Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I'm here to help ensure your vendor will show on the 1099 report in QuickBooks Online, ewsystems.

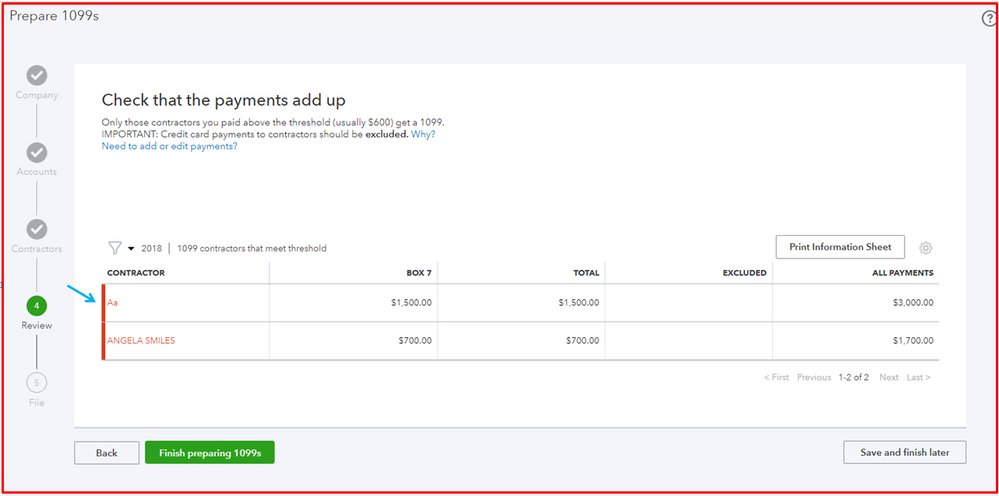

There are a few possible reasons why vendors are not showing up on the 1099 report even if they meet the threshold. These are:

To get this sorted out, ensure you're paying vendors from the right expense account and map them to report your 1099 transactions. Here's how:

For other troubleshooting steps in fixing 1099 issues, you can go through this article: Fix missing contractors or wrong amounts on 1099s.

Additionally, to know more about this process, here's an article for your reference: Create and file 1099s using QuickBooks Online. On the same link, you'll find the steps on how to E-file your 1099s as well as a guide on how to check the filing status.

If you need to file both the 1099-NEC and the 1099-MISC, you'll need to create a new expense account and transfer all the expenses for that Contractor from the old expense account to the new one for the purpose of mapping in 1099 NEC. This write-up will provide you more details about this: How to modify your chart of accounts for your 1099-MISC and 1099-NEC filing.

Please let me know how it goes or if you ran into a different situation by leaving a reply below. I need to make sure you're all set. I'm here to keep helping. Have a great rest of your day!

In addition to all of the above.....I found that some of mine didn't total because all of the transactions didn't have a VENDOR selected. Once I edited each transaction to make sure the VENDOR name was there, the totals were correct.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here