Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

BLACK FRIDAY SALE 70% OFF QuickBooks for 3 months* Ends 11/30

Buy nowSolved! Go to Solution.

I appreciate you for replicating your payroll scenario in your QuickBooks Online (QBO) account, @sharon108. I'm here to guide you as to how you can create one-time bonus paper checks without losing your employees' direct deposit information.

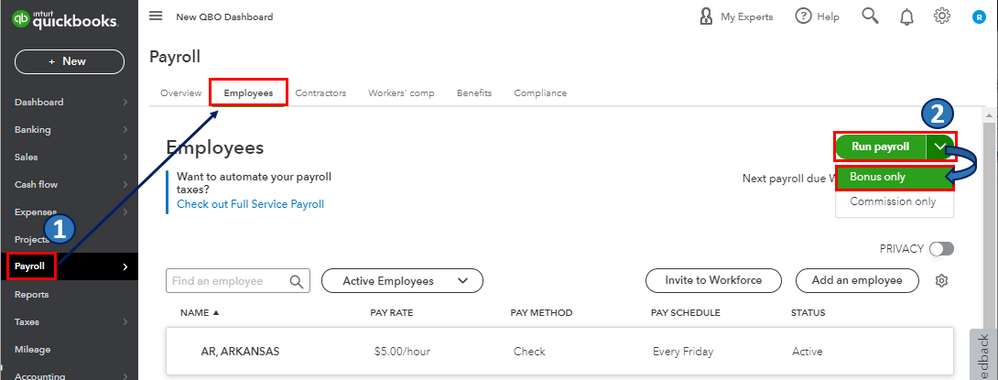

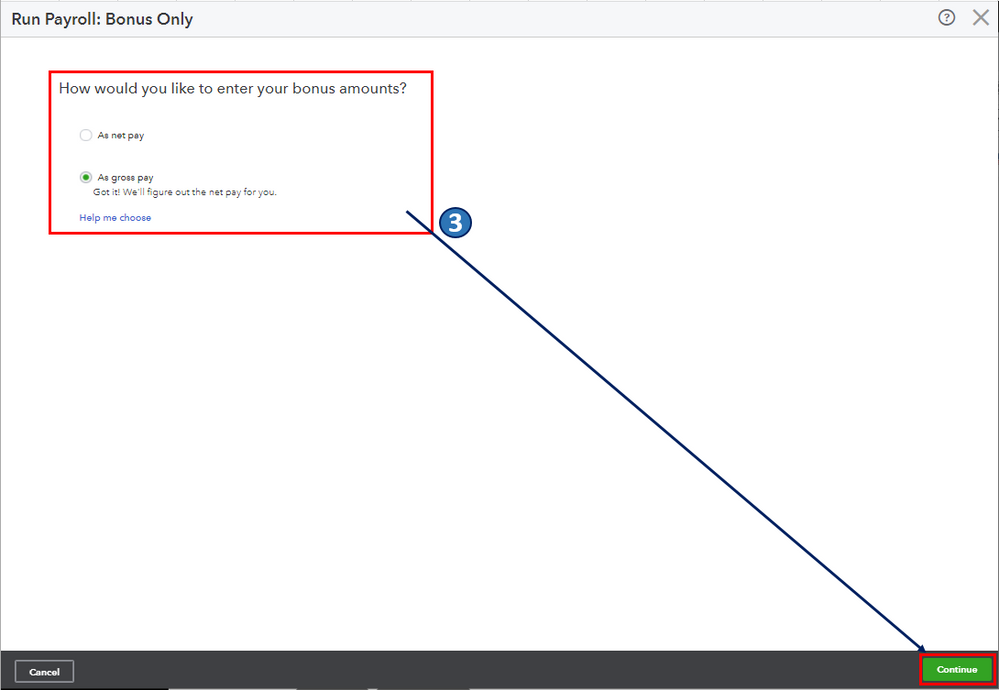

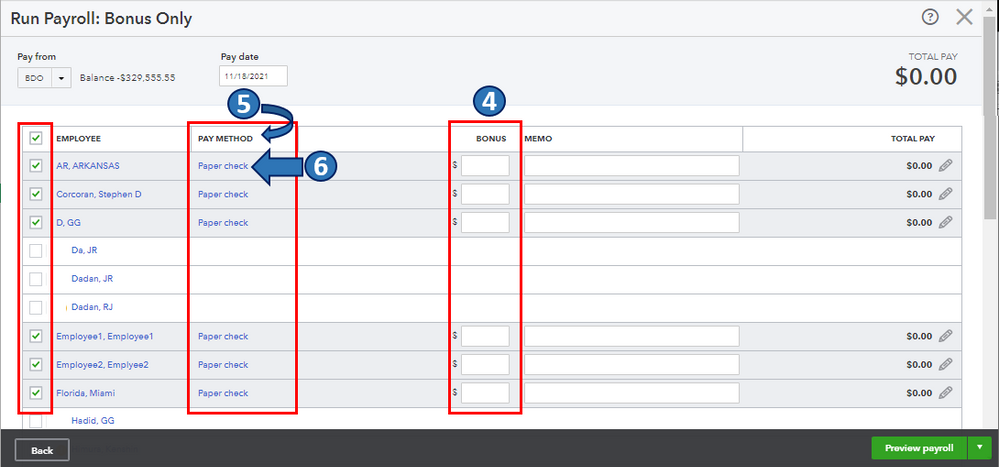

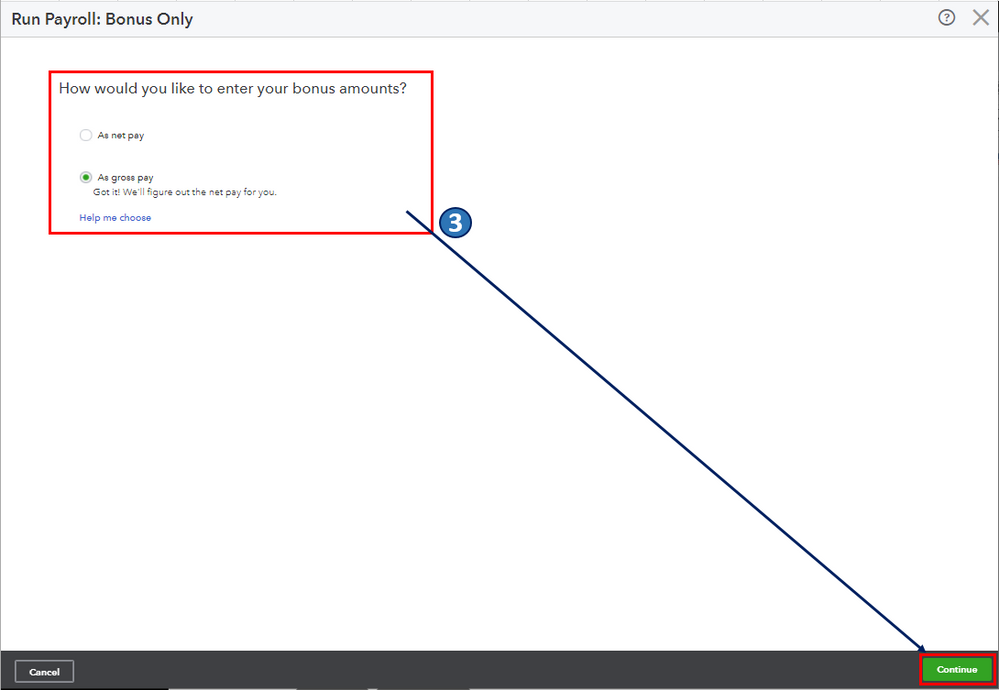

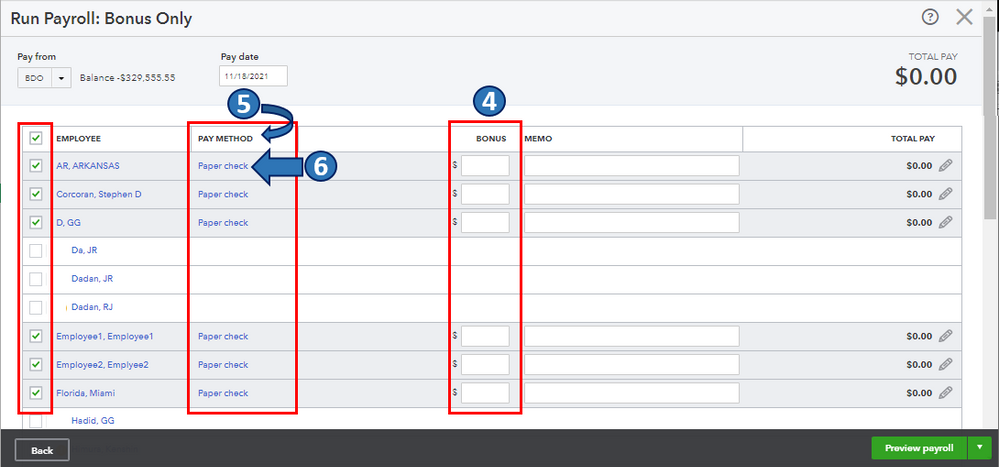

When you create one-time bonus checks, it isn't necessary to switch employees' pay method from direct deposit (DD) to paper check through their profile. You'll have the option to choose the payroll method (Paper check) you want to apply for each of them when you're already running the Bonus Only payroll. This way, you can keep their DD info accordingly. Here's how:

Also, to get a closer look at your business finances and employees, QuickBooks provides a variety of payroll reports. For the complete list and steps on how you can access, customize, and print these reports, I encourage you to check out this article: Run payroll reports.

Let me know in the comments if you have other payroll concerns and questions about bonus checks and employees' direct deposit info in QBO. I'm always around to help. Take care, and I wish you continued success, @sharon108.

Thank you for reaching out in Community, @sharon108. Let me share some insights about adding bonus on paper checks in QuickBooks Online (QBO).

You need to switch your payment method as a manual check, not a direct deposit to create a bonus check. Then, return the payment method to direct deposit after creating a bonus check.

