I'm here to ensure your IRA and child support liabilities will show up under the Pay taxes and other liabilities in QuickBooks Desktop (QBDT), @Kirsten26.

An active liability like child support will show up in the Pay Taxes & Other Liabilities section once you've created a scheduled tax payment. Since you already did but the issue remains, let's double-check the mapping. In QBDT, make sure to set up the Child Support properly. Review that the accounts associated with these payments are set up to be included in the "pay taxes and other liabilities" section. Make sure that it's a liability account.

Here's how:

- Go to the Lists menu and select Payroll Item List.

- Click the Payroll Item drop-down menu and select New.

- Select EZ Setup or Custom Setup, and click Next.

- Choose the Deduction option, then click Next.

- Type the name of the payroll deduction (child support), and click Next.

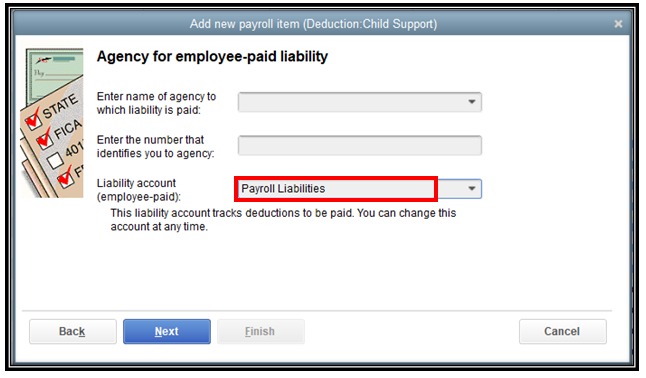

- Assign the correct liability account from the dropdown as seen in the image below.

When the mapping is accurate, the payroll item (Child Support) will show up under the Pay Taxes and Other liabilities.

If you wish to pay the scheduled tax payment, you can refer to this article in the How to pay a scheduled Liability section that details the process: Pay your non-tax liabilities in QuickBooks Desktop Payroll.

Keep me posted about the result by leaving a comment below or if you have other questions about managing payroll taxes. I'll be sure to provide the necessary help.