Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowJust about anything to do with the >2% shareholder medical in QBO or QB desktop payroll W2 reporting is a challenge. I'm still working through the best way to handle during the year (so added to pay) and throughout the year.

Karen,

Do you know if you will have this feature implemented for the 2020 tax year?

Thanks,

Vikas.

Good day, Vikas.

I understand that many of you want this option. While we don't have a time-frame when this will be implemented, you can always visit our QuickBooks Blog. All innovations and new features will be published there.

We also thank you for continues support and patience.

Tag my name if you have more clarifications. Wishing you all the best!

Hello,

Do you know if this issue was solved by now? Thank you

Thanks for joining this thread, ds tax.

As mentioned by my colleagues, the ability to track the Company HSA contribution for the 2% S-Corp shareholder is currently unavailable. I suggest consulting with an accountant or tax adviser for further assistance.

They can provide recommendations on the taxability of the payroll item. This also ensures that it meets your business requirements and properly reported on your W-2.

You can visit the QuickBooks Blog to keep you in the loop for the latest enhancements, news about QuickBooks, and features added to the product.

Additionally, these resources provide an overview of the supported payroll items and how QuickBooks populates the date on the W-2 form.

Reach out to the Community again if you need help with QuickBooks. Please know I’ll be around to assist further. Enjoy the rest of the day.

I know how this is taxed, but how do I add this benefit to the paycheck on Intuit Payroll and make sure is taxed as it should be?

Let me provide a few more information, Ds tax.

I suggest reaching out to your accountant. They'll guide you with setting it up and adding it to the paycheck. It is to ensure it's taxed correctly.

Also, I'll add an article about contributions as a future reference: Set up company contributions.

If you have other concerns, please feel free to get in touch with us. Take care!

Couldn't you just set-up a new payroll item. Call it HSA >2% or similar. Under the tax tracking type, select the same one you use to successfully process your Company paid health plan payments for >2% shareholder of an SCorp. Then on the withholding page make sure Federal Withholding is checked but none of the other FICA or FUTA boxes. That should already be set-up OK if you selected the health plan payments tax treatment. Then take any state specific considerations into account, for example, for CA which does not recognize HSAs you'd have check all the CA withholding item boxes since it will be subject to CA SUTA etc.

What if an Scorp 2% shareholder has both Premiums and an HSA plan?

I’m here to share some information about S-Corp Insurance items, @MariaABA.

An S-Corp owner's health insurance is for accident or health benefits provided to 2% shareholders of an S corporation. The feature to set up and record your S-Corp Insurance items in QuickBooks Online (QBO) is currently unavailable. I suggest seeking an advice from an accountant for further help.

For more information about supported pay types and deductions in QBO and how each impacts federal taxes and forms how it impacts federal taxes and forms, refer to the following article: Supported pay types and deductions explained.

I'm always here if you need more help with your payroll items and or anything else by leaving a reply below. Take care and have a great rest of the day!

I don't think I am following, there is and S Corp health insurance item Pay type in QBO Payroll

Thanks for getting back to us and for adding some clarifications, Maria.

Yes, there is an S-Corp health insurance payroll item in QuickBooks Online (QBO). QuickBooks already set up this item in compliance with the IRS. The option to set up a new item with both S-Corp and HSA plans isn't possible.

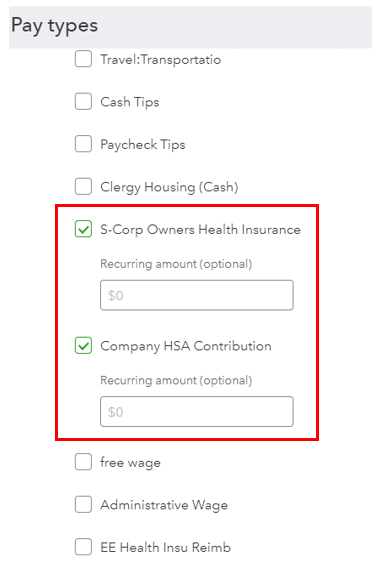

As a workaround, you can select both payroll items and add them to your employees' payroll information. I'll show you how:

You can also utilize this link for more details about the process: Add or Change Pay Types in Online Payroll.

