Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowHello, rudy13.

We appreciate you for posting your concern here in the Community space. I want to help you with it, but can you tell me more about it?

If you're an employer and you've changed your name, bank account, W-4 filing info, or moved to a new address, you won't be able to view your name when updating the payroll taxes. With this, you need to update your profile in your QuickBooks Payroll account. Here's how:

On the other hand, if you don't see your name due to the changes in your legal business name and address due to company movement, you should contact the IRS to update the changes. You can find the IRS guide, Change Your Address – How to Notify the IRS, or contact your state agency for assistance. Once we receive the form and will contact you if we need more information, we'll process your request to update your legal business name and address within five business days. Our account maintenance team works from 7 AM – 3 PM PT.

However, if you mean something else, feel free to make this thread active so we will know any additional information about your concern.

For future use, you can see this reference to have a guide for handling your payroll taxes and other forms in QBDT: Pay and file payroll taxes and forms manually in QuickBooks Desktop Payroll.

Tag us for more information you have regarding your queries. I'll be back to assist you. Keep safe.

i already did the update payroll

I have a cash advance payroll item. The type is "advance" and tax tracking is "none". Is this okay to use?

I'd be glad to address your concern about managing advance payment in QuickBooks Desktop (QBDT), tdferrari.

Before doing so, can you tell me more about the cash advance payroll item you mentioned in your post? Any additional details such as screenshot would help me provide an accurate resolution to address your concern.

If you're looking for a way to adjust your employee's payroll liability, you can refer to this article: Adjust payroll liabilities in QuickBooks Desktop Payroll.

We look forward to hearing back from you. Please keep in mind that we're always here to assist you with any questions or concerns you may have.

I'm not sure I need to do this. Quickbooks didn't take out employee taxes on 10/10 and I didn't notice until the next payroll. I called and they had me do a direct deposit offset because the individual employees checks didn't show up. I don't know if I need to do anything or will Quickbooks take out those taxes and the current taxes due on next week's paycheck?

I got you covered, tdferrari. Navigating the complexities of payroll taxes can sometimes be challenging, and I'm here to ensure you have all the information you need.

The direct deposit offset payroll item you created was for the missing paychecks. Creating an offsetting item will zero out the net pay of the individual paychecks since there will be a corresponding direct deposit liability check in your bank register. This approach keeps your payroll records accurate and ensures your financial registers remain balanced.

Regarding your concern about payroll taxes not being deducted in the previous pay period, please note that QuickBooks has an auto-correct feature, which means the program will automatically correct such discrepancies in the next pay period. However, for federal and state withholding taxes, you'll have to manually adjust the amount to double it when processing your next payroll. In this situation, inform your employees that the next paycheck will have increased tax deductions to compensate for the missed deductions in the last pay period.

Finally, you'll also have to update your tax table to ensure accurate payroll tax calculations.

My team and I, value open communication and want to ensure you fully understand your payroll and tax situation, tdferrari. If you have additional questions or concerns regarding payroll tax management, comment below. Our team is here to provide clarification on any aspects of the process, including tax withholdings, adjustments, or general payroll practices. I'm committed to addressing your concerns and providing the information you need to feel confident about your payroll tax management.

I said that I recorded a direct deposit offset as requested on the phone with Intuit, but I only did that so the paychecks would show up in the individual employees. I noticed it said net paycheck was zero so I went in and deleted the direct deposit offset. Should I not have done that? My thumb drive went bad and I lost everything from 9/20 to 10/9 so I had to go in and recreate everything. Payroll quarterly tax forms, tax payments and payroll.

Hi there, @tdferrari.

Thank you for reaching out to the QuickBooks Community. It sounds like you've had a challenging time with data loss and recreating payroll records. Let's address your concerns regarding the direct deposit offset and ensure your payroll records are correctly set up in QuickBooks Desktop (QBDT).

The Direct Deposit Offset account is a temporary holding account used to manage direct deposit transactions before they are settled in your bank account. Deleting the direct deposit offset entry could affect the accuracy of your payroll records and bank reconciliation.

