Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

I have a tax filing penalty with the IRS due to a QB migration error from QB desktop. Been through 22+ hours on chats and phone calls, but no one (with authority) can discuss my problem. Once my determination from the tax notice solution department was emailed- I have no way of contesting or discussing with that department??? How do I talk to the tax notice solution department about my determination???

I want to ensure this is taken care of, @drsue2.

To fix this, I'd recommend you directly contact the tax or IRS department. This way, they can check your account and help fix the issue.

I've also added this link about entering payroll in QBO: Manually enter payroll paychecks in QuickBooks Online.

Also, I encourage checking our Help articles page to learn some tips and tricks in managing your QBO account. From there, you can read great articles that can guide you through the steps by steps process.

Don't hesitate to drop a comment below if you have other questions. I'm always here to help. Take care!

thank you but it's a bit more complicated...the QB team did my migration from desktop to online last may but changed the tax filing frequency from bi-weekly to monthly. Once my payroll started in June- the taxes got paid but not on time. So the IRS sent me a penalty notice. I forwarded to the tax notice resolution email and they said it was my fault and I should pay the IRS $1300. I want to talk to the person who made the determination...I feel it was a QB mistake so QB should pay the penalty. Everything is corrected now except who pays the IRS. How do I talk to someone in that department? Every chat or phone call with an agent gets shut down with "that has already been determined":(

I know how you feel about this issue that you’re having right now, @drsue2.

Let me direct you to the right department so you’ll be able to get a resolution

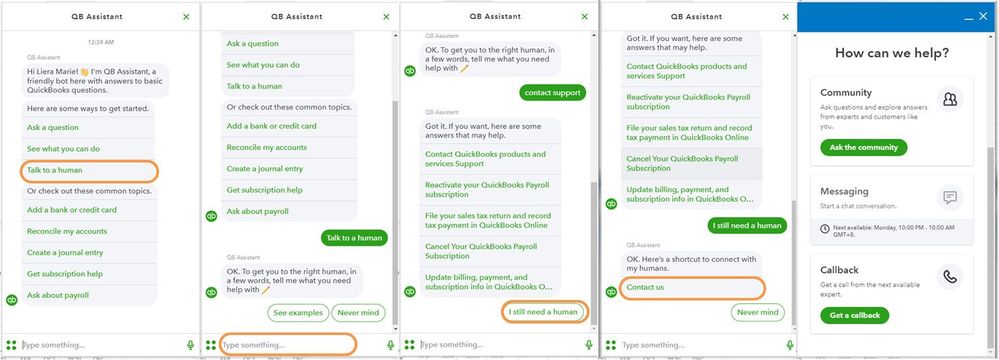

Here's how you can contact our dedicated support:

Know that you can always visit our Help Articles for QuickBooks Online in case you need some tips and related articles for your future tasks.

Please know that the Community is always here to help you with whatever concern you have related to QuickBooks. Have a good day!

What a great example of double talk.

I sent 2 tax notices emails to your tax resolution department so far. The first email was sent on June 26, 2023. To date, I have received no response and we're accumulating penalties and Interest. We have assisted payroll full service. I can never speak to anyone on this and it's very frustrating. They need to amend out 1st quarter 2023 941 and no one is responding to me. I just get a canned email about it taking 30 to 45 days to get a response. It's been over 2 months and still no response. I need to talk to a live person from this department or get a direct email address for someone in that department.

This isn't the kind of situation we want you to experience, Payroll239.

I'll personally share your feedback with our Customer Support Team regarding the no response from our payroll agent in amending your 941 1st quarter 2023. We'll be able to take action to improve our customer service. In this case, it would be best to contact our Payroll Support Team. I know you already contacted our Assisted Payroll Full Service Team, however, this is the the best option we have to amend your 941 form.

You may send a message via chat, call us at a time convenient to you, or we’ll get in touch with you instead. To ensure we address your concern, our representatives are available from 6:00 AM to 6:00 PM on weekdays and 6:00 AM - 3:00 PM on Saturdays, PST. See our support hours and types for more details about this one. From there. they'll pull up your account in a secure environment and help you with your discount inquiry. Here's how:

For more details about our support availability, refer to this article: Contact Support. I'd also suggest visiting our Community Help website. This website shares helpful articles to read on different topics about QuickBooks. Just select a subject from the Topics drop-down menu.

If you need to complete a certain task in QuickBooks in the future, please let me know the details below. I'll get back to this thread and help you out.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here