Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowI use my child to help me in my home- based business. What are the steps that I need to do to set her up?

I'll help you set up the employee profile in QuickBooks, SMenterprises.

According to the IRS, "Payments for the services of a child under age 18 who works for his or her parent in a trade or business are not subject to social security and Medicare taxes if the trade or business is a sole proprietorship or a partnership in which each partner is a parent of the child." More details about this are discussed here: Family Help.

If you belong in this category, follow these steps on how to set it up:

Let me also share these write ups for more details:

However, we still recommend reaching out to your accountant for additional advice about this. Some states have additional requirements such as the need for minor work permits and proof of age certifications.

You can also add a reply or visit us again if you need more help with QuickBooks.

In the Earnings section of the Payroll Info tab, what does Item Name mean? I pay my child according to the jobs that are completed. How do I record that?

Thanks for the clarification, @SMenterprises.

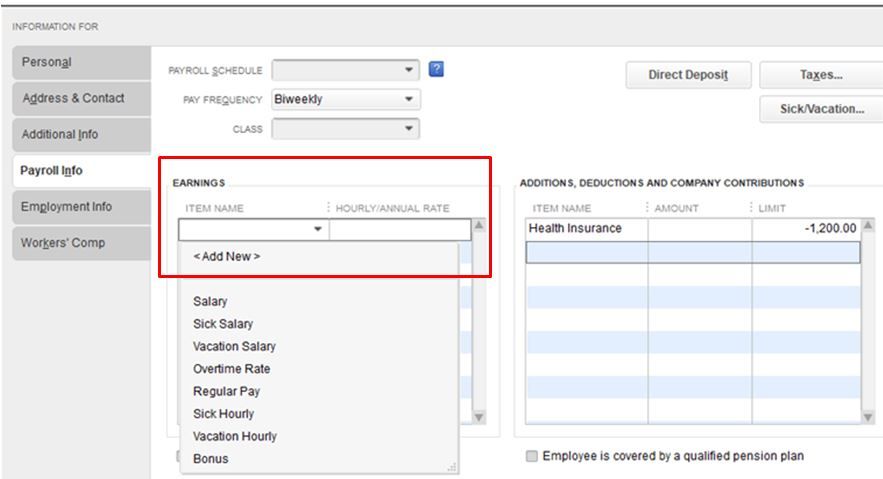

Let me share some information about the Payroll Info tab. This is where you enter all the payroll information associated with the employee such as earning, taxes, sick, and vacation time.

The Item Name under the Earnings section is where you can add or select payroll items. QuickBooks uses these items to track individual amounts on your employee paycheck. These payroll items are for compensation, taxes, other addition and deductions, and company-paid expenses.

To learn more about this, you can check out these articles for more details:

Also, you’ll want to select the Commission as the compensation type under Item Name from the Earnings section. The commission is used to pay employees based on their performance. If you haven’t created a commission type of payroll item, you can follow these steps to do so:

I’d also recommend getting in touch with your accountant for guidance on which account to use and the correct rate to enter. They can also advise you about the additional requirement for minor workers' permits.

Once all is set, you can now create a paycheck for your employee. You can refer to this article for the complete details about this process: How do I create a paycheck for an employee?

Tag me in if you have follow-up questions about setting up your employee’s payroll information. I’m more than happy to help you out again.

Taxes are still calculated on form 941. Why?

Glad to see you here, LRGC

As mentioned above, the payments for the services of a child under age 18 who works for their parent's business are not subject to social security and Medicare taxes only. Normally, if they have federal withholding, it will show in the 941 tax form.

If your employee qualifies for this rule, you'll want to make sure that the Social Security and Medicare options are unchecked in their profile. This way, QuickBooks won't calculate those taxes. Here's how:

I'd also recommend reaching out to the IRS or consult an accounting professional to know the legal guidelines of hiring under-18 workers. In addition, here's an article that will help you in managing your employees in QuickBooks Desktop: Update or delete employee info.

Do you have any other questions in mind? Feel free to leave them below and I"ll get back to you as soon as I can.

I am trying to set-up two 16 year olds (that are not family) in Quickbooks Online Payroll and it is giving me an error in the personal information section when I enter their birthdate. It won't let me continue to the next step even though I've looked into the rules of hiring minors in VA and I am complying with the regulations. Any suggestions?

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here