Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

Get 50% OFF QuickBooks for 3 months*

Buy nowHow can I set QuickBooks to accrue vacation time ONLY for HOURS ACTULLY worked? Our policy is one hour of vacation time accrued for every 40 hours WORKED. But, I only see that QB calculates it based on total hours. So, if someone takes 40 hours of vacation time, they still accrue 1 hour of vacation time.

Solved! Go to Solution.

I'd like to welcome you to the Community, michelet. I'd be happy to assist with your questions about managing vacation accruals in QuickBooks Desktop.

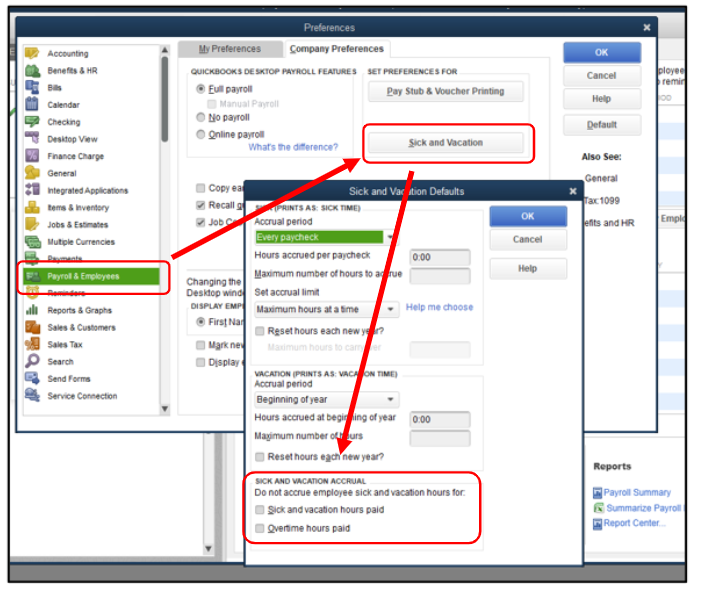

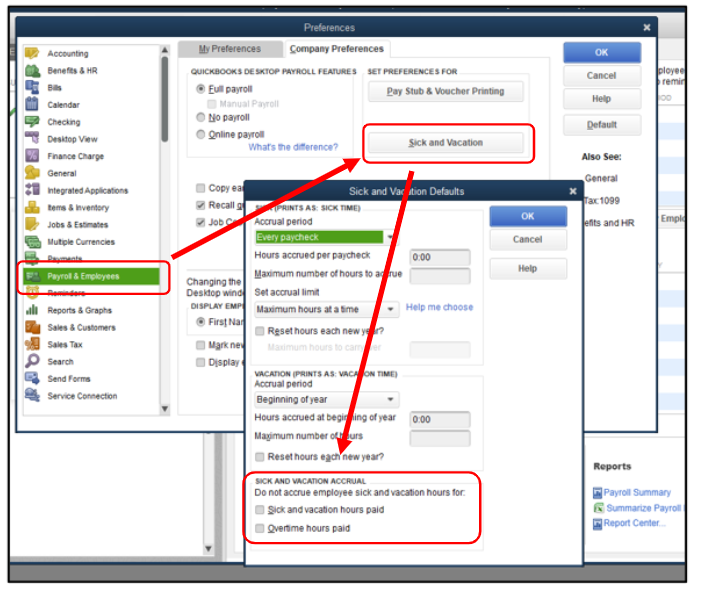

There's an option in the program to exclude vacation or sick hours in PTO accrual. This allows the system to only calculate the actual worked hours and remove the vacation time from the accrual.

Here's what you need to do:

By excluding vacation or sick hours from the PTO accrual calculation, QuickBooks Desktop will only use the actual worked hours when calculating the accrual amount. This ensures accurate tracking and management of your employees' vacation time.

You can also read more details about changing payroll preferences and other settings here: Set Payroll Preferences In QuickBooks Desktop Payroll.

Let me also share these resources for additional information when tracking time off and sick accruals in QuickBooks:

Feel free to reach out if you have any other questions about paying your employees in QuickBooks, michelet. I'll be more than happy to assist you again and provide any further help you may need.

I'd like to welcome you to the Community, michelet. I'd be happy to assist with your questions about managing vacation accruals in QuickBooks Desktop.

There's an option in the program to exclude vacation or sick hours in PTO accrual. This allows the system to only calculate the actual worked hours and remove the vacation time from the accrual.

Here's what you need to do:

By excluding vacation or sick hours from the PTO accrual calculation, QuickBooks Desktop will only use the actual worked hours when calculating the accrual amount. This ensures accurate tracking and management of your employees' vacation time.

You can also read more details about changing payroll preferences and other settings here: Set Payroll Preferences In QuickBooks Desktop Payroll.

Let me also share these resources for additional information when tracking time off and sick accruals in QuickBooks:

Feel free to reach out if you have any other questions about paying your employees in QuickBooks, michelet. I'll be more than happy to assist you again and provide any further help you may need.

@jenop2 Can this be done in QB Online Payroll? Currently, we can only choose to have, or NOT to have, PTO accrue on the current paycheck. But we cannot choose to have PTO accrue only on regular (worked) hours. This would be useful, obviously.

Thank you for reaching out about your concerns with PTO accrual in QuickBooks Online Payroll (QBOP), ZKarlo. It can streamline your payroll process if PTO accrual is used for regular work hours.

In QBOP, the option to accrue PTO only during regular work hours is currently unavailable. As it stands, PTO and sick time will accrue based on the total hours in the paycheck, which includes any overtime or additional hours worked.

It means that whenever you run a paycheck, PTO and sick time will accrue on the entire amount, not just the regular hours. I understand this is not ideal for your needs, and I appreciate your opinion. It helps us comprehend how we can improve our services in the future.

You can send feedback directly through your QuickBooks Online (QBO) account. This option will share your thoughts and suggestions regarding features like PTO accrual. Your input is essential as it helps our team understand user needs and prioritize enhancements for future updates. By sharing your insights, you make QBO even better for everyone.

In the meantime, you can manually adjust the PTO accrual amount before running the paycheck. This way, you can ensure that the correct amount reflects only the regular hours worked.

For more details, see this link: Set up and track time off in payroll.

Just in case you need to run reports, allow me to share these articles with you for additional guidance:

Let me know if there's anything else I can help you with your payroll time-off setup in QBO. I'll be right here to assist you with your employee settings.

You have clicked a link to a site outside of the QuickBooks or ProFile Communities. By clicking "Continue", you will leave the community and be taken to that site instead.

For more information visit our Security Center or to report suspicious websites you can contact us here