Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Feels weird to give Kudos to bad news ... but thanks.

I don't understand why a flat percentage on all gross pay involves this much work !

We use QuickBooks Online for payroll. Our company is less than 50, so no employer tax due. The company has opted to pay the employees' portion. Therefore I selected the "Employee .6333%, Employer 0%" option (1 of 2 options) and had to manually change every employee's tax set-up so it does not deduct this tax from their paychecks. I've only run one 2019 paycheck and they are okay.

My problem is when I run a Payroll Tax Liability report it does not show this tax at all, nor does it appear that it has made the expense and liability entry that I would expect. How can this be corrected?

Hello there, @ekileen.

Thanks for reaching back out to us. Allow me to provide additional insights into this Paid Family and Medical Leave concern.

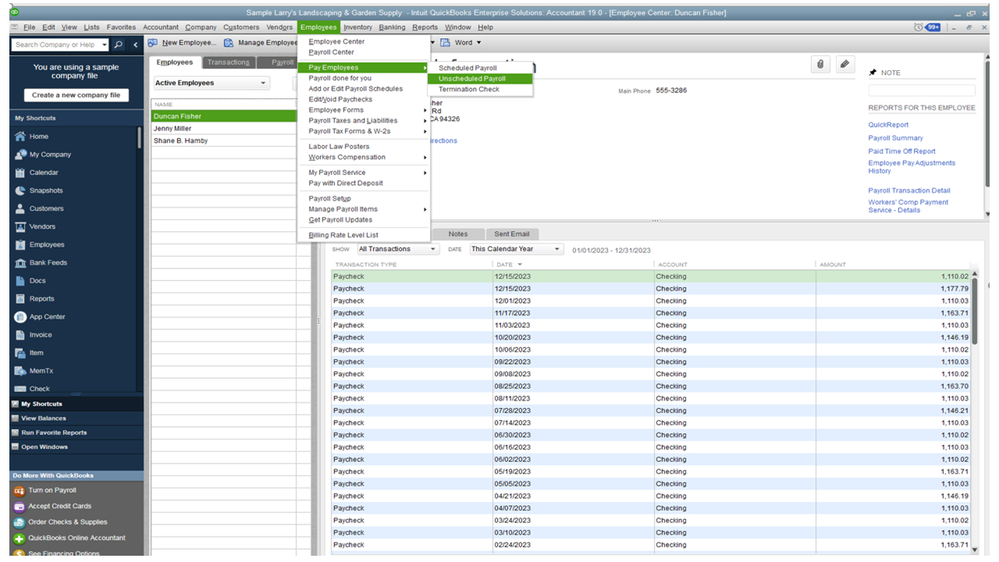

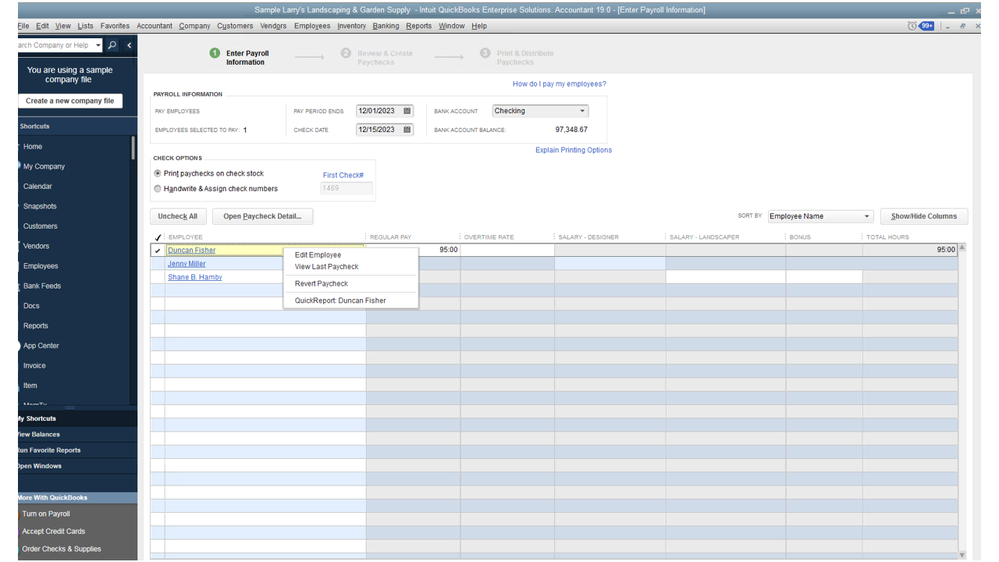

If you've tried performing the steps suggested by some of the Community members and gets the same result, let's try to check if there are paychecks that needs to be reverted. To do that, right-click on the employee's name which is highlighted with a yellow background and select revert paycheck.

To learn more about reverting paycheck in QuickBooks, please check out this article: How to revert pending paychecks.

If the issue persists, I'd suggest giving our Payroll Care Team a call. This way they'll be able to pull up your account and check on your payroll item set up.

To reach them:

Please let me know how it goes. I'll be around to provide additional assistance. Have a good one.

I called WA ESD and was told to pay the employee portion at gross wages x 0.2533%. This calculation will not work in QuickBooks payroll correctly. I have gone back to the WA ESD website and use their calculator to get the correct employee "benefit" to deduct, and override or "adjust" the deductions on each paycheck. Very frustrating.

Hello there, @AcPower,

I see you've already reached out to WA ESD several times and performed different steps to help calculate the WA Paid Family and Medical Leave payroll item.

Currently, the 0.2533% isn't supported in QuickBooks Desktop (QBDT) Payroll. The percentage to enter in the employee portion rate is 63.33% depending on your number of employees. This is the reason why you'll need to manually override the amount on each employee's paycheck. For more details, you can check out this article: Washington Paid Family and Medical Leave (New Tax 2019).