Moreover, I highly suggest working with your accountant to prevent messing up your records. They can provide additional information on better ways to record this. If you don't have one, you can visit our ProAdvisor page and we'll help you look for one from there.

Once you're all set, feel free to check out this article for guidance in running your payroll seamlessly: Process or run payroll.

Do you have other questions about setting up and managing your payroll? You're always welcome to leave the details in your reply and I'll take care of it for you. Have a great weekend ahead!

@MariaABA, what did you end up doing to get both the S Corp Health Insurance and S Corp HSA contributions for >2% shareholders? Did you adjust the W2 at the end of the year somehow? It doesn't appear that this has been resolved as of yet.

Is there any solution to this now?

I know you can create a custom "pay type" but there doesn't appear to be any control over how this pay flows through the tax schedules and forms. If we could create a custom pay type AND customize how it is taxed and where reported on tax forms, that'd be one solution.

The other solution is for QBO to simply duplicate the code for pay type "Shareholder Insurance Premium" but call it Shareholder Company HSA contributions since it would flow through the tax code the same way (except maybe W-2 Box 14???, accountants?)

Please create a solution to this issue.

Thanks for joining us in this thread. Allow me to give you details on how you can add an HSA contribution, S-Corp.

As you may have read in the previous responses, we're unable to create a custom payroll type in QuickBooks Online. For now, you can follow the steps on how to create another Shareholder Insurance Premium type and name it as Shareholder Company HSA contributions. Here's how:

You'll also want to reach out to a tax adviser for more guidance about this matter. I'd like to share these articles that talks about setting up this type of payroll item in QBO:

Customer feedback and suggestions are reviewed and considered whenever updates are designed. I recommend sending a feature request about being able to make a custom payroll items in QBO. Here's how:

Let me know if that option works for you. You can also ask more questions in case you need more help when running payroll and working in QuickBooks as well.

How do we get the W2 to be correct for the greater than 2%? Reported in Box 1 but not box 3 and 5

Hello, Stephanie.

I'll ensure you'll be able to get the correct amounts on the W2 form for your employees.

Pay types can affect how the amounts are reflected on the W2 form. So for employees who own more than 2% of an S-Corp, you'll want to set up an S-Corp pay item instead of an HSA contribution type instead.

My colleague has mentioned this on the previous page. Check their reply if you need a reference regarding the S-Corp pay type.

I would also need to mention that making the W2 corrections depends if the form was for a previous filing or not. It also depends if there are multiple paychecks affecting the W2 form or if there's only a single one.

For recent filings or if you're still on the process of preparing the W2 forms, make sure to select an S-Corp pay type as I mentioned before.

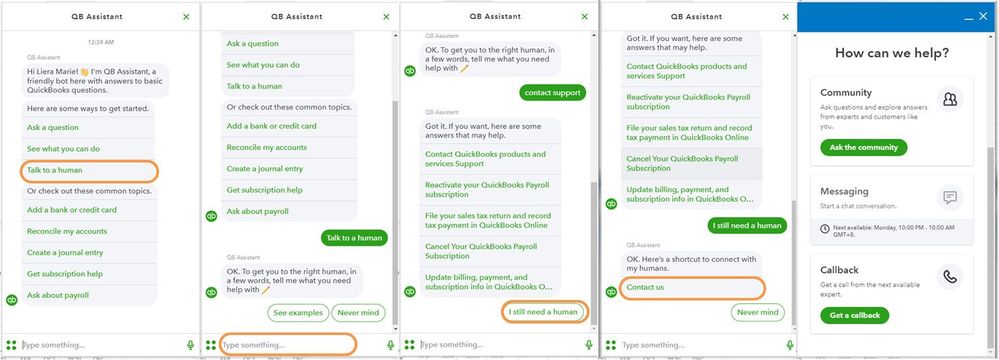

If this is from a previous filing and if there are multiple paychecks involved, then we'll want to override the amounts to correct the W2 form. To do this, we'll want to contact one of our payroll agents to make the corrections. Here's how to do it:

If this is only for a single paycheck and you're still on the process of preparing the form, simply delete and recreate the paycheck with the correct pay types:

If you're unable to delete this, you'll want to contact us so we can make the corrections.

