Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI use quickbooks desktop pro 2022. When I enter sick leave that an employee wants to use, it does not deduct from their total sick leave available.

Let me share some information concerning sick time not being deducted from the total, Ambyr007.

If any of the following conditions exist,, sick or vacation time may not be accrued to your employees' paychecks or deducted from their total:

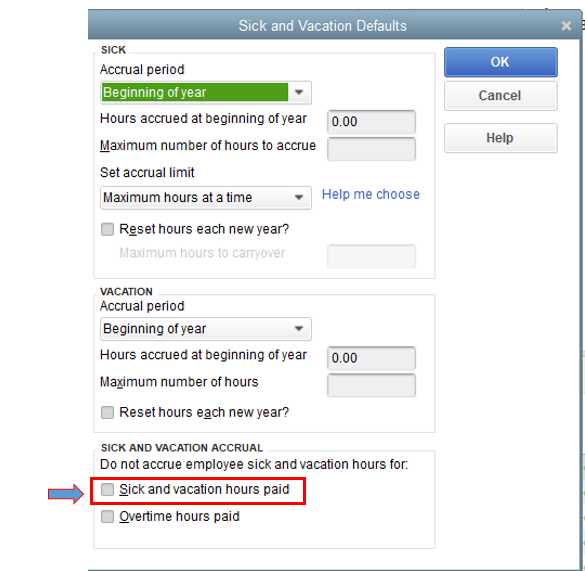

Let's ensure the Do not accrue employee sick and vacation hours for sick and vacation hours paid is uncheck in the Preferences.

Here's how:

Then, determine the payroll item is setup. I'll show you how.

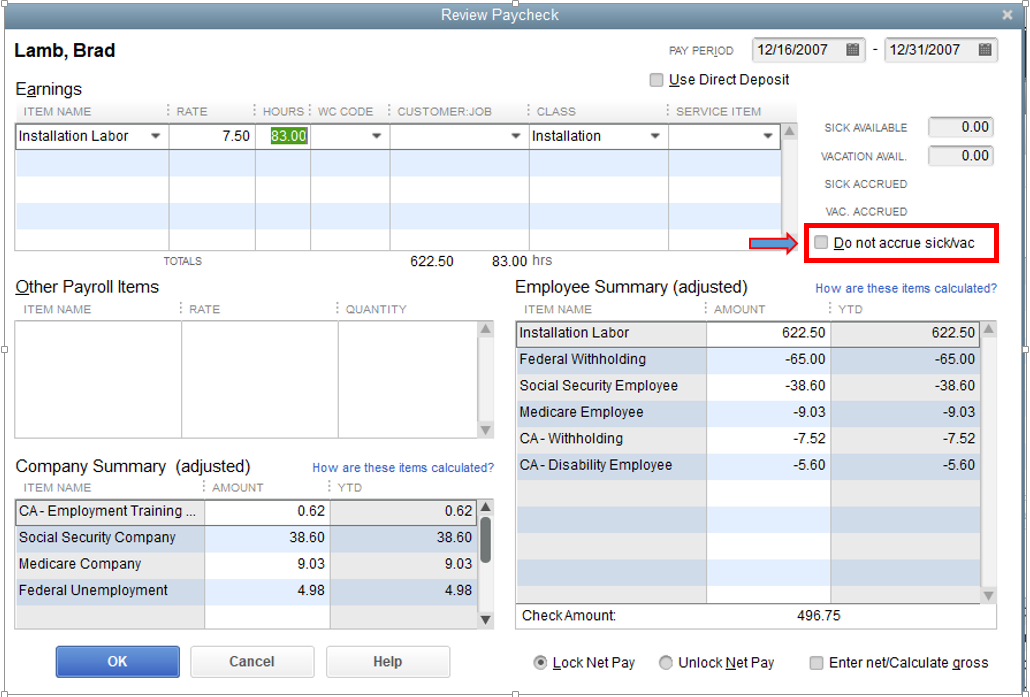

After that, check the paycheck and make sure the box labeled "Do not accrue sic/vacation" isn't checked.

For your reference, you can read this article for more insights: Sick and vacation time incorrect or not accruing on paychecks.

Additionally, QuickBooks Desktop enables you to create reports that display the total amount of accrued vacation and sick leave with the number of hours that have been used. You can use this to keep track of your employee's sick and vacation days.