While this option is not yet available, I'd recommend submitting feedback to our Product Development Team. We value your suggestions on how we can make QBDT Payroll even better. By doing so, our engineers can check this out how you'd like to automatically calculate the employee portion rate with the compliance from your state agency.

Here's how:

Your willingness to help us improve our products is highly appreciated.

Please let me know if you need additional assistance, @AcPower. I'm always here to help. Have a great rest of the day!

You might want to review Washington Administrative Code 192-510-065 (2), which states:

"If an employer fails to deduct the maximum allowable employee share of the premium from wages paid for a pay period, the employer is considered to have elected to pay that portion of the employee share under RCW 50A.04.115 (3)(d) for that pay period. The employer cannot deduct this amount from a future paycheck of the employee for a different pay period."

So this "catch-up" provision is probably illegal under Washington state law.

It appears QuickBooks' "automatic catch-up" provision for this payroll item is against Washington state's Administrative Code (because you can only collect for the current pay period).

How do I override this "automatic catch-up" provision?

I was one of those that did not have the 63.33% in and had 0 deducted from my employees checks for January. I have corrected the issue adding the 63.33% of .4 on each of my employees. But.... now it is deducting $18.09 on a gross salary of $2333.33 according to my calculation this should be $5.91 per month so even if it is playing catch up it should only be 11.82. I have contacted QB and my accountant and no one can assist me with this. Can someone help me, I need to complete payroll by tomorrow.

Hi there, @Ben Dardundat and @Skeeter.

Thank you for joining the Community. I'd be happy to help get you to the right support to get this taken care of today.

To verify QuickBooks "automatic catch-up" calculation, I need to check your account. However, I can't do it for your security purposes. I'd suggest reaching out to our Customer Care Team.

They have the tools like screen-sharing that'll review on the payroll set up, and determine what's causing the issue. To reach them, please follow the contact details found in this link: Contact the QuickBooks Desktop Customer Support Team.