For personalized assistance and to ensure all payroll records and transactions are correctly set up, it’s a good idea to contact QuickBooks Desktop Support.

Given the data loss you experienced, it’s crucial to back up your QuickBooks data regularly to avoid future issues.

By following these steps, you should be able to verify and correct your payroll records and ensure everything is accurately recorded in QuickBooks Desktop. If you have any further questions or need additional assistance, please don’t hesitate to reach out again. We're here to help ensure your QuickBooks experience is as smooth and accurate as possible.

Okay, so I went back in and put the direct deposit offset back in there. The previous person that assisted me said to double the federal and state withholding taxes on the next paycheck. One employee is no longer with us and the other I checked "2020 and later" under the w-4 and it looks like there have not been any federal withholding taxes taken out of her paycheck. Me and the owner are salaried so that is easy enough to double. What should I do?

Okay, I went back in and added the direct deposit offset. The previous that helped me said to double the federal and state withholding taxes but one employee is no longer employed and the other I check "2020 and later" under w-4 form and it looks like it's not withholding any federal taxes from her. Me and the owner are salaried so that's easy enough. What should I do?

Thank you for rejoining this conversation, Tdferrari. I’m here to assist you in addressing the payroll tax concerns you’re experiencing with your employees whose taxes are not being withheld. This is a crucial matter, and it's important to ensure compliance and accuracy in processing them.

First, review your employees' profiles, including the inactive ones, and verify if taxes have been set up accurately. Here's how:

For more information, check out this article: Troubleshoot no income tax withheld from a paycheck.

If everything is set up correctly and the issue persists, I recommend contacting our Payroll Support Team during their support hours. They can provide specialized guidance on managing tax withholdings for both active and inactive employees. Please refer to the steps below:

By maintaining accurate records and promptly fixing any discrepancies, you'll ensure compliance and smooth payroll operations for your business. If you have further questions on handling taxes in QBDT, please comment below. I'm here to aid in improving your efficiency.

my payroll today, didn't take out taxes?

There are possible reasons why your taxes are not being taken out, Pat.

In QuickBooks Desktop (QBDT), the paycheck shows $0.00 or no income tax being withheld because of the following reasons:

