Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

https://community.intuit.com/questions/814782-wages-paid-cogs-or-expenses wages paid COGS or expenses - QuickBooks Learn & Support

Solved! Go to Solution.

Hi there, PaulChoate,

I'm glad you reached out to me about how you can separate the liability/expense portion of the paychecks for the owner.

Thanks for adding specific details concerning what you're trying to accomplish with payroll. At the moment, we're unable to separate the owner's salary.

QuickBooks Desktop Payroll is designed to assign only one liability/expense account per payroll item/tax. You may want to consult an accountant how to handle this type of situtation.

If you have additional questions about payroll, let me know and I'll be here to help however I can.

Hi there, PaulChoate,

I'm glad you reached out to me about how you can separate the liability/expense portion of the paychecks for the owner.

Thanks for adding specific details concerning what you're trying to accomplish with payroll. At the moment, we're unable to separate the owner's salary.

QuickBooks Desktop Payroll is designed to assign only one liability/expense account per payroll item/tax. You may want to consult an accountant how to handle this type of situtation.

If you have additional questions about payroll, let me know and I'll be here to help however I can.

Can this be done now on QB Online? I would also like to differentiate owner's salary as a separate expense category.

I appreciate you coming in asking for an update, Ccb123.

The ability to differentiate the owner's salary as a separate expense category is still unavailable in QuickBooks Desktop. You'll want to consult an accountant for expert ways on how to handle this.

You can also find an account by clicking on this link: Find an accountant.

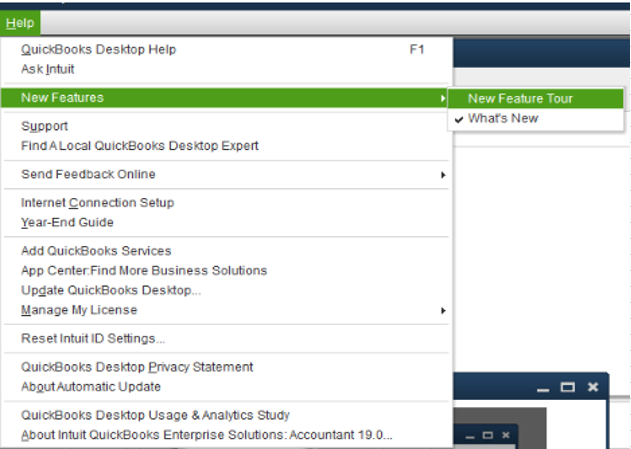

While we continue making improvements with the software, I want you to be updated with the newly added features in the product by following the steps below:

Here's how:

Another way to be updated to the latest future release in QuickBooks Desktop is by visiting this website: QuickBooks Updates: New QuickBooks Accounting Software Updates.

Let me know if you have any follow-ups or other questions. I'm always here to help. Wishing you a good one.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here

I have a question about separating the employer liability portion of paychecks (such as owner matched taxes, SS, unemployment, etc.) for checks written to the owner who is considered an employee of the S-corporation?  For example I (the owner) can allocate my weekly salary to operate/run the company to an expense sub-account I call, "Owner's Salary" under the parent expense account called,  "Payroll Expenses Non-COGS" but I am unable to create a 2nd tax-based PAYROLL ITEM for Owner's payroll expenses (such as owner matched taxes, SS, unemployment, etc.) that I can then allocate to another subaccount in my "Payroll Expenses Non-COGS" that I'd call "Owner's Match Non-COGS". These payroll expenses can only be allocated to one Tax-based payroll item which I have linked to a sub-account called "Owner's Match" under MY COGS parent account.  There is no way to separate owner's salary payroll expenses from employee labor payroll expenses because I can't duplicate payroll items that can be allocated to different accounts...QuickBooks doesn't allow me to create more than one Tax based account that will allow me to separate Non-COGS expenses from COGS expenses. Does this make sense?

[post edited by moderator for clarity]