Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Hello there, dgray2. Glad that you've posted here.

Your state may not be supported for Electronic services. We can figure it out by checking this link. Find your state from there and check if it's supported for electronic tax payments and form filings.

If you've found out that your state is supported E-services, you should have seen the worksheet in your QuickBooks Online account. To guide you further, you can go to Taxes on the left panel. Then, click Quarterly Forms in the Forms section.

For additional information about it and running payroll reports soon, you can check these articles:

Let me know if you have other questions with QuickBooks Online. Always take and stay safe!

I NEED TO FIND THE WORK SHEET FOR FORM NJ927 FOR 2018 3RD QU

Hi there, yorktrans.

The NJ-927 Worksheet for 2018 is no longer available since it's from a few years back. QuickBooks Online only keeps both the current and last year's version of the form.

If you're trying to submit this form, you can run a payroll report in QuickBooks Online. Then, go to your state website and file it directly from there. Here's how to run a report:

Let me share this article with you for more details: Run Payroll Reports.

Don't hesitate to reach out to us again if you need more help with QuickBooks.

I don't have a list of forms. I can't find the Quarterly Forms anywhere

Glad to see you here, @MrCOB. I'm here to assist you regarding your concern about the Quarterly Forms in QuickBooks Online.

Users subscribing to the Payroll subscription have access to its forms. If you're enrolled to any payroll services and you’re unable to see the forms, it can be caused by the browser’s cache. With this, let’s perform some troubleshooting steps to resolve this issue.

You can use a private window or incognito mode to open your QuickBooks Online account. It won't use the data from the existing webpage cache.

Here are the shortcut keys:

Once done, select Taxes on the left pane to check if the forms are visible. If this works, you’ll need to clear your browser’s cache and cookies to refresh the system. You can also switch to other browsers to see if the problem is with the one you're currently using.

After that, we can then file or pull up the payroll forms you need. Feel free to visit these articles for more details:

Moreover, if you’re using the e-file feature within QuickBooks, it will be automatically archived. However, if you filed manually, then I'd suggest going to the IRS website.

If you only have QuickBooks Online and wanted to add a Payroll service, you’ll want to take a look at this link to see all plans: Find the right payroll plan for you.

I’ve also included this resources learn about which taxes and tax forms Intuit handles for your business:

Please don't hesitate to come here with all of your payroll needs. The Community and I will be here to ensure your success. Keep safe.

Quickbooks online is not any easier or smoother than desktop. I cannot find where to create the file for State SUI report to upload. In desktop I used to go to Quickbooks Employee Center - Payroll - File Forms - E-file State SUI

Now in Online Quickbooks I cannot find it at all.

Hello, @MrNobodySpecial.

I'll chime in to provide information about filing payroll tax forms in QuickBooks Online (QBO).

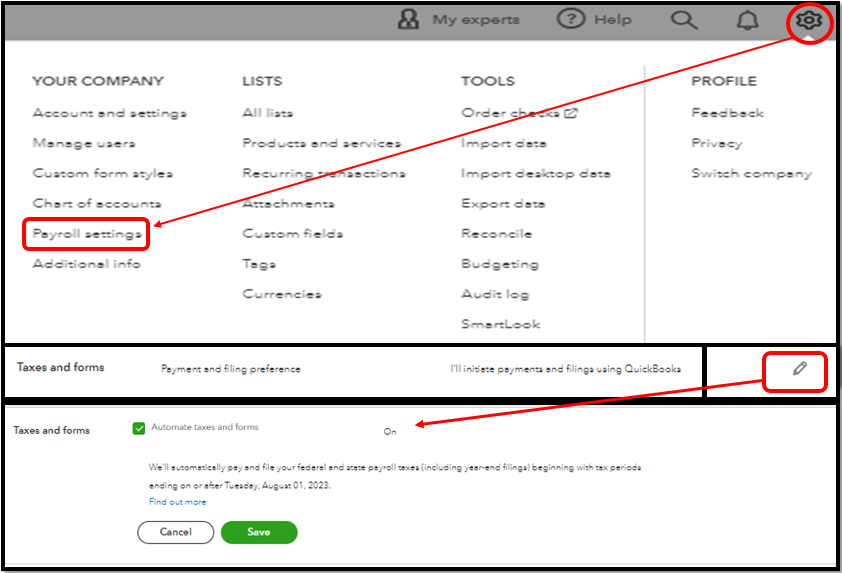

Let's start by checking your preferences to pay and file payroll taxes in QBO. If you have enabled the feature, you can save time and ensure compliance by having Intuit file and process your tax payments and file payroll forms. Payroll taxes at the federal, state, and local levels are handled for you by us.

Additionally, the automated tax payment and form filing feature is by default turned on. Here's how to check:

If it's turned on, you can go to the Payroll tax tab and scroll down to the Done section, or select Archived forms and filings to view a copy of the records after they've been filed.

On the other hand, if it's turned off, you can see your forms under the Coming Up or Action Needed section.

Furthermore, you can visit this article to learn more about viewing your payroll tax payments and forms in QBO: View your previously filed tax forms and payments. Just select the QuickBooks Online Payroll dropdown for the exact steps.

Let me know if you have other payroll-related issues or questions about QuickBooks. I'll be around to provide the information you need.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here