Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI'm new to QuickBooks, and I'm setting it up for a small Corporation that will have the sole shareholder as an employee so he can withdraw a salary with the deductions for income tax and CPP.

I plan on handling the payroll manually using journal entries, but my question is how do I record the "pay cheque" when it will be a direct deposit to the employee? Do I use the cheque form and just not print it or is there another way to record it?

Solved! Go to Solution.

Good day, m-veitchx2-gmail.

It's my pleasure to help you record manual payroll in QuickBooks Online (QBO). Before recording a manual paycheck, you'll want to create manual tracking accounts to track your payroll liabilities and expense. Then, you can enter the paychecks as a Journal Entry.

Here's how:

For a complete guide on how to manually enter payroll paychecks in QBO, here's an article that you can refer to: Manually enter payroll paychecks in QuickBooks Online.

Then, you can write a manual check for an employee. Make sure you know the Net amount and the taxes to be withheld to manually calculate the gross wages.

Here's an article to learn more about calculating gross wages in QuickBooks Online: Calculate gross wages.

To write a check:

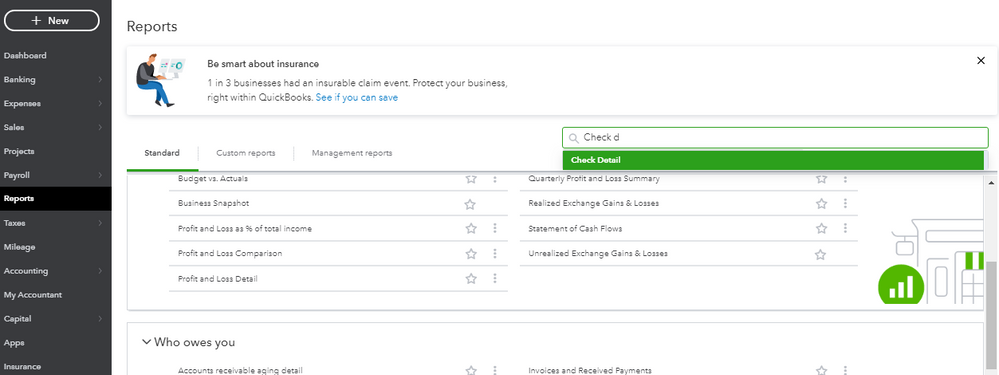

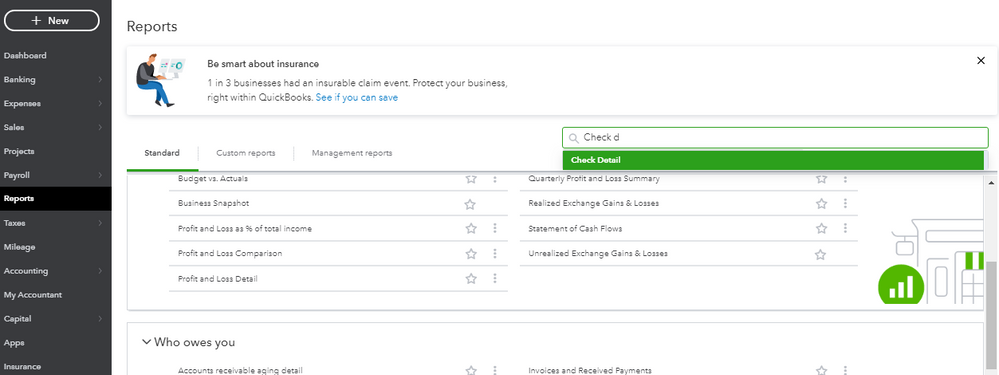

You'll also want to run a report for Check Detail if you wish to review the check you created. Here’s how to run the report:

Since you're new to QBO, we have easy-to-access articles, webinars, and video tutorials that will help you in familiarizing the different tasks, features, and functions of QBO. Below are the following:

Know that you're always welcome to post if you have any other concerns. Wishing you and your business continued success.

Good day, m-veitchx2-gmail.

It's my pleasure to help you record manual payroll in QuickBooks Online (QBO). Before recording a manual paycheck, you'll want to create manual tracking accounts to track your payroll liabilities and expense. Then, you can enter the paychecks as a Journal Entry.

Here's how:

For a complete guide on how to manually enter payroll paychecks in QBO, here's an article that you can refer to: Manually enter payroll paychecks in QuickBooks Online.

Then, you can write a manual check for an employee. Make sure you know the Net amount and the taxes to be withheld to manually calculate the gross wages.

Here's an article to learn more about calculating gross wages in QuickBooks Online: Calculate gross wages.

To write a check:

You'll also want to run a report for Check Detail if you wish to review the check you created. Here’s how to run the report:

Since you're new to QBO, we have easy-to-access articles, webinars, and video tutorials that will help you in familiarizing the different tasks, features, and functions of QBO. Below are the following:

Know that you're always welcome to post if you have any other concerns. Wishing you and your business continued success.

Thank you so much giving me such great detailed instructions. I really need and appreciate all the help.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here