Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI filed w2s then found out I needed to put health insurance on forms. I sent to state of Illinois and federal government How do I fix

Thanks for getting in touch with the Community, Dougc83. I appreciate your detailed information.

If you need to fix something on an employee's W-2, the process will depend on which payroll service you're using and if the form has already been filed.

Here's the different types of payroll plans and what to do with each of them:

I've also included a detailed resource about working with W-2s which may come in handy moving forward: Understand why W-2 box amounts are different

Please feel welcome to send a reply if there's any additional questions. Have a great Wednesday!

Thank you for your response . I already E Filed with state illinois and federal government. I have the enhanced version but when I call I only get a first level employee that does not understand what I . I realize as I am not an accountant. I am a small business. I have not given out w2s yet so I just need direct help in refiling all the paper work

Thank you for revisiting this discussion and providing clarity about correcting your e-filed W-2, @Dougc83. Your input is truly valued, and I'd be more willing to guide you through the step-by-step process.

In QuickBooks Desktop (QBDT), we have two options to enter health insurance for your employee's W-2. Either create a payroll item specific to health insurance or override the amount for your employee's health insurance within the program.

The first option is to create a company contribution payroll item. The payroll item will be used to serve as health insurance for your employee. Once done creating a payroll item, let's add it to your employee's paychecks and run a payroll before the end of the year to report it on your employee's W-2.

For complete guidance on creating company contribution payroll items, please check out this resource: Report employer health insurance on W-2s.

Alternatively, you can submit a W-2c form to enter your employee's health insurance using your enhanced payroll service. This will allow you to override the amount reported for your employee's health insurance contributions.

After creating the W-2c in QBDT, the next step is to print it on perforated paper. Once printed, you can now mail it to the Social Security Administration.

Furthermore, we offer this helpful guide to assist you in preparing your tax forms. This reference is thoughtfully designed to provide you with all the essential information and resources you need to navigate the process with confidence: Year-end checklist for QBDT Payroll.

Accurate W-2s can lead to effective tax reporting, and we need to ensure that you don't experience any difficulties with IRS audits. If you still have additional queries, leave us a comment so we can provide immediate assistance.

Is there a way you can help me direct with on line connect

I understand you're having an issue with your W-2 forms related to health insurance information for your submissions to Illinois and the federal government, @Dougc83. It's important to correct this to ensure compliance. I'm chiming in to point you in the right direction.

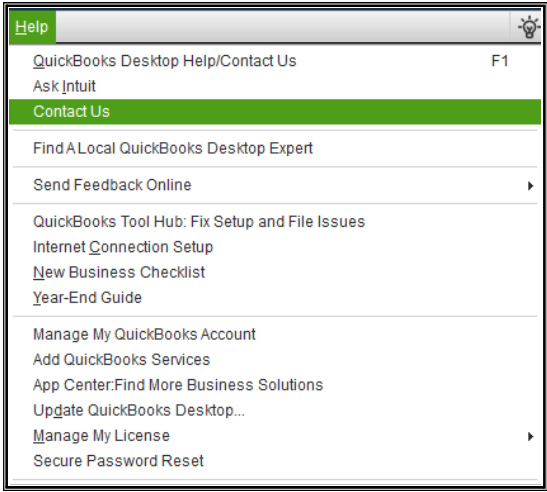

I see you’ve reached out to our phone and chat support team. However, I still encourage contacting them again. Rest assured they can help you with the correction process directly through a screen sharing session in a secure environment. Here's how to get a follow-up with them:

Once this is resolved, inform your employees about the correction and provide them with the corrected W-2 forms. I'm adding these articles as future reference:

I hope that contacting our live Support Team help you with successfully correcting your W-2 forms and ensure the health insurance information is included for both Illinois and federal submissions. If you have any follow-up concerns or other questions, feel free to click on the Reply button. You've taken an important step in addressing this. Have a great day!

I understand what you are asking of me but I must not be asking for the correct help. How would I word it to the support person. I am not an accountant. Can you help with this. Like to I say I need to correct and refile w2s ? Then what other filing to state of Illinois do I need to do and I need the help of refiling the w3s

Thanks for checking back, @Dougc83.

No worries at all. You can always tell support something like "I'm not an accountant, and I need help correcting and re-filing W2s, W3s, and finding out what else I need to do for Illinois state filings". That should get you to the right line of support.

In case you need the direct link, here's where you can connect with our team:

Please don't hesitate to let me know if there is anything else I can assist you with. Have a good one!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here