Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowI have 8 employees.

I currently have subscriptions that are breaking the bank. Do I need all three to do payroll and taxes?

I have QB Payroll Annual Fee Enhanced

QB Plus Annual Subscription Pro and

Enhanced Payroll Plus

thank you for your help

Solved! Go to Solution.

Hello, Karen.

Thank you for choosing QuickBooks as your accounting software. Our mission is to provide you with a comprehensive range of features that can help you streamline your accounting tasks. One of our most popular features is the ability to use a single payroll subscription to process payroll.

This means that you can easily manage your payroll tasks without having to purchase additional subscriptions. QuickBooks also offers customizable payroll options, which allow you to set up payroll to your specific needs. You can automate payroll calculations, tax filings, and payments, which saves you time and money.

With that said, let me explain how the three subscriptions work and their features. The QuickBooks Payroll Annual Fee Enhanced service offers basic payroll features, such as calculating paychecks and taxes, paying employees via direct deposit or check, and filing and paying taxes. This service is designed for businesses that have simple payroll needs and do not require advanced features.

The QuickBooks Plus Annual Subscription Pro, on the other hand, is a software that offers more comprehensive accounting and payroll features. It includes all the features of the Annual Fee Enhanced service, as well as additional accounting features such as creating and sending invoices, tracking expenses, and managing bills.

Finally, the Enhanced Payroll Plus is a more advanced service that includes all the features of the Annual Fee Enhanced service, plus additional features such as the ability to file and pay taxes electronically. It also includes features such as the ability to create custom reports and track employee time off. This service is designed for businesses that have more complex payroll needs and require advanced features to manage their payroll effectively.

After choosing the subscription that fits your business, if you need help running payroll and checking your liabilities, we have some helpful articles you can refer to. These articles provide step-by-step instructions on how to run payroll and check your liabilities in QuickBooks:

Our Community team is always ready to assist you with any questions you may have about using QuickBooks for payroll processing. Have a great day!

How much do you pay for those 3 products?

Do you only need to use QB Desktop Pro Plus for single user or more?

Hello, Karen.

Thank you for choosing QuickBooks as your accounting software. Our mission is to provide you with a comprehensive range of features that can help you streamline your accounting tasks. One of our most popular features is the ability to use a single payroll subscription to process payroll.

This means that you can easily manage your payroll tasks without having to purchase additional subscriptions. QuickBooks also offers customizable payroll options, which allow you to set up payroll to your specific needs. You can automate payroll calculations, tax filings, and payments, which saves you time and money.

With that said, let me explain how the three subscriptions work and their features. The QuickBooks Payroll Annual Fee Enhanced service offers basic payroll features, such as calculating paychecks and taxes, paying employees via direct deposit or check, and filing and paying taxes. This service is designed for businesses that have simple payroll needs and do not require advanced features.

The QuickBooks Plus Annual Subscription Pro, on the other hand, is a software that offers more comprehensive accounting and payroll features. It includes all the features of the Annual Fee Enhanced service, as well as additional accounting features such as creating and sending invoices, tracking expenses, and managing bills.

Finally, the Enhanced Payroll Plus is a more advanced service that includes all the features of the Annual Fee Enhanced service, plus additional features such as the ability to file and pay taxes electronically. It also includes features such as the ability to create custom reports and track employee time off. This service is designed for businesses that have more complex payroll needs and require advanced features to manage their payroll effectively.

After choosing the subscription that fits your business, if you need help running payroll and checking your liabilities, we have some helpful articles you can refer to. These articles provide step-by-step instructions on how to run payroll and check your liabilities in QuickBooks:

Our Community team is always ready to assist you with any questions you may have about using QuickBooks for payroll processing. Have a great day!

After reading your answer, I am confused. if the QuickBooks payroll annual subscription enhanced covers payroll, then why do I also need the QuickBooks plus annual subscription pro? I guess the other person who posted the question it doesn’t make a lot of sense to have multiple subscriptions. Can you make the answer clearer?

Hi there, jackpotconcrete.

Allow me to join the thread and provide information about QuickBooks subscription.

The QuickBooks Payroll Annual Subscription Enhanced covers payroll processing, including paying employees and filing payroll taxes. On the other hand, the QuickBooks Plus Annual Subscription provides additional features such as tracking income and expenses, creating and sending invoices, managing bills, and tracking inventory. If you require these additional accounting features alongside your payroll processing, then the QuickBooks Plus Annual Subscription would be beneficial for your business.

