Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

How do I skip 1 month's payroll for single employee s corp? I need to skip it for 1 month. Do I just put 0 hours?

Solved! Go to Solution.

Thanks for getting back, @fds.

Yes, you're correct. Just change the pay period ends and the check date with the information you've mentioned above.

For more information about changing the paycheck date, check out the following article. It contains detailed steps and screenshots for visual reference (scroll down to Create paychecks in QuickBooks Desktop Payroll):

Reach out to me anytime if you have any other concerns. I’ll be right here ready to help you. Enjoy the rest of the day.

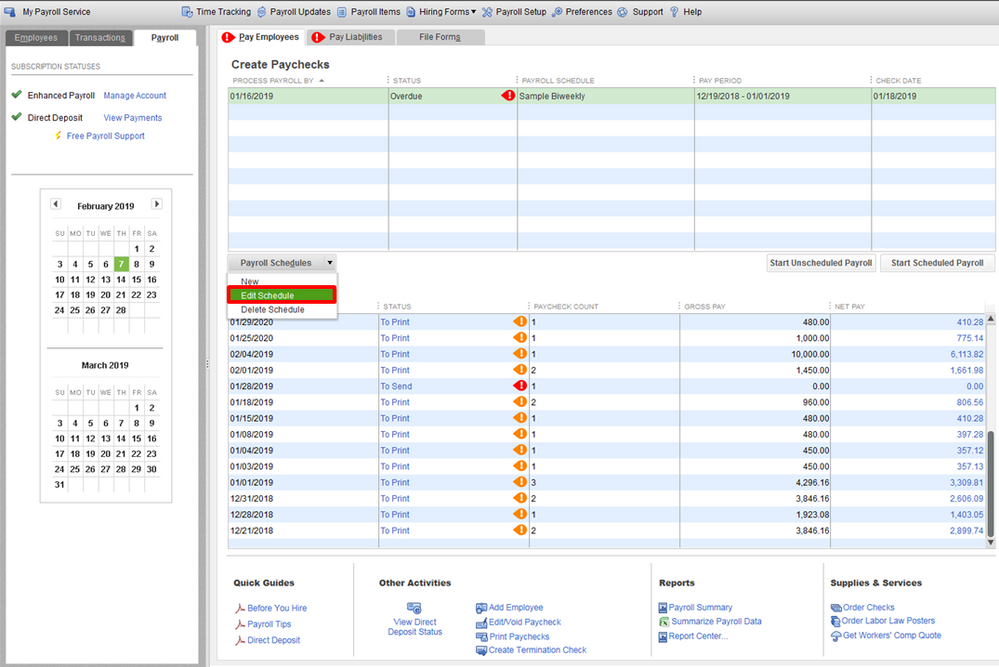

If you use a payroll schedule, edit it and change the next pay dates to the correct dates.

If you don't, there really isn't anything to do. When you next create a payroll, watch the pay period and pay dates carefully as they may want to default to the payroll you skipped.

ok so after doing this it will just skip 1 month of payroll but it should not cause any errors on tax forms or anything like that? i just put the next pay date to the following month

Yes, you are free to skip a payroll if you don't have anyone to pay...

Thanks for the info. I couldn't find the first option so I think it would be easier once I issue payroll for November on December 1, 2019, I just choose November dates for payroll. The pay employee tab keeps having exclamation mark saying Status Overdue under create paychecks so I can just ignore that for now?

Let me join the conversation, @fds.

I agree with BRC. Since you're not paying anyone with that payroll schedule, you can ignore the overdue status.

When creating the next paycheck, please don't forget to edit the pay dates. I'm adding this article for reference: Create paychecks.

Leave a reply in the comment section if you need anything else. I'm more than happy to help. Take care!

So in order to change the pay date when I enter the payroll information all I have to do is change the pay period ends to 11/30/2019 and the check date to 12/01/2019 and it should be fine right?

Thanks for getting back, @fds.

Yes, you're correct. Just change the pay period ends and the check date with the information you've mentioned above.

For more information about changing the paycheck date, check out the following article. It contains detailed steps and screenshots for visual reference (scroll down to Create paychecks in QuickBooks Desktop Payroll):

Reach out to me anytime if you have any other concerns. I’ll be right here ready to help you. Enjoy the rest of the day.

ok i Just did what you did. I think I might have created another paystub a few days ago how do I delete it. I did it halfway and didn't realize it but I never submitted it to intuit to process direct deposit except for this one transaction today.

When I click on the exclamation mark it says I have a paycheck dated 12/2/2019 which is on or after the new Check Date of 11/29/2019. More nfo you might have unintentionally created an extra payheck for this employee.

I checked the paystub stub for the payroll issued today it is correct pay period and pay date

It's great to hear from you again, @fds,

If you accidentally run payroll and want to delete it from your books, open the employee transaction list. Here's how:

Overdue payroll notices in the Payroll Center also comes up when the schedule is incorrect or past dated. Follow the steps below to edit your pay run:

If you have any questions or need help with other QuickBooks payroll, let me know in the comment below. I'll be happy to share and provide guidance whenever you need it. Have a productive week!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here