Add the Bonus pay type to the employee profile.

Add the Bonus to a pay check.

You can also check this article to learn more about creating a separate bonus pay check.

I'll be around if you have other questions or concerns. Please don't hesitate to let me know in the comment section. Have a great day!

Hi Kevin - thanks so much for your response. When I switch the employee from direct deposit to paper check, and then go back to direct deposit, it loses all of the employees banking information.

Is there anything that can be done to keep that info? I did it for myself first, that's how I know for sure this happens.

I appreciate you for replicating your payroll scenario in your QuickBooks Online (QBO) account, @sharon108. I'm here to guide you as to how you can create one-time bonus paper checks without losing your employees' direct deposit information.

When you create one-time bonus checks, it isn't necessary to switch employees' pay method from direct deposit (DD) to paper check through their profile. You'll have the option to choose the payroll method (Paper check) you want to apply for each of them when you're already running the Bonus Only payroll. This way, you can keep their DD info accordingly. Here's how:

Also, to get a closer look at your business finances and employees, QuickBooks provides a variety of payroll reports. For the complete list and steps on how you can access, customize, and print these reports, I encourage you to check out this article: Run payroll reports.

Let me know in the comments if you have other payroll concerns and questions about bonus checks and employees' direct deposit info in QBO. I'm always around to help. Take care, and I wish you continued success, @sharon108.

