, in addition to the IRA Company Contribution in this same manner?

Thanks!

You're welcome, @mathieug872. It's great to have you back here.

Yes. In addition to setting up your company Simple IRA contribution, you'll also need to establish a payroll schedule for employee deduction. You can use the steps I provided above to guide you through the process.

For additional information, you can see the following IRS resources:

Feel free to reply to this thread if you have any questions or need further assistance with setting up your payroll schedule. We're committed to providing you with the best possible service.

Hi LieraMarie_A!

Is there a way that I can change the period dates for the IRA Deduction and the IRA Company Contribution liabilities? Currently they run Saturday to Friday. I need the period to be from a Thursday to a Wednesday to match our payroll pay period.

Thanks!

Hello again, @mathieug872.

We're unable to change the payment period dates for the IRA Deduction and IRA Company Contribution liabilities in QuickBooks Desktop. However, you can adjust your payroll pay period to match the payment period for these liabilities.

Feel free to leave a comment if you have any additional questions or concerns related to payroll.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here