Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHi suhays1937,

Welcome to the QuickBooks Community!

Yes, here's how you can enter an additional amount for the Federal Income Tax:

Please let me know if you have additional questions. Thanks.

Hi suhays1937,

Welcome to the QuickBooks Community!

Yes, here's how you can enter an additional amount for the Federal Income Tax:

Please let me know if you have additional questions. Thanks.

Is it only federal income tax that an employee can have withheld as an additional amount and not state?

Thanks for taking the time to reach out to the QuickBooks Community, 6443.

I'm here to help provide some insights about the employee's payroll taxes.

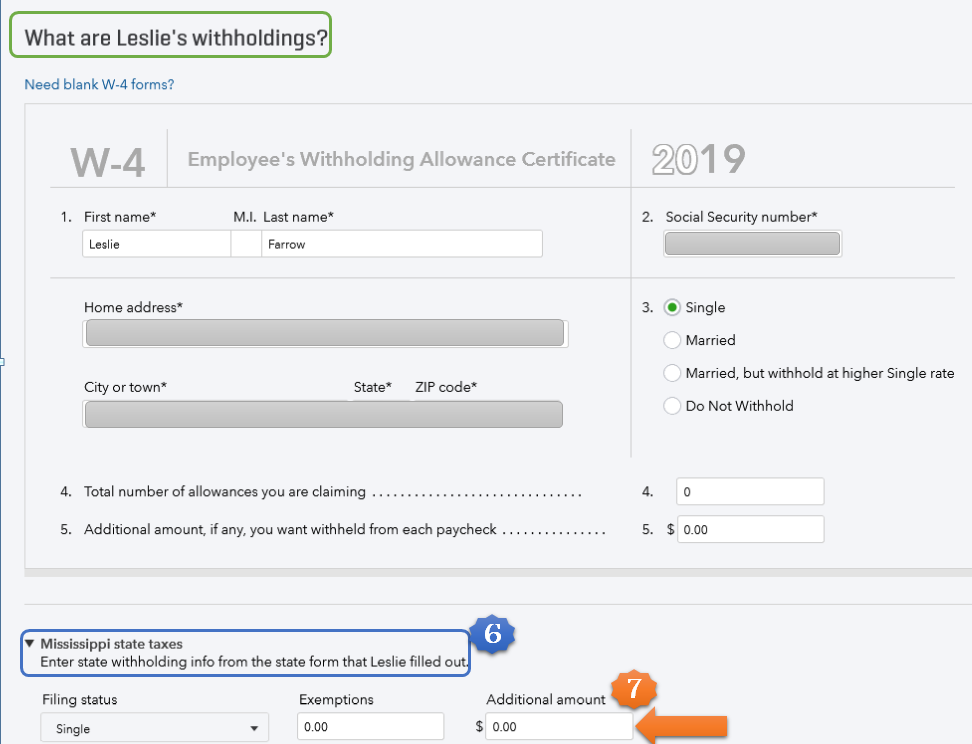

QuickBooks Online (QBO) is set up to add both Federal and State additional amount that withheld on the employee's paycheck.

Here's how to enter the state withholding additional amount:

Once done, you can review the employee's paycheck to ensure the state withholding an additional amount calculated accurately.

For additional reference, you can check this article: Change employee details.

That should do it! Fill me in if you have additional questions about the payroll taxes. I'll be around to help. Wishing you and your business continued success.

WHAT IF THE WITHHOLDING AMOUNT IS TO BE 10% OF GROSS PAY, HOW DO YOU ADD AND TRACK IT SO IT SHOWS ON THE 941 FORM?

Hello @JESS64,

In QuickBooks, the calculation of your withholding taxes is based on the IRS' Publication 15 Percentage Method. I can provide more details about this.

Withholding taxes are calculated based on your employee's gross pay, pay period, and their number of allowances.

I've attached here an article that you may read for more information: Publication 15 Circular E.

Don't hesitate to let me know if you have any other concerns. I'll be around to help.

We have an employee who wants 10% withheld.