Got it, many thanks!

I do not have that function and have been told by two chat people "it doesn't exist". This was after 5 months of you removing the "bonus only' feature all together. We also can't switch to paperchecks during a payroll - so when you do weekly your only option is to come in on a sunday to change everyone to paper check, run the bonus, then RE ENTER all deposit information. What an absurd option. Plus for some states this causes a huge legal issue with having to print final check day of quitting.

Did I miss the part where the direct deposit information stays intact?

When I have to generate a paper check for our employees, due to a banking holiday, ect., I have to re-enter all the direct deposit information .

Greetings, @service50.

Thanks for joining in on this thread. Allow me to point you in the right direction to get this problem handled.

If the steps above don't work, then I suggest contacting our Customer Support Team for further assistance. They'll be able to take a closer look at your account with the tools that they have. Here's how:

It's that easy!

Keep us updated on how the call goes. We're always here to have your back. Have a good one!

The pay method column does not exists in my version of QBO. How can I enter a bonus check that was written by hand, NOT sent via DD? I don't need to print anything, I just need to enter the bonus check.

Hello there, @Sibyl.

I'll help you get the PAY METHOD column in QuickBooks Online.

Before doing so, I would appreciate if you can provide a screenshot of your view without the PAY METHOD column.

We can start troubleshooting by logging in using a private browser. Regular browsers stores a lot of caches which causes problems in bringing up data to your account or latency issues.

