Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI originally didn't setup my Workers Comp manually and after one payroll I have an amount in payroll Liabilities. I pay this monthly online with the insurance company and just need to track the payroll by code and do not need to accrue liabilities. I have now gone through the set up manually process but need to know how to get the amount out of liabilities.

I have all the steps you'll need to clear your payroll liabilities, @CindyP3.

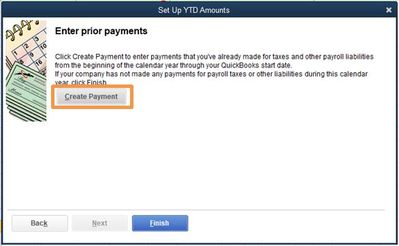

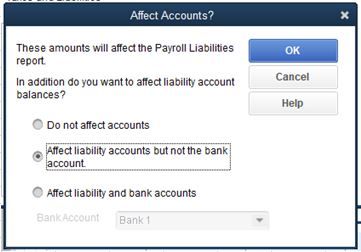

You may enter prior payments and choose the Affect liability accounts but not the bank account option. Selecting this option will cause the prior payment to not have an effect on your bank register.

Here's how:

These instructions are available from our guide on entering historical tax payments in Desktop payroll. Doing this will clear the amounts in the Payroll Liabilities report.

Additionally, here are some resources for more insights about calculating your total Workers' Compensation premiums:

Please let me know if there's anything else I can do to be of assistance. I'm determined to ensure this payroll liability issue gets straightened out. Have a great day.

I need to make sure you completely understand my situation before I try your solution. I just started doing payroll in January and have completed one payroll. Therefore I have not paid workers comp prior to this and that is what I want to remove from liabilities.

I do not need to pay workers compensation from payroll. All I was trying to do was track my workers comp by code so that I could go online to the insurance web site and pay by workers comp. I have other discounts and charges that apply to my workers comp liability and can not pay it through payroll.

All I really want to do is remove the amount showing in payroll liabilities and track my wages by wc code and not record any more liability for wc.

If your solution will work in this case I will be thankful. I just didn't want to try it and it make the situation worse.

I have since figured out how to remove the liability by going in on each paycheck and changing the employee wc code to exempt. I just need to know if I can track wc by code without creating any liabilities. If not I will have to do it by hand each week.

Let me know if you have a solution for tracking without recording liability.

Thanks

Great job in removing the liability from your employee's paycheck, @CindyP3.

Let me shed some light regarding tracking the Workers' Compensation code in QuickBooks Desktop.

If the employee's code was set to Exempt upon the setup, then this won't create any liability.

However, if there's a specific code assigned to the employee and you need to change it Exempt on the paycheck, this needs to be done manually like what you did to the previous paychecks.

You can edit the employee's Workers' Compensation code to the accurate one. This way, it will take effect on your succeeding payroll transactions.

To learn more about managing Workers' Compensation together with modifying its rate, please scan through this link: Learn how to set up your Workers’ Compensation in QuickBooks Desktop.

I'll be around to provide more help if there's anything else you need. Keep safe!

On setup my employees were setup with the correct wc codes. My question is if I run payroll with these codes will it create a liability or will I have to go back and edit the checks to exempt after I get my wc tracking report?

Thanks for getting in touch with us here, @CindyP3.

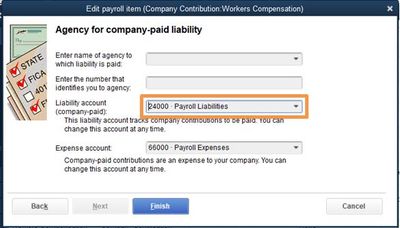

Yes, running payroll with these codes will create a liability since QuickBooks tracks the Workers Compensation as a payroll liability. To see the accounts affected by this item, follow the instructions listed below.

You can follow the steps listed from our guide on manually tracking Workers' Compensation in QuickBooks Desktop. At the bottom of the page, you can find steps on how to edit the rate, as well as the Experience Modification Factor.

Don't hesitate to post a comment below if you have other questions. We're always available here to help.

This is extremely helpful for we who pay these liabilities with an AMEX or Visa, BECAUSE:

there is no credit card payment option in the payroll liabilities window.

Thus, I have to do this payment clearing every month in order to keep my liabilities balanced.

I used the option that doesn't affect my bank; the center option, and just listed all of my 2021 payments so that I got close to my real balance that I can zero out. I'm still way over in what I owe, but I'm working it out thanks to this thread!

Thanks!

CORRECTION - I used the "do not affect accounts" and that was what worked. I had an Intuit assistant/CPA on the line with me and she helped me walk through this, too. We were both happy to find this works.

Hi - a year later! :)

I'm one who has to have the WC codes to report properly to our insurance carrier, as each code is billed differently. I found the 'fix' to the original question to be a great fit for my giant liability balance that was showing. By "not affecting accounts," I was able to clear that balance, keep my codes and my sanity. :)

Thus, by making your employees exempt, I feel you're not going to get the most out of your QB experience and its time-saving reports, as well as making payments easily. You'll always have a minor adjustment to clear to your WC expense account at year-end, but the fix in this thread is working for me, now, as I learned it yesterday! :D yay!

I also learned that this method is the only way to clear credit card payments of the liability, and lower that balance at the same time! So.. the long-time mistake by prior bookkeepers has led to an answer to a two-fold problem!

I hope this helps you, too!

T

I need to zero out the amount in the Workers Comp Payroll Liability account. I pay workers comp from a monthly invoice from our insurance company and do not need to track the amounts. I do need to be able to track the hours and print the workers compensation by code and employee report for our annual workers comp audit performed by our insurance company.

How can I not track it as a payroll liability but still track on for this report?

I know a way on how you can zero out the amount of the payroll liability account, @mlanclos.

I'd be happy to guide you on how so you can achieve your goal.

To start, we can disable the payroll schedule for the Workers Compensation account. Here's how:

When finished, let's now run the Payroll Liability Balance report and set the date to the whole year. From there, check to see if the Workers Compensation liability account still has a balance.

If yes, you can make payroll liability adjustments. I'll guide you on how:

For your reference about the process, please check this article: Liabilities were paid, but never entered into QuickBooks Desktop.

Also, running other payroll reports in QBDT is easy. Once you open one, you can also download and print the data to have a handy copy of it.

I'm just around the corner if you have any other payroll concerns in QBDT. Simply leave a reply below and I'll circle back to help you out. Keep safe always and have a great day ahead.

I have tried this approach several times and it doesn't work. I can enter a JE in the register and it will clear it but it does not clear it out of the Pay Liabilities window in my Employee Center. This has been going on for years and I feel like there has to be an easy fix yet I can't find one...

I’m here to help and ensure you'll be able to clear those payroll liabilities dues, ShaunaS.

There are several possible reasons why this is happening on your end. We need to make sure we set up Workers Compensation and record the payment correctly in QuickBooks.

For using the manual process for the Workers Compensation feature, we can either pay using payroll liability checks or through the scheduled payments feature.

Before doing so, let's ensure that we updated QuickBooks to the latest release and downloaded the payroll tax table. Then, we can follow the steps below on how to do payroll adjustment so we can clear out those amounts in your payroll liabilities:

We might want to visit these resources to learn more about managing payroll liabilities in QBDT:

Don’t hesitate to leave a message if you have other payroll concerns. I’m always here to help. Have a great day and always take care!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here