Hi, @dpacheco1. I want to ensure you get the guidance you need to amend your and your husband's W-2 forms.

Updating the W-2s will depend whether your automated taxes and forms settings are on or off in QuickBooks Online (QBO). Let me provide more details about this.

If your automated taxes and forms are on, you can contact our live phone/chat Payroll Support team to fix them for you and your husband and file a W-2c form with the SSA. You’ll also receive a copy of the W-2c forms and updated W-3 copies to print for your records. The expert you talk to can let you know the approximate time when to expect the W-2c and W-3c. You can follow these steps to reach out to them:

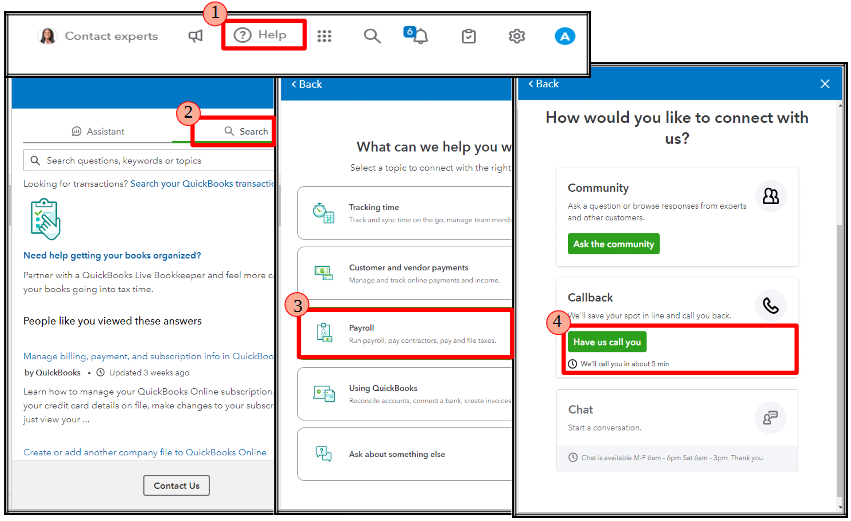

- In your QBO account, click on Help (?).

- Choose the Search tab.

- Type in keywords like "Amend W-2" in the search field. Then, select Contact Us.

- Choose Have us call you.

However, if your automated taxes and forms are off, please know you'll need to manually create and file a W-2c and W-3 form with the Social Security Administration.

To do this, see the General Instructions for Forms W-2c and W-3c section in the General Instructions for Forms W-2 and W-3. You can then run payroll reports to help you in the task of filling out the W-2c form.

If you need help updating or assigning your payroll items in QBO after this, I'm adding this article as a guide: Manage your payroll items in QuickBooks Online Payroll.

We'll be here in the Community if you have further questions about correcting W-2 in QBO. We'll do our best to assist. Take care!