That should point you in the right direction today and get you back to business in no time.

Please let me know how the call goes. I'm always here to provide assistance if you have any other questions about WA Paid Family and Medical Leave ,or with QuickBooks. Wishing you well.

Duplicate post, see next post.

Here's how I solved the QB automatic catch-up of the WA Family/Medical Leave tax:

1. Create a payroll item, a non-taxable addition (call it something like "WA Leave Reimbursement"). Select to calculate based on net pay, which you wouldn't think would matter, but I believe it does (as far as the non-taxable part, for some reason).

2. When running payroll, allow QB to automatically catch up the WA Family/Medical Leave tax, but under Other Payroll Items select the reimbursement payroll item which now exists and input either

A) The amount skipped (not paid) on the first paycheck of the year.

B) The difference between the amount QB calculates on this paycheck and what the correct calculation should be.

A and B should not differ by more than a penny or two, so either will work.

Thanks for getting back to us, Ben Dardundat.

I appreciate you for sharing the details on how you resolved the automatic catch-up calculation of the WA Family/Medical Leave tax. This will surely help other users who encounter the same issue.

For future reference, you may want to check this article about the Washington Paid Family and Medical Leave (New Tax 2019).

Please know that you're always welcome to post if you have any other questions about the WA Paid Family and Medical Leave. Wishing you and your business continued success.

Did this actually work for you? I've done it two ways for the deduction: .6333 /.3667 AND 63% and 36% neither are correct for me. I am holding now to get a live person for help but it has not been deducting correctly since the start. QB says it's withholding .4 % but even that amount alone does not compute correctly. Example: Employee gross: 960.32 With the settings at employer paying 100% QB is deducting 68.00+ waaaay off.. Did this work for you?

Thanks for joining on this thread, foxbrothersdrywall.

I appreciate letting us know the steps you've taken to resolve the issue. Allow me to step in for a moment and help get the payroll item to calculate correctly.

Let's perform some basic resolution steps to fix this. To start off, download the software release and tax table update.

These updates will provide the most current and accurate rates and calculations for supported state and federal tax tables, payroll tax forms and e-file and payment options. After completing the process, open the paycheck in question and refresh the information.

To revert:

Next, go back to the employee's profile. Then, update the WA - Paid Fam Med Leave Emp. and WA - Paid Fam Med Leave Co and enter the correct rate.

For detailed steps on how to change the payroll item's rate, follow the steps in the

Washington Paid Family and Medical Leave article and choose Desktop Payroll.

These steps should help you get back to business in no time. Let me know how it goes after performing these steps. I'll be right here to assist further.

Mine is not calculating at all. Has not ever calculated. Updated today to 21912 tax table and using payroll version 06172044. Help please!

Hello @ptfool,

I personally want to address your concern about your payroll tax calculations. But we have a separate team who can privately review your account and get your concern addressed as soon as possible.

Here in the Community, we don't have a direct view of your account for security reasons. Thus said, I'd recommend contacting our Payroll Customer Care Support.

With their available tools, someone can pull up and look into your account in a secure environment. From there, they can explain the components of your payroll tax calculations. And also share the steps needed to fix your payroll tax calculations.

Thus said, here's how you can contact our dedicated team:

Lastly, you can also read this article which can be your guide for any future payroll tasks: QuickBooks Desktop Payroll Year End Checklist.

If there's anything else that I can help you with, please let me know in the comment section down below. I'll be always around ready to help.

I, too, entered 63%, but it actually needs to be 63.33%. When I finally got to report to the state they said I owed more than QB showed, and that was the difference. The .33%.

It's nice to hear from you again, @Jrmm-s.

I've got some information to share regarding updating the WA Paid Family and Medical Leave rate.

Having some differences after changing the WA Paid Family and Medical Leave rate in QuickBooks Desktop has been reported as an ongoing issue. Our engineers are still looking into the root cause of this matter so they can come up with a resolution.

