Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

CYBER MONDAY SALE 70% OFF QuickBooks for 3 months* Ends 12/5

Buy nowQB Premier Edition 2020 Desktop continues to accrue sick leave for employees after they have reached their limit. This confuses the employees because it then reports that information on the paycheck stub. Without going into each paycheck and removing that checkmark to not accrue sick time how can this be resolved? I have gone through all of your knowledge base and my sick time is set up correctly.

Thanks for coming back and sharing more details, @JenBokisch.

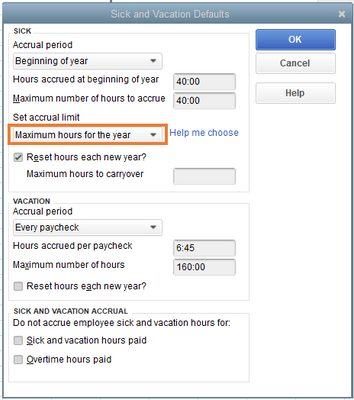

Did you set up the accrual limit from your preferences? The following instructions will stop sick leave from accumulating once your employee reaches the maximum accruals in a year:

Once done, your employee won't accrue more sick time until the new year starts. For more info, check out this article: Sick Pay Maximums.

I'm also adding this guide for more details: Set up and track time off in payroll.

If there's another issue, please provide additional details. I want to make sure everything is taken care of.

We have had this set up this way for 2 years and it does not work. My employees are confused because it continues to tell them they have available sick time on their pay stub but they have used it all for this year. Any other suggestions?

LieraMarie -

I do not believe that you are reading the thread correctly or reading above. As stated by numerous people- we have the accrual & the maximum hours all set up correctly. It is not working in your system. It keeps accruing hours after the maximum hours have been reached. We have one employee that had a maximum of 40 hours & we caught it when it reached 60 hours. It does NOT stop accruing - how can this be fixed. This SAME question has been asked since 2020 if you look at the thread above & there is no answer. You keep posting the same answer and it does not work. This is a glitch in this program & you have to be aware of it. Will you please find an answer to this. It is so frustrating to pay for this program and when it is set up properly it still does not work. One of your techs even walked through our program to make sure it was set up properly & it is STILL accruing time. Please fix this!!!

Hello! I have been following this thread for several months. I have also posted a reply to QB stating that we ALSO have the payroll set up correctly and it was set up by one of their techs! It is still accruing sick time past the maximum hours. Did you ever find a resolution to fix this? We are so frustrated as it takes so much time to manually verify each employee's hours every pay period! If you have any suggestions, please let us know.

After a 42 min phone call w/QB support, I can pass info on to you regarding how to set up sick pay so that sick pay does NOT accrue on top of sick pay or vacation pay being paid out.

1. Click on EDIT on top bar in QB home

2. Click on PREFERENCES on drop down menu

3. On left menu window click on PAYROLL & EMPLOYEES

4. Choose COMPANY PREFERENCES tab @

top

5. Click on SICK & VACATION DEFAULTS

6. In the SICK & VACATION ACCRUAL area Check boxes that apply DO NOT ACCRUE:

□ Sick & Vacation

□ Overtime

This will prevent any future accrual but you will have to manually fix any incorrect accrual previous to this.

Take into consideration your company & state policies.

Has anyone gotten a good answer as to why this is happening? I have read through the responses and checked all of my settings (they are correct). I have an employee that reached the maximum on his last paycheck, he worked 88 hours, the system accrued 2.93 hours instead of only .53 which would have brought him to the maximum. Do I now have to make sure to check the "Do not accrue sick/vac" on all of his checks for the rest of the year?

I am sorry to say, No. I have not gotten a good answer to this. It seems as though QB does not want to admit to an issue or fix what they know to be an issue. You as the user should not have to open each paycheck to remove a checkmark after tracking their sick leave in a spreadsheet to make sure you are correct.

Sorry, I tend to get a bit riled up on this subject.

What about the instance the employee has not reached its accrual of 40 hours in the year and they use 30 of sick time. Quickbooks keeps accruing to 40 hours even though they have used 30 hours

Let me help you accrue the right employee's sick leave accrual, hughesmj.

The employee's sick leave accrual is calculated based on the regular hours worked, holiday pay, and sick hours. There are several factors why hours for sick/vacation aren't calculated correctly. A couple of them are the following:

We can fix the hours by manually changing them beside the Hours available as of (date) section. Moving forward, ensure to fill in the field correctly and select the desired accrual period to avoid any error/s. See the screenshot below as an example:

Also, Let's make sure that you've set up a maximum number of hours for the year in your QuickBooks preferences and employee payroll details. Here's how:

Once completed, you can run a payroll checkup to review your employees' payroll information. I'll guide you on how:

For additional tips about tracking sick and vacation time in QuickBooks Desktop Payroll, you can open these links:

I also recommend checking out the topics from our Payroll help articles for additional resources about QuickBooks and payroll.

If you have any follow-up questions, please click the Reply button below. I'll be right here to provide additional assistance. You have a good one.

Entering New Employee Sick/Vacation screen. Line item asks - Hours accured at beginning of year.

This is a formula or calculation. All other employee has 0:02:00 in this field. It will not let me type this into new employee line item. I have tried all combinations.

thank you. Now i need calculator for hour accured for hours paid

I have Every Pay Check - QBs to calculate Hours worked per pay period for hours sick leave accured

How do I enter the calcuator....California 1 hour sick leave for every 30 worked

I’m here to share information on how QuickBooks handles the calculation of your employee's sick leave, fleming2.

