Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

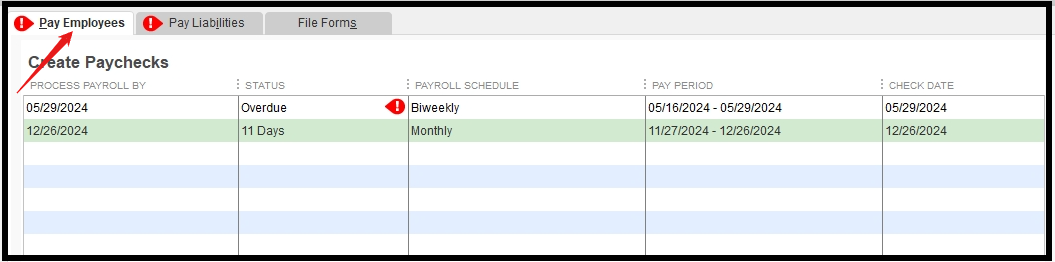

Buy nowIn Create Payroll screen...there are several payrolls with a rec circle and exclamation point in it saying it is overdue and needs to be run. I have already run these payrolls. Why is this happening...it happens also in the liabilities screen. In the past it has taken care of itsself but I'd like to know WHY this happens. All my payrolls are run thru the payroll screen as are liabilities....Is this a quirk in QB?

It happens when you create a payroll and then at the end of the payroll you don't check the box to advance the payroll. If you pay all of the employees, then the box is checked automatically. If you pay some of them, then it is not as the assumption is you may be returning to pay the other employees. In this case you must assert you are done by checking the box.

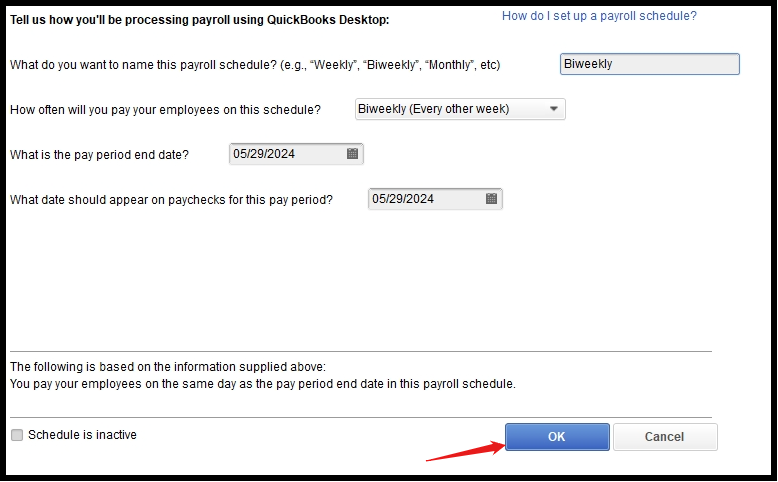

Change the next payroll date for a payroll schedule by editing it.

"I have already run these payrolls. Why is this happening"

It also happens if you use "Unscheduled Payroll." The Function is Payroll Schedules, as a helper tool. For instance, someone set up that Salary People are paid Monthly and Hourly People are paid weekly, and the program now tries to help you stay on track. Then, someone is Bypassing the use of the function, so the program isn't Incrementing the dates (pay period and pay date) for you per how you told it to help you manage schedules.

"...it happens also in the liabilities screen."

That's a Different Warning. This warning is telling you about Scheduled liabilities. This one is telling you that someone told it what taxes and other withholdings and payments related to Paychecks, need to be paid By a specific date and on a specific Cycle, such as FICA might be due mid-month for the prior month's paychecks. It means you need to be using Pay Liabilities, to show you Paid what was owed for the Period owed and by the Due Date for each Liability (payroll item) that is Scheduled. It means you should not be using Bills or Write Check, for these activities that are part of Payroll.

Thank you for the explanation - this applies to me as well since I did an unscheduled payroll for someone who submitted hours late and also did not pay everyone since one hourly employee had not hours. So although everyone who was supposed to get paid, got paid this week, my Payroll Center says payroll is overdue. Is your suggested solution to just change the dates for the next payroll run in two weeks? It's possible to just change the dates? Thank you, S

Hi there, @Stephanie6.

You can edit the date on your next payroll run. Let me provide more details about this.

Changing the date for your next payroll run allows you to manage your pay schedule again in QuickBooks.

You'll just need to remember to enter the correct day before hitting submit. Also, this allows you to have the correct taxes every time you run your payroll.

You may also read this article for more information: Create Paychecks.

Please let me know if you have any other concerns. I'll be around to help.

I had this problem appear last payroll even though the payroll before was complete. I manually changed the dates for the last payroll, but Quickbooks is still telling me that payroll is overdue. How do I clear this error so I can go back to starting my scheduled payroll instead of manually changing dates? Thanks

You need to update your employee's payroll schedule to reflect the correct pay period, shariimpel. Just revise all upcoming payroll schedules from the Edit Payroll Schedule window.

I'll walk you through the process:

To view the new payroll periods based on the updated pay schedule, navigate to the Transactions tab in the Employee Center and select Paychecks. QuickBooks will automatically adjust your employees' compensation and taxes to reflect the new payroll period.

Additionally, you can remove or delete a scheduled payroll liability in QuickBooks Desktop Payroll. However, you cannot remove tax liabilities from the payroll schedule once they have been set up in QuickBooks Desktop.

You can always get back to us if you need more help with payroll. Just click the Reply button below so we can assist you promptly.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here