I've got you covered. Let me guide you on how to update the Deposit Schedule of Arizona Unemployment taxes, jnherrera.

We can change your state payroll tax payment schedule in QuickBooks Online (QBO). This way, it will notify you and your client of the correct due date of the payroll tax. You can follow the steps below to get these done.

- Go to the Gear icon at the top.

- Choose Payroll settings under the Your Company section.

- Select your state name under the Taxes section.

- Click the Change or add new schedule link.

- Press OK.

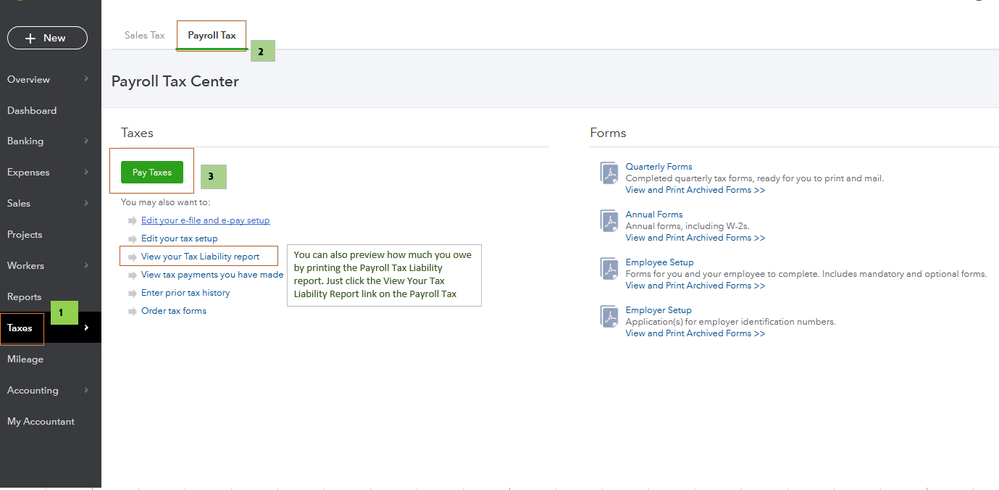

To have a preview of how much you owe for other payroll taxes, we can access the Payroll Tax Liability report. Just click the View Your Tax Liability Report link on the Payroll Tax Center page.

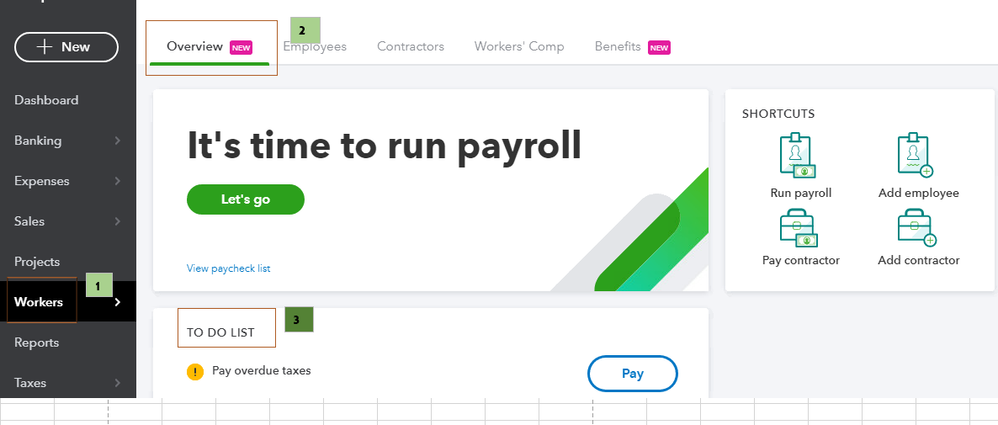

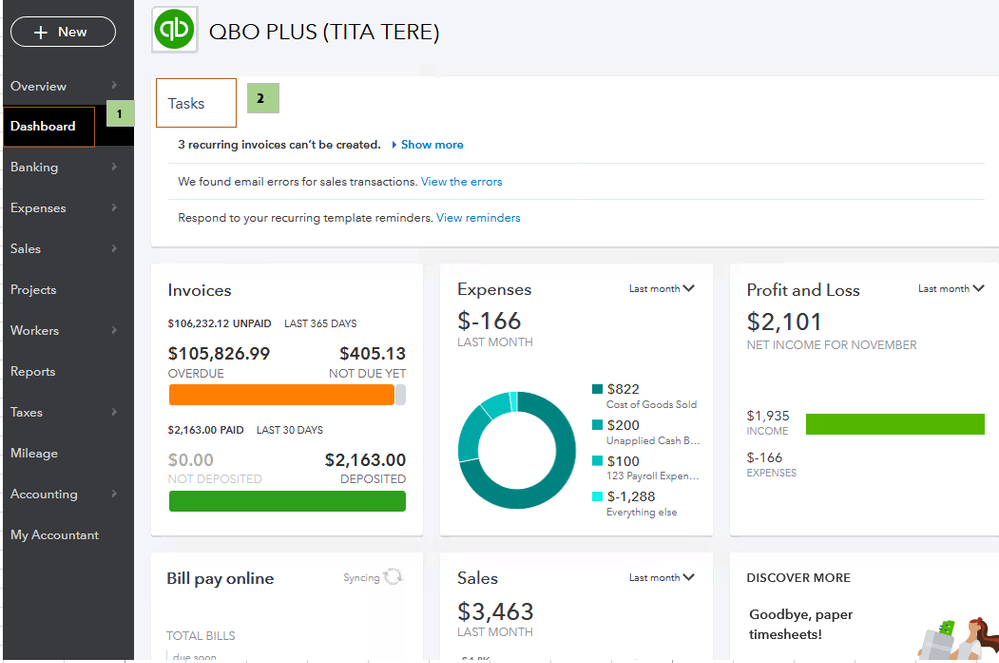

Another way to access the overdue taxes is by going to the To Do List section. Then, click the Workers tab on the left menu and choose Overview. Under the TO DO List section, you can see all the payroll tax duelist with the Pay overdue taxes message. You can also go to the Dashboard menu and access the Tasks section.

You can use these resources for additional information. The other article gives payroll report lists that you can generate in the program:

We're always available to help you. You're welcome to post again if you need anything else. Have a great day.