Or how can I track it to end up on my 941 Form, I have it entered so when I do payroll but it does not show up on my report as withholding. I can add it manually. . . . it shows up in my reports.

Thanks for chiming in this conversation, JESS64.

I can add some insight about the employee's federal withholding taxes.

At Intuit, we do our best to be compliant by the IRS and your state agency. QuickBooks Online correctly calculates taxes according to the IRS tax table. This is to make sure we can avoid any penalties due to a variety of errors and omissions related to withholding.

While we are unable to use a fix percentage for federal withholding, you can override the tax amount on the employee's paycheck. Keep in mind that this tax will still be reported on the 941 form even if this was changed. Here's how:

This article will give you information about federal and state taxes: Payroll 101.

That should answer your concern. If you have follow-up questions about QuickBooks Online Payroll, please let me know. I'm always happy to help. Have a good day!

Hi,

I have been deducting extra federal and state tax from my personal paycheck as an owner by adjusting it on the bottom part of payroll. Is there a problem with this ? I never thought about this until recently when a message popped up

Hi,

I have been deducting extra federal and state withholding from my personal paycheck as an owner by adjusting it as I create my payroll check. I never thought anything about it until a message popped up recently. Everything seems to have balanced in the past. Any problems with this?

Thanks for joining our forum today, @CM50,

I want to help you out with this, but I need to know what specific error are you getting? Any information or screenshots you can share will greatly help.

In the meantime, if this just came up, and you don't get it before, try doing some browser troubleshooting first. This is to check if this issue is caused by the large data in the cache.

The cache stores your data and it stacks up overtime. This is because it will constantly overwrite itself without deleting the old stuff, causing QuickBooks to function poorly.

First, open your account in a private window. This will not save any history making it a good place to identify browser problems.

To open a private browser, use these keyboard shortcuts to lauch private browsing:

Secondly, you can clear the browser's cache. This will help delete the history of the browser, so you can start in a clean slate.

Let me know how it goes, as I want to make sure this is fixed. I'll be right here if you need further help. Enjoy the rest of the day!

How can I tell if the additional withholding for my employee is being removed on the paystub? I followed the directions to add an extra amount and can see it’s applied but I’m not seeing it removed in the paycheck.

Hello there,

You may want to check the Employee's profile about their withholding taxes.

I'd be happy to show you the steps below:

Try to run a payroll and use a check so that you can void and delete it after that. This is done to check if it's calculating the withholding taxes correctly. If it's still not, you may consider the wage range of your employee. Here's an article for more details: IRS Publication 15 Circular E. Go to the Withholding From Employees' Wages section on page 22.

Feel free to tag my name in the comment section if you need further assistance or other questions. I'll be here to help.

Hi i have a question regarding for withholding tax, coz add addition 50$ for my tax, so my question is there possible that ican get a tax refund incase my tax is over..?im married but no kids..tnx?mh husband have a 24000 in year.. and me is my first time.

This is an old post and does not apply to Quickbooks Online in 2022.

Let me provide some information about deducting extra federal income tax, @Aprli.

Federal taxes calculate based on the details from an employee's profile. For the federal withholding taxes, QuickBooks calculates them based on the following elements:

Make sure also not to set the employee to Do Not Withhold for federal and state income taxes in the employee setup. To verify, here's how:

Additionally, I've attached some articles you can utilize for future use about managing your payroll in QuickBooks:

Don't hesitate to comment below if you have other questions about withholding taxes. I'm always here to help. Stay safe!

Where dies this show n the pay stub?

@marshma22 With the rest of the taxes being withheld from the gross pay; probably right above the social security tax being withheld as Federal Withholding.

Hello, @marshma22. I appreciate you reaching out with your question about pay stub details.

To assist you better, please clarify what specific information or item you’re trying to find on the pay stub. By understanding what you need, I can guide you more effectively through the process, ensuring you get the results you’re looking for.

Once I have a clearer idea of your needs, I can provide step-by-step instructions or point you in the appropriate direction in QuickBooks Online to display or customize the information on the pay stub.

Looking forward to your response so we can resolve this together!

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here