Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowGreetings, steven. I have some ideas to share regarding the information showing on your Profit and Loss (P&L) report in QuickBooks Online.

Before anything else, I want to ask where did you see the Net Pay amounts? This way, we can look into it further and guide you through what to do.

The Payroll Expenses area of your P&L report should ideally only reflect the Gross Wage and Employer Paid Taxes. If you see the net figure in that particular field,I suggest clicking on the amount hyperlink to review the transactions associated with it.

Note: Below is only an example report. Nonetheless, you can use it as a reference in drilling down the net amount.

Finally, I recommend reaching out to your accountant in case there are any journal entries or other transactions that may need to be deleted or modified in order to rectify this issue. This will help ensure that your books are well-organized and maintained in proper order.

Once you're good with this, you can also explore this useful guide about fixing discrepancies on your account balances: Reconcile an account in QuickBooks Online.

Keep me posted if there's anything else I can help you with your payroll transactions or reports. I'll be right here to assist you. Take care!

Hello! I'm seeing the net amounts in my Wages account, under Payroll Expenses, just as the screenshot shows. We have been using QB since June, and that's how it has been every payroll we've run. There are listing for the gross amounts, showing the employee's name and DD designation, and then the net amount paid is also listed (the bank feed for our linked checking account automatically feeds them into our QB).

So it looks like QB creates the payables for the gross amounts, and then QB imports the net amounts from the bank feed. And both remain in our Payroll Expenses > Wages account, effectively overstating payroll expenses by a huge amount.

Does that explanation make sense? Please let me know if there is a payroll setting that we can change? Or if there's a workaround for this scenario? Thank you!

Thanks for your follow-up on this, Steven. I recognize the issue you're facing having an overstatement of payroll expenses in your wages account when running a P&L report in QuickBooks Online (QBO). Allow me to share some insights about the possible reasons for this and route you to the best support you need.

First off, please know that if the transaction that was downloaded from your bank already exists in QuickBooks, then instead of categorizing it, you may have the option to match, add, or view multiple matches to avoid duplicates.

Moreover, I suggest you double-check the setup of your employees if these are accurate and alter things that are needed. However, if there are things that really need to be corrected but you're unable to do so like deleting and recreating some paychecks, or if it already involves multiple paychecks, then it's best to reach out directly to our Payroll Support team. They have all the necessary tools to pull up your account securely and make corrections if needed.

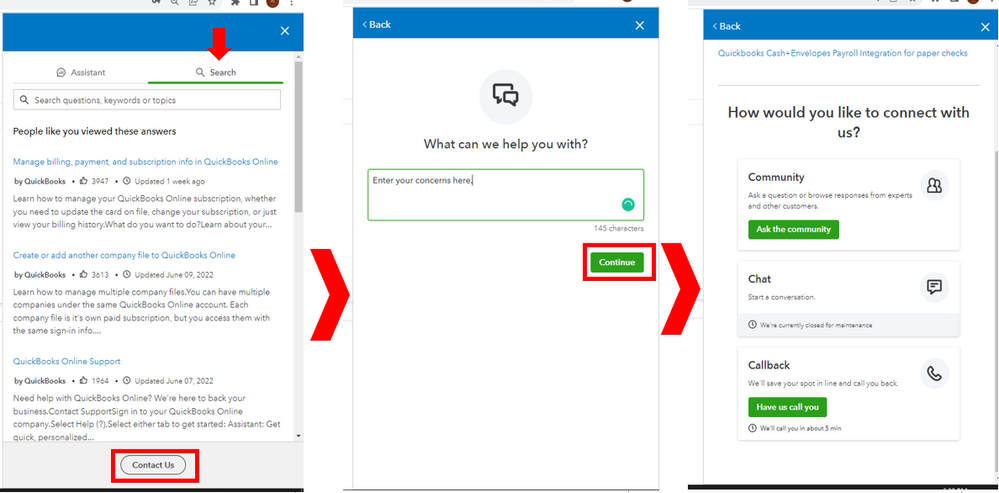

Here's how you can reach out to them:

Please consider checking our available hours to make sure we address your concern timely.

Don't hesitate to leave a reply if you have other QuickBooks concerns. The Community team is here to assist.

Another part of this problem is that the gross pay transactions remain uncleared and unreconciled on my bank register. This list will continue to grow as time goes by. Not only that, but it overstates the amount spent from my bank account, so that now my checking account shows a negative $11,000+ balance on my banking screen as the balance in QB when the bank balance is much much higher than that.

I cannot simply void the paychecks to correct the balance and to be able to reconcile my account because then the payroll tax amounts would then be made incorrect.

Is there really no fix for this?

Is there no fix for this still? The gross paycheck amounts are still on my P&L as well as the bank register, preventing me from properly reconciling the accounts without voiding the paychecks. But if I void them, then my payroll tax amounts will be made incorrect. Meanwhile, the bank balance on my banking screen is tens of thousands of dollars off. Is there really no way to correct this?

Our company just started using QB a few months ago. Will our books always be off? Will we always have to compensate for wrong numbers, or can Intuit fix this for us?

I hadn't mean to post twice. I didn't think that first one saved.

Hi there, @steven-maus.

Thank you for choosing QuickBooks as your payroll tool. I understand the importance of recording paychecks as well as tracking them accurately. Allow me to share additional information to help correct the gross paycheck and net amounts on the Profit and loss report.

First, let's review your Accounting Preferences from the Payroll Settings. From there, you can choose the correct account to allocate the wages. This will help us verify the possibility of having the bank account associated resulting in an overstatement. I'll show you how:

To learn more about the different payroll account types you can use to track your payroll transactions, refer to this guide: Change your accounting preferences in QuickBooks Online Payroll.

I recognize the need for accurate accounting as the program is accounting software. Please know that books should not be off. Therefore, you don't always have to compensate for the wrong numbers. If you'd like to seek help from our representatives, contact our Support Team. They can pull up your account in a secure environment and investigate this matter further to provide appropriate solutions. To proceed, follow the steps below:

Please note our operating hours so you can contact us timely. For other ways to reach us, refer to this article: Contact Payroll Support.

Do you need help paying and filing your taxes after correcting the duplicate payroll and net amounts? Read through this article: Pay and file payroll taxes and forms in Online Payroll.

I'm just a click away if you need further assistance reconciling accounts or handling payroll transactions. Let me know in the comment section below if anything else comes up. It's my pleasure to help you.

Yep, I've done all of that. That had been a problem, but it has since been corrected. Now, the net and tax amounts are landing where they should on the P&L. However, now that that is happening, the gross amounts are a third entry that is still happening on the P&L.

Is there any update on this issue? Also, now neither of my October payrolls have posted to the wages account on my P&L. The paychecks are recorded in the bank register and have been paid out via direct deposit. But I cannot for the life of me find them on the P&L. I can't go into the transactions themselves because it always re-routes me to the paycheck list rather than to the actual transactions. How can I view where certain direct deposit paychecks are categorized on the P&L?

I want to ensure this is taken care of, @steven.

Since the troubleshooting steps provided didn’t work for you, I recommend contacting our Technical Support Team. They will be able to investigate the leading cause of the issue and determine the correct solution in a secure setting.

Additionally, you can visit this article about running and customizing reports in QuickBooks Online (QBO): Run payroll reports.

If you have any other questions about payroll paychecks in QuickBooks, feel free to ask. I'm here to help. Take care.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here