Here's how to open private browsers:

If everything is okay in a private browser, you can fix your regular browser and clear its cache.

Once fixed and you have the same interface with the screenshot below, and you still have no Pay Method column, I recommend contacting our Customer Care team.

For future reference, you can read this article to guide you in creating a zero net paycheck: Create a zero net paycheck.

Let me know if you need further assistance about payroll. I'm always here to help. Have a great day.

I spoke with customer service who confirmed that there is no pay method column when issuing bonuses.

Attached is my screen shot. I had to change the employee's settings to pay via paper check, that action removed all of the DD information. Now I have to collect the employees DD information again in order to set him back up for DD.

[attachment removed}

I have a need to create a paper check once each month for some employees who are other wise paid by DD. It is not a bonus so I can not use the scenario described here. It is a Self Employment Tax check. We used to be able to chose a paper check with out changing the employee profile from DD which wipes out their DD banking information. After creating the paper check, I hopefully have saved their banking information and can re-enter and return them to DD.

Is is possible to include once again the ability to choose a one time paper check in the payroll process and not have the DD profile wiped out ?

Hi there, @keneb. Yes, you can pay your direct deposit (DD) employee a paper paycheck just for one time in QuickBooks Payroll, and future paychecks will change back to direct deposit.

On the other hand, if a paycheck hasn't been created, you can switch the employee’s pay method to Paper check as you run payroll.

Here's how:

To learn more on how to pay a paper check to an employee, you can check out this article: Change a direct deposit paycheck to a paper paycheck

Also, I've added this article for future reference that will help you identify what specific report you will use to keep track of your books about payroll: Run payroll reports.

Should you require any further information or have any other payroll-related concerns, questions about bonus checks, or managing employees' direct deposit information in QBO, please leave a comment.

These feel like AI answers and are not viable solutions the problem being shared by many users. Is there a live Intuit person on this chat? Once entered, Quickbooks Online should hold/retain the employee's direct deposit information with the employee record - just like their name, address, and social security number - like it does in Quickbooks desktop. When you issue a paper paycheck for an employee for one of the many reasons employers often need to do that, QBO should not erase/delete the direct deposit account information from the employees record, which is what is happening now in QBO and needs to be fixed.

I understand the importance of not losing the direct deposit information of your employees when switching to other payment methods, @jkoster.

I'll share some insights about creating a one-time bonus paper check without losing your employees' direct deposit information.

When creating one-time bonus checks for employees, you do not need to change their pay method from direct deposit (DD) to paper checks in their profile. Instead, you can opt for the payroll method (Paper check) you want to apply for each employee when running the Bonus Only payroll. This way, you can ensure that their DD information remains intact.

Here's how:

If the issue persists even after following the steps above, I recommend contacting the QBO Payroll Support team. This way, we can ensure you'll be assisted accurately with completing this action.

Moreover, I'm adding this helpful article as your reference in setting up an overtime pay item in QBO Payroll: Add overtime pay to an employee.

Come back to this post if you have other concerns and follow-up questions about creating bonus pay in QBO. I'll be here to lend a helping hand.

The option to select the "pay method" has been removed with the last payroll changes. We can no longer choose the pay method for bonuses. This needs to be fixed, it would be great if testing could be done on these things before updates are released, it causes users a lot of time and frustration.

I found that you can change to papercheck in the middle of payroll. The column that used to be Payment Method is gone, but when I clicked near (not on) the employee name, the row expanded to see the "paper check/direct deposit" pulldown menu. Hopefully this can help.

Thank you for answering the question that the Quickbooks AI bots were unable to! Just to emphasize this, when on the "Run payroll: Bonus only" screen, the pay method (Direct Deposit/Paper Check) is inexplicably hidden unless you click in the blank area near the employee's name (not ON the name), which then allows you to make a selection from the drop-down.

This now no longer works. Looks like the only option is to copy down all the bank info. Switch off direct deposit, create the check and then switch direct deposit back on. Such a pain. Quickbooks needs to fix this ASAP

I know how crucial running payroll is, Timber. Let me assist you with this.

The option of switching from Direct deposit to paper check is still available. Let me share how.

Follow these steps:

However, if you are experiencing the same issue, we recommend contacting our support team for further assistance.

I'd attach these articles to help you manage your payroll;

Keep me posted if you still have any issues with your payroll. Take care always!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here