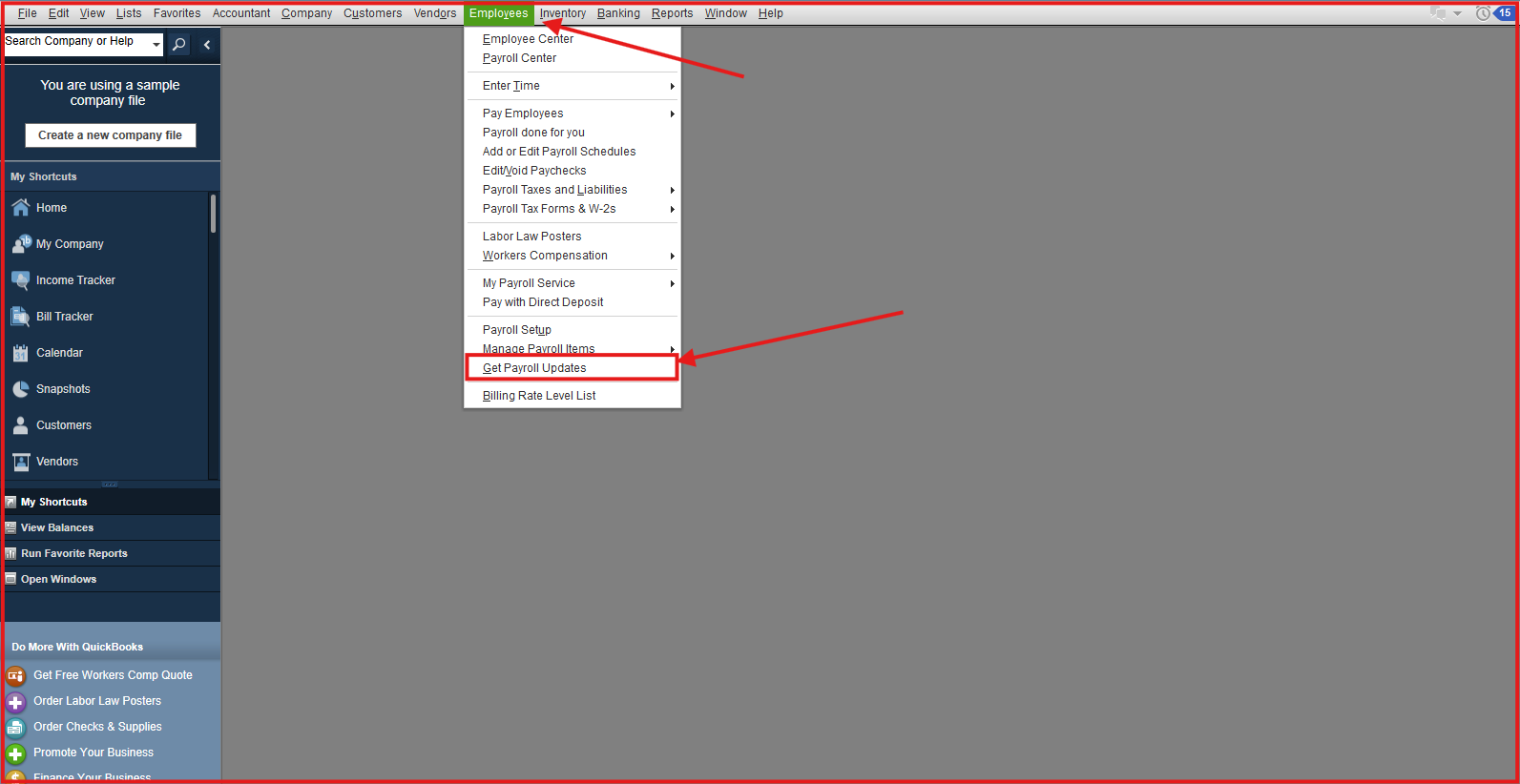

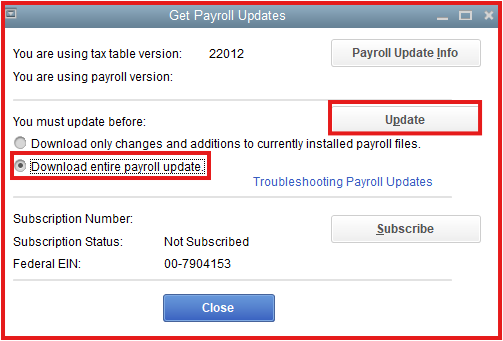

Here's how to Update:

