Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowThe OSHA 300A log instructions from the Dept of Labor require that we add the total number of employees in EACH pay period. We pay weekly so that is 52 pay periods. Is there a way to do this easily, i.e. not have to do it 52 times?

Hi there, CCNCem.

I'd like to help with your payroll question. Do you mean you want to get a report for the number employees that are paid in every pay period? For now, there's no specific report that would give us the total number of employees in a certain pay period. Although, you can run the Payroll Summary report and manually count how many were paid in for every period.

If you want to get the total hours worked that are already used in the paychecks, use this article as a guide: Create A total Hours Worked By Employee Report.

Aside from that, you can also run the Time by Name report if you used the Time Sheet feature to record the hours worked. Here's how:

Add a reply below if you have follow-up questions. You can also reach out to us again if you need anything else.

Every company in the entire country has to fill out this log for OSHA annually and we are all suppose to run a payroll report for every single period and manually count the number of employees? That's awesome.

Welcome back, @CCNCem.

I'm here to ensure you can pull a report that shows the total employees' worked hours. This way, you can complete the OSHA 300A. Running and customizing the Payroll Item Detail report would help you get the information need. Here's how:

You might want to read this article to learn how to customize payroll and employee reports: Customize payroll and employee reports.

I'm still open to your replies. If you need clarification about this, or there's anything else I can do for you. I'll be standing by for your response.

I already know how to run a report for the hours. What I asked for is a way to count the number of employees for each pay period. Both of these items are required for the OSHA log. I'm still convinced that these "QuickBooks Team" responders are bots that just look for key words and spit out scripts accordingly. They rarely seem to answer the actual questions asked.

I need the same data as well. Please Quickbooks, this report would save hundreds of man-hours.

I’ve got you covered, @Marlin_Fisher.

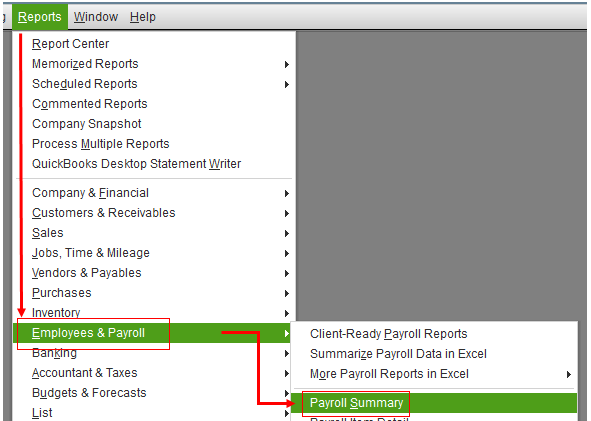

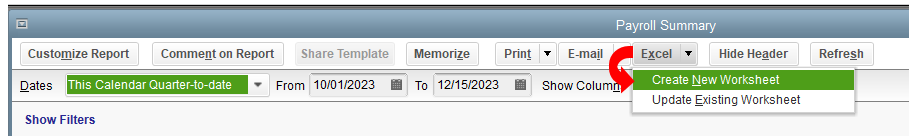

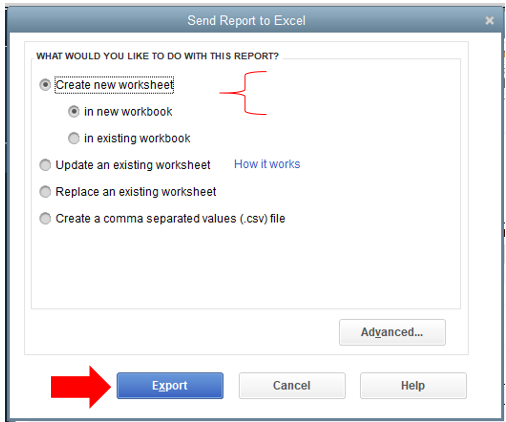

As my peer mentioned above, there's no specific report that would give us the total number of employees in a certain pay period. Consider running a Payroll Summary report and export it to Excel.

Once exported, you can eliminate the unnecessary details on the worksheet. That way, you can easily count them manually. Let me show you how:

I’ve also attached an article that has information about Excel-based payroll reports. This provides instructions to generate and summarize data in Excel.

Let me know if you still have other reports and payroll concerns. The Community is always here to help in any way we can. Always take care.

Yes, I have used that report many times and I use it to get the hours that are entered on the Osha 300.

However, the Osha 300 hundred also askes for an additional piece of data that I am requesting a report for on the behalf of many users.

