Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Currently we have an employee that elected to defer the social security in 2020. Based on the IRS guidance we must only include in Box 4 of their W-2 the amount of Social security they paid in 2020 we cannot include the deferral. QuickBooks enhanced payroll will not allow us to print or efile these W-2s because it is showing an error. How can we fix this?

You've come to the right place, @swanksalch.

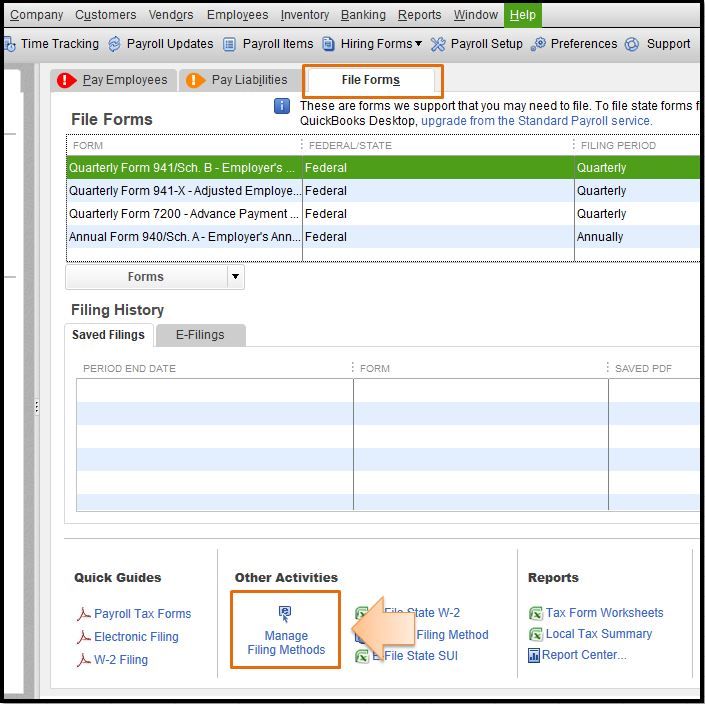

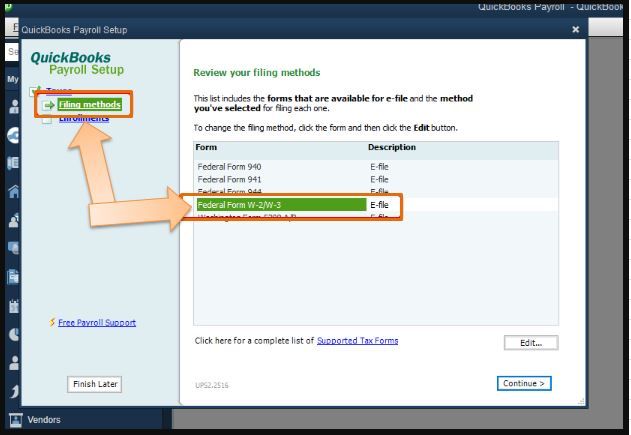

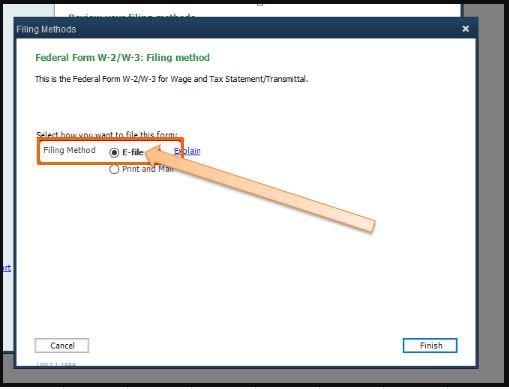

Let's ensure your filling method is set to e-file. To do so, refer to these easy steps:

Once done, print or e-file the W2 again.

Let's also make sure that you have the newest payroll tax table in QuickBooks Desktop Payroll so you have the most current and accurate rates and calculations for supported state and federal tax tables, payroll tax forms, and e-file and payment options.

You can always seek self-help articles on our QuickBooks help articles page, this is to help QuickBooks users like you to get your task done in no time.

I'm just one post away if you need a hand with submitting your W2s. I'm always here to provide answers and resolutions to achieve your goal. Have a good one.

I've made sure that I am setup to efile w2's but I am still receiving the error that the box medicare withholding is smaller than calculated from box 5 wages

Thanks for coming back, @kkeen4146.

I'll share some fundamental troubleshooting steps. So you're able to file the W-2 form in QuickBooks Desktop.

I appreciate you for making sure that the filling method is set to e-file. Since you've received the same error, I'd suggest running a Payroll Summary Report for the entire calendar year. Then double-click on the amount of Medicare Employee to see the total of the wage base column. Make sure that the amount for both is identical.

For more details, check out this article: W2 form boxes explained. Directly go to Box five.

If the issue persists, let's run the verify and rebuild data in your account to isolate the problem.

Here's how:

If there is an added obstacle, go back to the File menu, choose Utilities, and tap Rebuild Data. For more details, check out this article: Verify and Rebuild Data in QuickBooks Desktop.

Once done, re-file and print the form to verify if it's already functioning well.

I've added some articles about the different codes, print forms, and other related matters.

Let me know in the comment section if you have other concerns. I'm always here for you, ready to help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here