If you also need to file the W2C form, you'll want to do it manually by getting the form from the IRS. Then, make the necessary corrections. You can get the form here: https://www.irs.gov/forms-pubs/about-form-w-2-c.

I'll also include these articles in case you need help with HSA contributions and the supported pay types:

Need to check and verify your employees' current liabilities to prepare taxes in the future? This article will guide you on what reports you can run: Run payroll reports in QuickBooks Online Payroll.

Do you have more questions about managing your employees' HSA contributions and their settings? Or do you need help with your recent payroll entries? Let me know and I'll guide you through.

Hi this is for one single pay check hsa contribution for the year 2022. We currently have it entered as S corp medical but no taxes were withheld Do I call into Qbo payroll to have this corrected on W2 at the end of the year or how do I fix this?

Hi there, @Stephanie G.

Thanks for coming back. I'll get you pointed in the right direction to address your concern right away.

Yes, I recommend contacting our Payroll Support team. They can further check why it isn't withholding tax for the S-Corp pay item. Then, help you make the corrections.

Here's how:

Please update me how the call goes or if there's anything I can do. I want to help however I can. Good day!

Hello,

It's December 2022 and it still hasn't been implemented. This is a shame as it's such a simple solution. Basically create a Pay category for S-Corp owner's HSA contribution that mirrors S-Corp owners health insurance for tax treatment purposes.

And how do you propose one do that? I tried just that- I added a new 'Pay Type' in QBO payroll and called it 'S-Corp owners HSA contribution', but there's no options to specify tax treatment. I ran test payroll after adding this pay type and it add the HSA amount to box 3 and box 5, which it should not.

Good day, @Ravi M.

I can see the need of being able to record or enter the Compay Distribution by S-Corporation, however, based on the latest updates from our Product Developers, this is still unavailable. While we don't have a time frame for when this will be implemented, you can always visit our QuickBooks Blog. Publication of every new innovation and feature will be published there.

Referring to the workaround you followed in the thread, yes it's unavailable to specify the tax treatment. In the meantime, you can follow the workaround provided by @MaryLandT above.

In addition, feel free to browse through this article to help you set up ad assign pay schedules to pay your employees in the future: Set up and manage payroll schedules in QuickBooks Online Payroll.

You can ask more payroll-related questions here in the thread. I'm just a reply away. Have a great day!

It is Dec 20, 2023 and QBO still has not duplicated the S Corp Owners Health Insurance item and called it S Corp Owners HSA. This NEEDS to be resolved. If a taxpayer doesn't show the HSA contribution made by the company separately on the W-2, then it is too easy to double-dip the HSA deduction on the taxpayer's 1040 tax return when they receive Form 5498 showing HSA contributions but they do not have any indication on the W-2 that it was company paid because the amount is buried inside of S Corp Owners Health Insurance. These pay items are treated identically, but need to be listed separately in Box 14. It's unacceptable that QBO developers haven't copied over the payroll item and renamed it yet. It's been 5 years.

I am also stumbling upon this post nearly 5 years later and the issue still does not seem to be fixed. Absolutely inexcusable, Intuit!

We set up a new firm HSA and need the special item for >2% shareholder HSA that is in W-2 Box 1 but not Boxes 3 & 5. I can't believe that there isn't a programmer somewhere at Intuit that can do this.

Here's a tip: Stop working so hard on sending me an e-mail every 3 months telling me that all of your products are increasing in price by 30% and start making the product functional. This simply needs to work.

Has anyone found any workaround for this if you are using Quickbooks Payroll? I spent over an hour with support trying to find options. I was even considering just keeping track of the amount the entire year, then asking for a W-2 adjustment after the W-2s are created each year. I was told that wouldn't be possible because they make paycheck modifications from the year to fix the issue so box 1 on the w-2 is correct.

It looks like the only way to have a semi correct w-2 is to include the money in S Corp Health Insurance bucket since it will at least give me a w-2 that will have the correct taxes accounted for. As a solo s corp member I will be able to keep track of what part of the S Corp Health Insurance money was for health insurance and which part was for the HSA contributions. I could see this being a problematic approach if the w-2 was just mailed to other people at the company, but I don't have that problem. Has anyone found a better way to handle this?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here