If you have any more payroll-related queries, let me know. I'll be around until you fix sick accrued time.

None of these fixed the problem. Everything seems to be set up correctly. I even made a new payroll item and started over and that also did not work.

Hello Ambyr007, thanks for getting back to us. I appreciate you for considering the steps shared by my colleague.

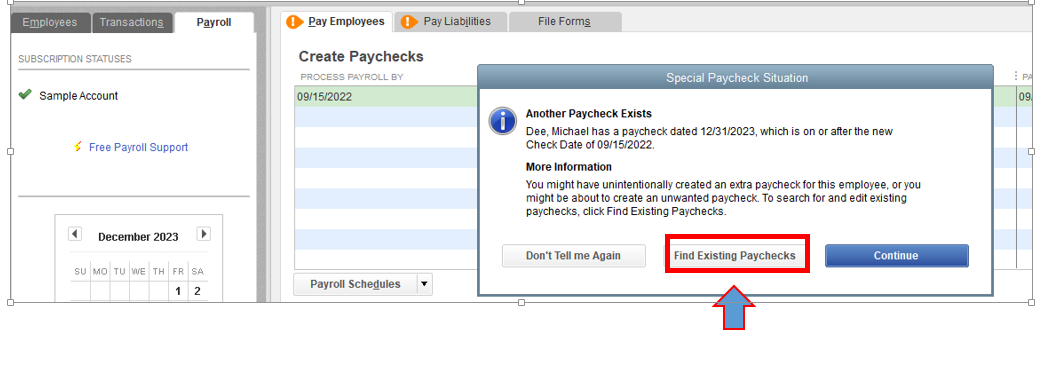

Since you've already performed the suggested troubleshooting and followed the steps above, let's also ensure to update your file to the latest release.

Then, run the Verify and Rebuild Data within your company file to fix the incorrect calculation and other issues you're experiencing in QBDT. Here's how:

Once done, we can restart your computer and install the latest payroll tax table using the steps outlined in this article: Get the Latest Payroll Tax Table Update.

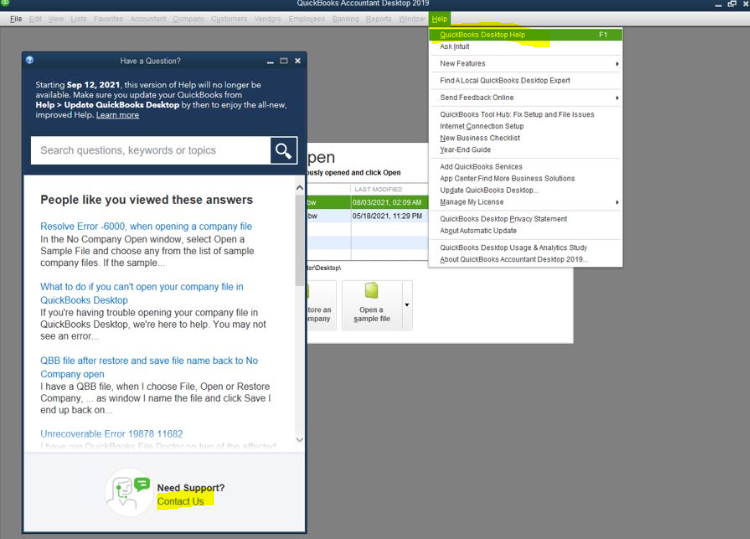

If the issue persists, please give us a short call. Our Payroll Team will help us determine the problem and will help us resolve this using their tools. Here's how to contact them:

Also, we can visit this article for tips about taxes reports and how QuickBooks calculates your payroll taxes: Understand how your payroll taxes are calculated.

You can post more if you have concerns about your employee's paycheck or anything related to QuickBooks Desktop payroll. We're always here to help in any way that we can.

This almost always or always means that the sick pay earnings payroll item you're using for the sick pay isn't really a sick pay item, though its name suggests that it is.

You can verify by editing the item. When you so a reference to sick pay should appear in the title-bar of the item window. If not, then it's not actually a sick pay item.

In this case, because once created you can't change the item to a sick item, create a new sick item to use and discontinue use of the old item. As you create the new sick item, be sure to select the option for sick pay.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here