One of the first steps in the Osha 300 packet has this paragraph: "Add up and then enter the number of employees your establishment paid IN EACH PAY PERIOD during the year. Be sure to include all employees: full-time, part-time, temporary, seasonal, salaried, and hourly." "Note: You CANNOT divide the total number of W2s by the number of pay periods to calculate average employment. You must add up the number of employees paid IN EACH PAY PERIOD and then divide by the number of pay periods."

I would love to see a report in QuickBooks that can produce this info without needing to dig for it.

I hope that makes sense.

I found a work around that I was able to use to count my average employees:

Not an ideal way to do this, but beats looking up each pay period and counting the number of employees paid. It would be nice if Quickbooks incorporated reports for the OSHA 300 in the future.

Hello there, @Marlin_Fisher.

I hear you and realize the importance of being able to have a report that will produce the OSHA 300A information directly in QuickBooks Desktop. For now, to get your work done, you may follow the recommendations shared by my peers above.

I'd like to let you know that our developers are always working to be compliant with the tax agencies and to improve the product to cope with your business needs. I encourage you to send this preference to our developers.

To do that:

You can also visit our Firm of the Future site to be updated with our product road-maps.

Reach out to me whatever questions you may have about QuickBooks. I’m more than happy to assist further. Have a good one.

Because I didn't have time to breakdown every payperiod's data to arrive at this, I just took the total hours worked for the year & divided it by 2000 to come up with the avg # of employees (based on a full time employee working 2000 hours) for the year.

This was helpful.

Thank you!

Thank you - this is the best solution I've found so far! Hopefully QB will get their act together & produce this info for their customers.

Hi. My company pays weekly. Not sure how well this will work for everyone, but I went under file, then print forms, paystubs and chose the time period that is needed, made sure it was for all employees. It will tell you how many paystubs were printed during that time then I divided it by how many weeks to get the average. Hope this helps!

I just ran into this for 2021. I did just what was suggested here. The only thing different is that I know each paycheck has either 'regular' hours or salary so I filter for those two payroll items. Export to Excel and count the rows divided by 52. That should keep OSHA satisfied?!

I opened my check register, all the employees paychecks are usurally together , I just counted each employee for each pay cycle for 52 weeks at them up and divide by 52 , took me 15 min

This is the right answer! Brilliant! Thanks a lot!

Brilliant! This is the perfect option to do it right. Thanks!!

This is what I do.

1. Pick Time by Name Report.

2. Click Customize Report, Click Display tab.

3. Under columns choose Display Columns by week.

4. Under that Display time grouped by "Time by Name Only"

5. Convert to Excel spreadsheet.

6. This will display all of your hourly employees in a column with followed by their time by week.

7. Every other column is black. Starting in column D line 3 put the following formula

IF(C3>1,C3/C3)

8. Copy that report down to the last employee. Then copy and paste that formula to every other column.

9. If an employee had time that week there will be a "1" in that column. If they did not have any time that

week the word "FALSE" will be displayed.

10. Total the bottom of each column. It will only total the 1's. Ignore the word FALSE.

11. Add any salaried employees to that total.

12. Divide by the number of weeks for average number of employees/week.

It sounds like a lot but it really isn't. Save a copy so you can cut and paste the formulas for the next year.

| |||||||||||||||

| |||||||||||||||

Old thread, but in case anybody else is reading this looking for a simple solution, I found this on a different thread. This is a hack to get the total number of pay stubs in a given year.

Example: In 2023 we have 1446 pay stubs and we pay weekly -> 1446/52 = 27.8 -> round up to 28 for OSHA form 300A average number of employees.

It is beyond embarrassing that QB does not have a way to produce this very simple report. The data being asked for is already shown on the payroll processing page, but only into the limited past and with no way to export it. The fact that a weird work-around hack is necessary to get this simple bit of information says a lot about this software product.

jeffrecinc

Why didn't I think of that! Lololololo!! For our situation it won't work every year. We are a union contractor and often have projects running concurrently in our state and the neighboring state. An employee could and often does work in 2 states in the same week. That means - 4 different union trades, several employees and monthly fringe/deduction remittances to the Union locals where the work is performed. For the purpose of union reporting, union auditing it's just easier to issue 2 separate paychecks. I tried your method compared to our 2023 report and there was a significant difference -because of the number of stubs. I also don't understand why Quickbooks hasn't developed a report to solve this issue! After all, it is an OSHA requirement in all of the United States. I will definitely use your method in the one state years.

Leanne

This is how I figure it out. We pay weekly. I have two ways.

FIRST:

SECOND:

Quickbooks should make this easier to figure out since it is a requirement for most businesses but I don't think they are in the business of caring what would make life easier. LOL

I hope this helps!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here