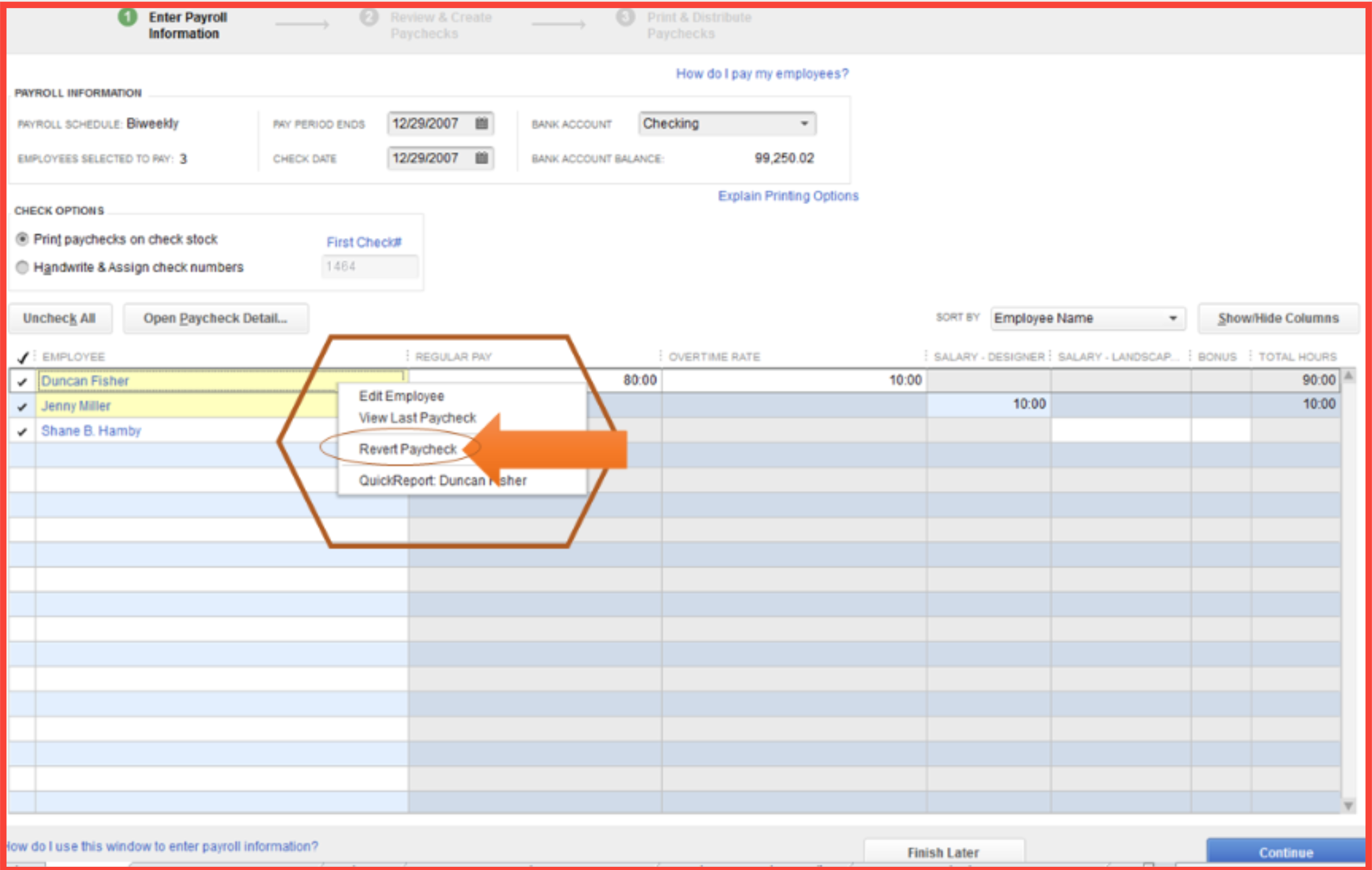

Once you have completed the payroll update, please revert your employee's paycheck. This refreshes your payroll information and calculates the taxes on the transaction.

Here's how:

Please see screenshots for reference:

I've included this article for more information about payroll calculations in QBDT: Understand how your payroll taxes are calculated.

Leave your comment below, and we are always here to assist you.

I didn’t get a code

I need help with payroll as I have to do it today and it’s not taking any taxes out and I have updated payroll and restart the computer. Still not working. Now what

I appreciate your efforts in resolving the issue with your payroll not taking out taxes, Nancy.

Please note that there are several possible reasons why your taxes are not being calculated. For instance, your employee’s wage didn’t meet the minimum threshold, or the total annual salary exceeds the limit.

Since you already updated your payroll tax table, I recommend reverting your employee's paycheck. This updates your payroll details and calculates taxes for the transaction. Please refer to my colleague @NerbynMaeI's answer above for the steps. Once done, please run your payroll again.

If you've completed the steps and verified your payroll setup is correct, I suggest reaching out to our Live Support Team. You can check your spam or junk folders and look for the code.

Alternatively, you can connect with them using this link: Contact QuickBooks Support. Once you're in, select QuickBooks Desktop Payroll from the drop-down, then follow the on-screen instructions.

If you need any further assistance in managing your payroll transactions, don't hesitate to leave a comment below.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here