For more details about the plans and pricing including their features, see this site: https://quickbooks.intuit.com/desktop/.

If you have further questions, let me know by commenting below. I'll be more than happy to answer them for you.

QB Desktop Payroll is an add-on for QB Desktop Pro/Premier/Mac. You can't use it as a stand-alone program. If you are using QB Desktop Enterprise, you don't need to use QB Desktop Payroll.

I would like to only have the Quick Books Annual fee enhanced version. Presently i have this plus the Quick Books Plus Annual Subscription Pro. How do i get rid of the annual subscription pro?

QuickBooks Enhanced Payroll requires an active QuickBooks Desktop subscription to work. Since payroll service is an add-on to the QuickBooks Desktop software, it cannot operate independently. Allow me to suggest a potential solution for you, trinesmith01.

You can consider exploring QuickBooks Online Payroll that doesn't require the purchase of additional accounting software. This could better match your specific needs if you're only seeking payroll functionalities. If you want to take advantage f this, I've added this for you:

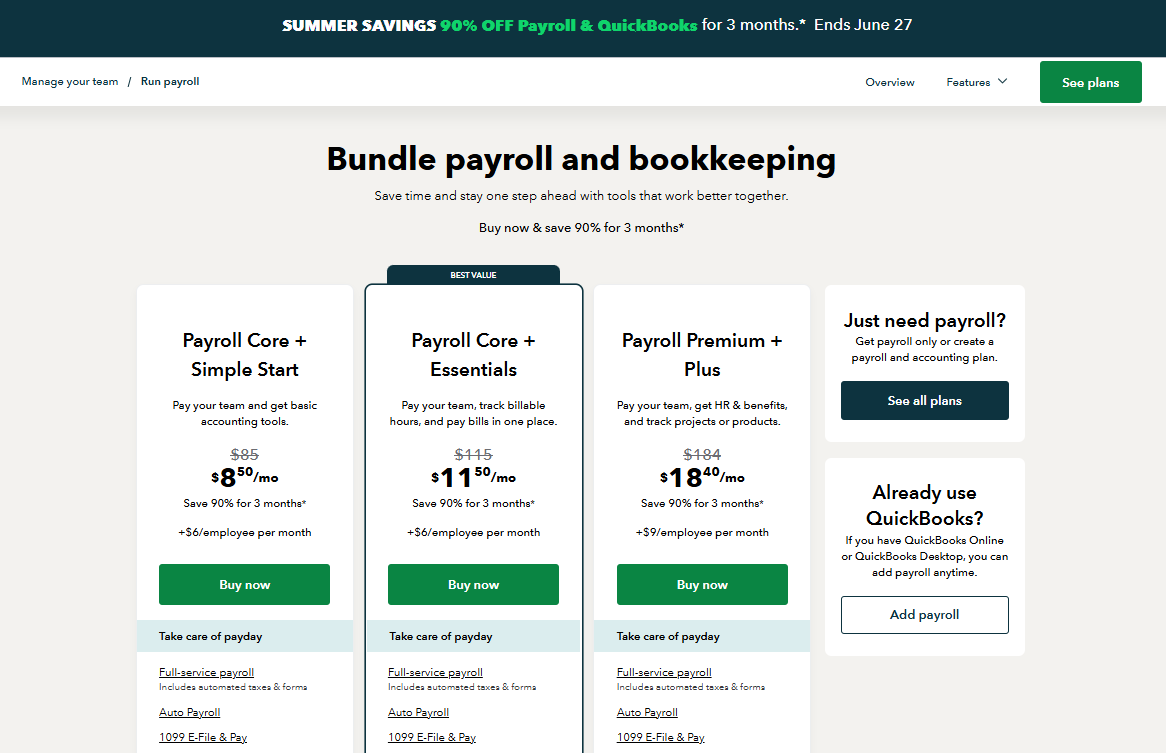

For more detailed information, please visit our website by clicking on the following link: Bundle Payroll and Bookkeeping.

On top of that, check out this article that typically contain a wealth of information to help you set up and manage the payroll systems effectively if you'll take advantage of the plan: Get Started with Online Payroll.

If you have any additional questions about our payroll services, or if there's anything else you'd like to clarify, I'm here to ensure you have all the information necessary to make well-informed for your business.

Consider switching to old QB Desktop with a non subscription license + a 3rd party payroll app.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here