To get updates about the status of this investigation, I'd recommend getting in touch with our Customer Care Team. This way, you'll be added to the list of the affected users and received notifications via email. They will also check on your transactions and help you get this sorted out.

Thank you for your patience while this is being worked on. Feel free to reach back out to me if you have any questions. I'm here to help you out. Take care!

I'm letting everyone know that QB is giving people the WRONG information about the correct tax rates for employees and employers. I encourage QB to make a phone call directly to the Family Leave department of ESD and talk to them about these percentages. For example, if you have 50 or fewer employees and choose to pay the employee's tax and opt out of paying the employer's portion, the correct tax rate is .25332% that needs to be plugged into the COMPANY portion. I hope QB will correct this error very soon.

When the WA PFML payroll item was offered by QB's I could not get it to work properly. All of my clients have less than 50 employees and the rate could not be changed in QB's. I opted to build my own payroll item using the rate .25332% and that calculated the premiums correctly for me. A problem arose when I went to file my quarterly reports. My liability balances were correct but the information was not pulling over in the report that I could use to file on-line with WA ESD. I called QB's Accountant Support and they could not help me. We tried many options but nothing worked. I found a solution. I am continuing to use my payroll item that is calculating properly and I go into the payroll set-up and click the employee list. I then go into the WA employees and check the WA PFML box showing they are subject to that tax but leave the rate boxes blank. Now my payroll item works and the information will now pull in to the report. If only QB's would allow us to change the rate of their payroll items this would have went much smoother.

Just a quick note to those who are still having issues (we just discovered one client where we hadn't updated the rates):

1. As pointed out several times, the employee rate needs to be set at 63.33%. This is completely counter-intuitive, since every other tax rate throughout the entire program is an actual amount rather than a percentage of a pre-set percentage.

2. More important, if you notice this late and make the change be sure to double-check the amount being assessed. By law, if you miss a paycheck withdrawal you are NOT allowed to make it up later! This is something the QB developers apparently didn't catch when they set everything up. It's okay to adjust for overwithholding, but not for underwithholding.

Do you have another link on "How to revert pending paychecks" as it is not available.

I recently within the last month took over a client who had set up the PFML himself and it was done wrong. So the first correct deduction happened in August. I was told it would adjust based on gross wages for the year, however it did not. Am wondering if the revert pending paychecks is the next option?

Hello tshep1,

Welcome to the Community. Allow me to step in and provide assistance concerning the WA Paid Family and Medical Leave deduction in QuickBooks Desktop.

The Revert Paycheck option will only help undo the changes you've made to the employee's paycheck in the program. Check out the detailed steps on this:

For your visual guide, I'm attaching a sample screenshot below:

For your concern about the Paid Family and Medical Leave calculation, I recommend reviewing the payroll item to ensure it's correct. The step by step instructions is available through this article (scroll down to Setup):

Washington Paid Family and Medical Leave (New Tax 2019).

After making sure you have the correct setup, I suggest running the payroll reports available in our program to determine the adjustment amount. Additionally, when creating the next payroll, you can manually enter the exact amount on the deductions to correct calculations moving forward.

In case you need to reach out to one of our Payroll Support Specialists for further assistance, here are the steps:

Please get in touch with me here should you have any additional questions or concerns with your payroll. I'm always here to provide a helping hand.

I'm still having the same issue after entering 63.33% in the employee portion, company Zero%???

Hi @SLPWA,

Let me guide you in the right direction for support in this query about payroll items.

If you have already tried the troubleshooting steps provided in this thread, then I suggest contacting our Technical Support team for assistance. They can investigate the issue further by starting a screen share session, with your permission.

Here's how:

With regards to changing payroll items you use on paychecks, view this article for more details: Edit payroll items used on paychecks.

For other questions or clarifications, post them below. I'll be sure to get back to you.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here