Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have set up 401k and have run for 5 years. New plan and we are offering Roth 401k.

I set up roth 401k and it is taking $ out of paycheck and employer contributions are correct.

After payroll there is not a liability to pay for the roth 401k employee contribution. what did I do wrong or do I have to do a journal entry for this item?

Solved! Go to Solution.

Thanks for reaching out to us here in the Community, @drjameso1.

Let's get the Roth 401 (k) contributions to show up as liabilities to pay.

Here are the possible reasons you're unable to see the Roth 401 (k) liability amount:

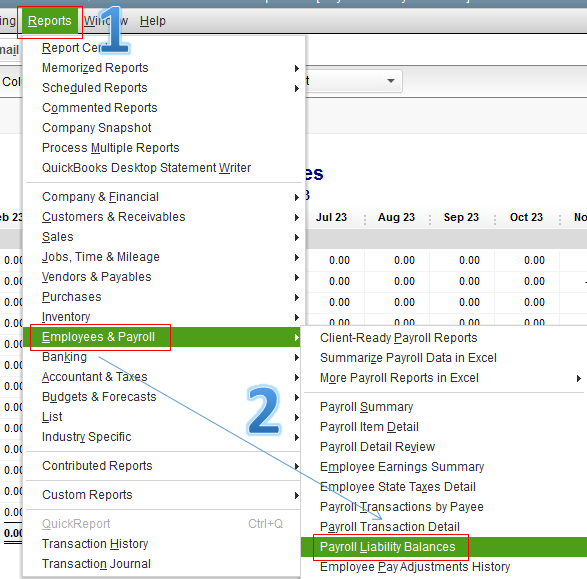

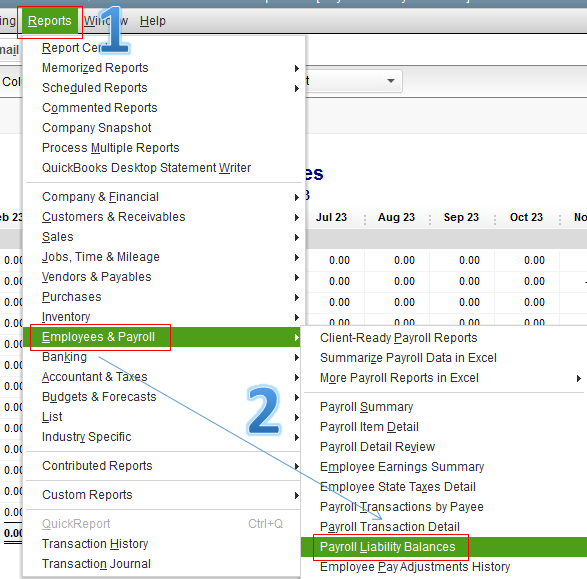

To help fix this, let's run the Payroll Liability Balances report. This way, we can check if the payroll item was correctly set up. Here's how:

If the payroll item is present on the report, you can create a payment schedule for payroll liabilities. Please take note that once you've set up a scheduled payment, it will no longer be removed. Here's how:

If the payroll item isn't present on the report, it's possible that it was set up on the wrong account or inactive in Chart of Accounts. The posting liability account should have the Other current liabilities type. Here's how to check the liability account:

Here's how to check that payroll liabilities is active in Chart of Accounts:

For more details, you can check out this helpful article: Edit Payment Due Dates/Methods are Missing Some Benefits and Other Payments.

Stay in touch with me how it goes on your end, @drjameso1. Feel free to click the Reply button below if you have follow-up concerns. I'm always here to help. Have an awesome day!

Thanks for reaching out to us here in the Community, @drjameso1.

Let's get the Roth 401 (k) contributions to show up as liabilities to pay.

Here are the possible reasons you're unable to see the Roth 401 (k) liability amount:

To help fix this, let's run the Payroll Liability Balances report. This way, we can check if the payroll item was correctly set up. Here's how:

If the payroll item is present on the report, you can create a payment schedule for payroll liabilities. Please take note that once you've set up a scheduled payment, it will no longer be removed. Here's how:

If the payroll item isn't present on the report, it's possible that it was set up on the wrong account or inactive in Chart of Accounts. The posting liability account should have the Other current liabilities type. Here's how to check the liability account:

Here's how to check that payroll liabilities is active in Chart of Accounts:

For more details, you can check out this helpful article: Edit Payment Due Dates/Methods are Missing Some Benefits and Other Payments.

Stay in touch with me how it goes on your end, @drjameso1. Feel free to click the Reply button below if you have follow-up concerns. I'm always here to help. Have an awesome day!

YEAAAAAA. Thanks!!!. I spent a few hours researching before posting. After following your directions fixed in a matter of minutes. :::))))))))

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here