With QuickBooks Desktop, your employee's PTO calculation depends on how you set it up in the system or how it will accrue. For now, you can only track sick accruals by adding the time to the employee's paycheck. However, this field is only available for hourly and salary-paid employees. Here's how to set it up:

Once completed, you can run a payroll checkup. This way we can review your employees' payroll information.

Here's how:

You can also read these articles to learn more about sick time and how you can update the employee's information:

Keep me posted if you have other questions about managing your employee's payroll information. I'm always here to help.

Hey Intuit Admins. You may have noticed I stopped responding to all of the comments because they are all the same. My set-ups are correct, yet all employees earning sick leave continue to accrue past 40 hours. This is a problem with the system. No one wants to correct it. It seems all I find are problems with no real answers to correct.

Hi RWalczak - The system should continue to accrue past 40 hours if you are in NYS. It needs to continue to accrue so there are available hours on the 1st of January. You do not need to allow an employee to use more than 40 hrs annually, but it still needs to accrue. You can cap the accrual amount by adding a figure to the box 'Maximum number of hours to accrue' under the 'Hours accrued per hour paid' box, but again, NYS requires that you continue to accrue hours as long as the employee works.

The bigger issue is that it calculates the hours on 'Every Hour on Paycheck', which could include the actual Sick Time used, Vacation, Holiday hours, if you have multiple time tracking items.

As I have stated my set-ups are correct. All the little tips and tricks that I have been given were useless and yet the system continues to accrue past 40. And I am not in NYS, but if I told the system to stop accruing at 40 why would it ignore that? BECAUSE THERE IS A GLITCH !!!

The problem with using the Accrual Period- 'Every hour on paycheck' is that it is calculating the actual Sick Time used, Holiday, Vacation etc when technically it should not as those were not "worked" hours. As many states are now moving to this type of Sick Time Law, there really should be a separate accrual period function to allow users to choose which payroll items it should factor in the calculation. You still need to have the normal Sick Time feature as many still use that as well, with a set number of hours annually.

And before you say, just manually adjust the available hours using the 'Every hour on the Paycheck' option, I can say to you - Please manually adjust every Intuit customers system. Its not a feasible option now is it? When you have over 50 employees that you have to "manually" adjust every payroll, that's after you note the correct calculation for what the actual accrued hours should be, well just not a feasible option with that many employees.

That is strange. I started out using the max hours of 40 and it did stop accruing, thus I had to remove and update everyone's accruals. I can see it would be very frustrating if that is the case with your system.

You do know that you can tell the system to not accrue on leave time, right?

Thanks for getting back here in the thread, @RWalczak. I'll share some details about your concern so you can stop QuickBooks Desktop (QBDT) from continuing to accrue 40 hours.

Before we proceed, I'd like you to know that we value the time and effort you've exerted into this. Also, this isn't the kind of experience we'd like you to have here in the Community. Please know that it'll only continue to accrue 40hrs if your employees' accruals get deducted, Or they plan to use it.

To stop QuickBooks from doing it, go to paycheck details and then check the box for Do not accrue sick/vac. Here's how:

You can also send feedback to our Product Development Team. This way, they'll see your request and consider on the next product updates. To begin, here's how:

Additionally, here's an article to help you manage payroll schedule in QuickBooks: Set up and manage payroll schedules.

You can also check this page about tracking time off payroll in QBDT: Set up and track time off in payroll.

@RWalczak, thanks for visiting the Community today. If you have any additional QuickBooks-related concerns, feel free to get back to me. I'll make sure to lend you a help once again. Take care, and have a nice day.

That just tells me that the system is not working properly. If an employee is only allowed to ACCRUE 40 hours, then the system should stop once they have actually accrued this time. If the system is looking at their balance, which includes time taken then it is not calculating the right way. Hence a glitch in the system. The developers need to fix this. Others systems work properly.

Also, I know about the "Do Not Accue" on the paycheck, but that is now an additional step that I have to remember to perform for each payroll through the end of the year.

What was the solution to this? To me it's an error in Intuits software causing this and the YTD total accrued to be incorrect on the paycheck stubs! I've had not luck at all with a solution.

Hi there, jnihmi.

I haven't received a report about the sick leave accrual issue in QuickBooks Desktop. You may want to contact our QuickBooks Live Team since the solution provided by my colleague didn't work for you.

Our Support Team can pull up your account and gather the data that causes the YTD total accrued to be incorrect on paychecks. Once they have the complete details, they'll be able to correct the totals.

Here's how to get in touch with them.

I'm adding this article to help you check the setup while waiting for our Live Team to your accrual concern: Find out why sick and vacation time may accrue incorrectly or does not accrue.

Get back to me on how the contact goes by commenting below. I'll be right here whenever you have follow-up questions.

I have same issue with the sick time.

For example: If employee work 4 days (32 hours) and take 1 sick/holiday/personal day (8 hours). The correct sick time accrual should be 1.07. If I add 8 hours sick time the accrued hours now are 1.33. Thats incorrect!!!

This should be simple fix for QuickBooks, and I don't understand why it's not fix. It cost employer more money because the software miscalculation.

I am tired to seek help because there are no solutions, its waste my time!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here